EU pig prices: Movement more subdued in November

Tuesday, 28 November 2023

Key points

- The EU-27 reference pig price continues to decline throughout November

- Lower production driven by challenging farm margins

- EU pig meat exports impacted by lower production and less competitive pricing

Prices

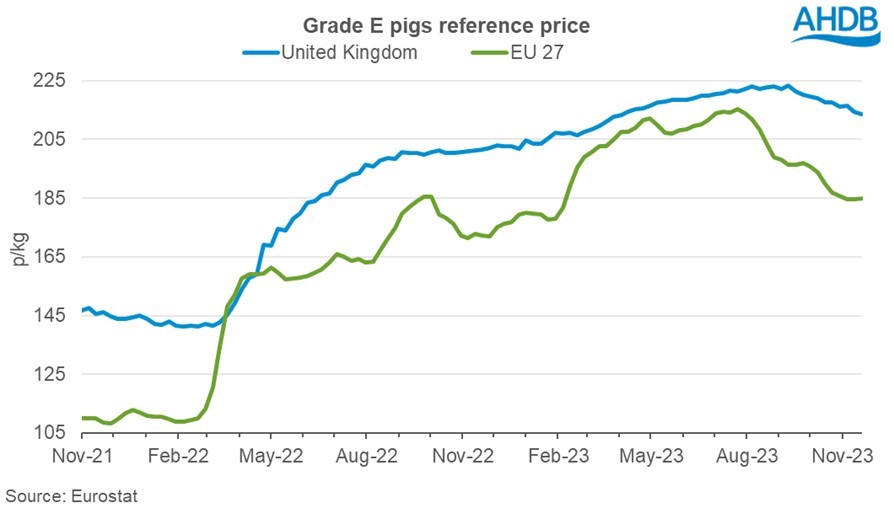

The average EU reference pig price has continued to fall throughout Q3 but shows some tentative signs of stabilising, currently sitting at 184.93p/g for the w/e 19 November 2023. Demand both domestically and globally has been easing throughout 2023, resulting in a decline of just under 31p from the peak pricing (215.45p/kg) seen in July this year. The European Commission forecast suggests little change in the current downward trend seen in EU pig prices.

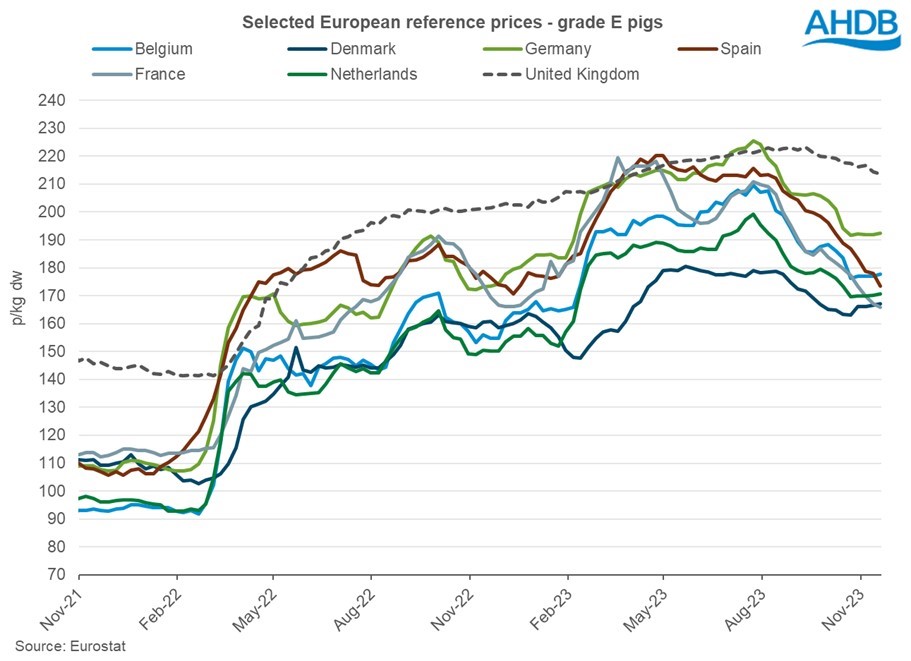

Compared with figures seen four weeks ago, the EU average price has declined by just over 2p. This is a more subdued decline than previously seen, with some key producers recording minor price increases in the most recent weeks. This overall downward trend in prices has been driven by the large drops experienced in Spain (-13p) and France (-11p). However, prices in other key regions have been more stable in recent weeks, with Germany, the Netherlands and Belgium seeing prices increase by around 1p in the latest four-week period. Denmark has seen a price increase of almost 4p; however, trends show consistently lower prices in Denmark. It should be recognised that across the key producers, prices do remain elevated above those seen in 2022.

The UK price currently sits at 213.69p/kg for the w/e 19 November 2023 – this is just short of 29p above the average EU price. Due to market pressure following the drop in EU prices, UK pig prices have also been in decline for the last couple of months, albeit at a steadier rate than those seen on the continent. For the w/e 19 November 2023, the UK reference price was 9.54p lower than the price peak seen in w/e 10 September.

Production

Production levels for 2023 (up to July) have continued to fall short compared with 2022, with tight supply reported among key EU pig meat producers. There was an overall decline of 8.2%, with the largest declines seen in key pig meat producing countries such as Germany (-9%), Denmark (-21%) and Spain (-5%). This is likely to have been driven by an overall reduction in EU pig slaughter in 2023 (up to July), of 8.5%.

High input costs over the past two years have eroded farm margins, seeing many opting to leave the sector, resulting in a decline in pig numbers and thus limiting pork production. Despite a small easing in input costs, the cost of production remains high for pork producers throughout the EU, particularly energy and feed ingredient prices. However, with feed prices slowly easing in Europe, production rates are likely to see some recovery towards the end of 2023 and into 2024, according to the European Commission’s latest forecast.

Exports

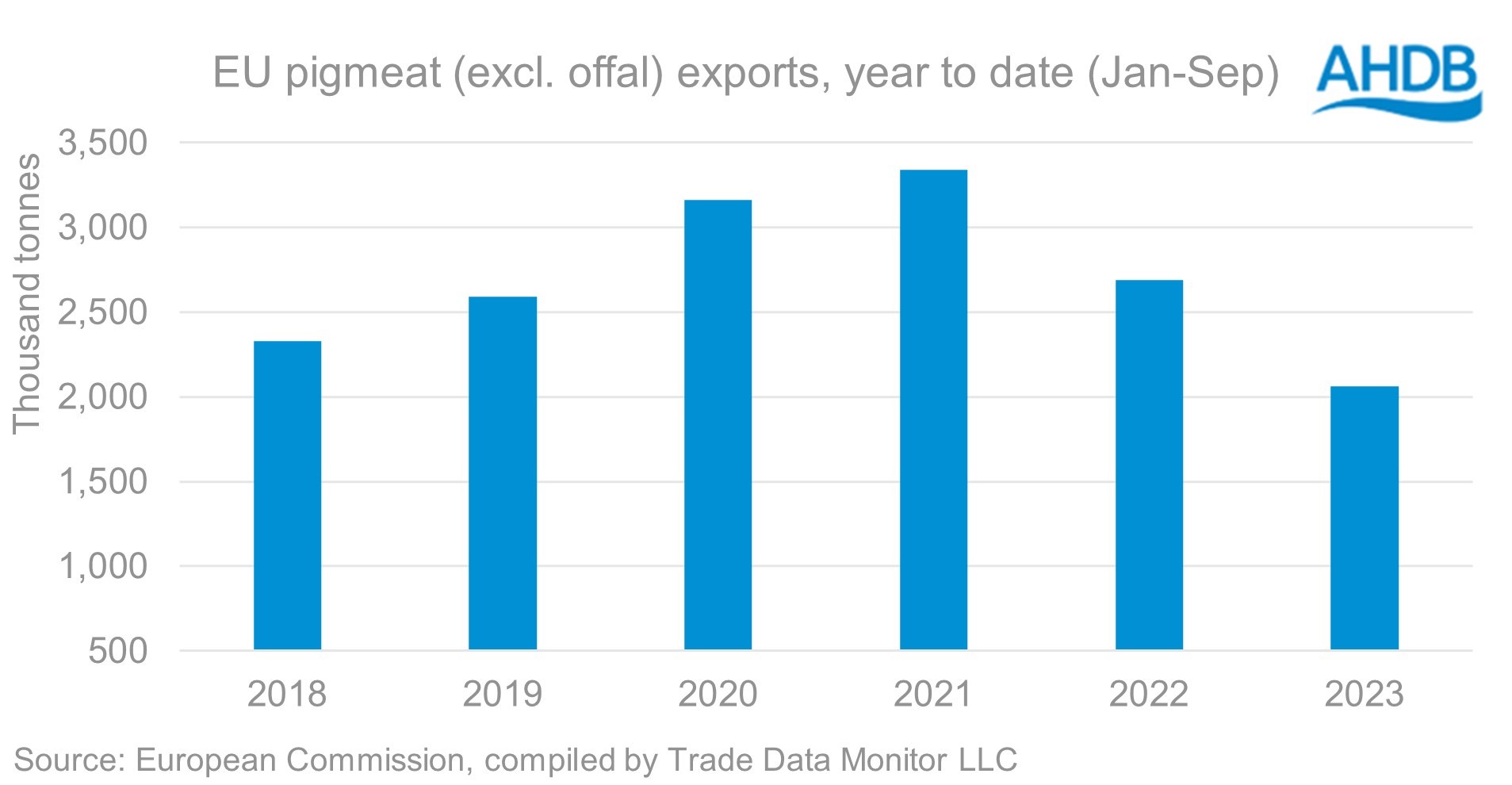

Overall EU exports of pigmeat (excluding offal) have declined year-on-year, currently sitting at 2.06 Mt for the year to date (January–September). This is the lowest volume since 2015 and has been driven by reduced product availability as a result of declining production. Another limiting factor on EU export opportunities has, until recently, been pricing. It is reported by the European Commission that, due to greater price competition on the global market, EU producers have lost volume share in key markets, including Japan, Australia and the Philippines. Volumes shipped to China have fallen 27% and are now similar to levels seen in 2018.

The UK remains the largest importer of EU pig meat (excluding offal), with a 28% market share on volume, and is the only key importer to increase their import volumes in 2023, by a marginal 5,900 t (1%). UK consumption of pork through foodservice is growing year-on-year, likely contributing to the increase, paired alongside lower EU pricing compared with UK product.

EU exports of pig meat are estimated to end the year down 16% compared with 2022. However, if pig prices continue to decline, there may be room for improvement in 2024.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.