EU pig prices: weakening demand lowering prices

Wednesday, 30 August 2023

Key trends

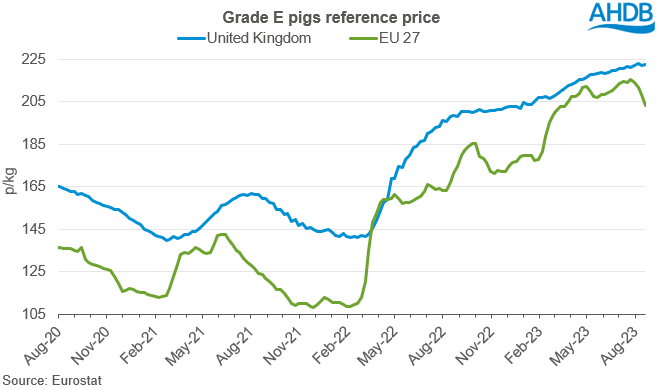

- EU references prices have declined for four consecutive weeks, although the rate of decline is mixed across the region

- Weather over the summer has negatively impacted demand on the continent

- The UK vs EU price differential has grown, returning to a historical average

Market overview

Since peaking at the record high of 215.47p/kg in the penultimate week of July, EU pig reference prices have been in steady decline, losing just over 12p/kg in four weeks.

Pig kill remains low in the EU, suggesting the drop in prices is predominantly driven by easing demand. There have been some reports of over supply on the continent, as unfavourable summer weather in some regions has limited the BBQ market.

Higher pig prices have also been driving up the unit value of exported product. This has resulted in the differential between the EU reference price and the UK reference price increasing to 19.5p/kg in the week ending 20 August. This is a return to more normal trends that we have seen over the last couple of years, with the price difference in recent months trending at historical lows.

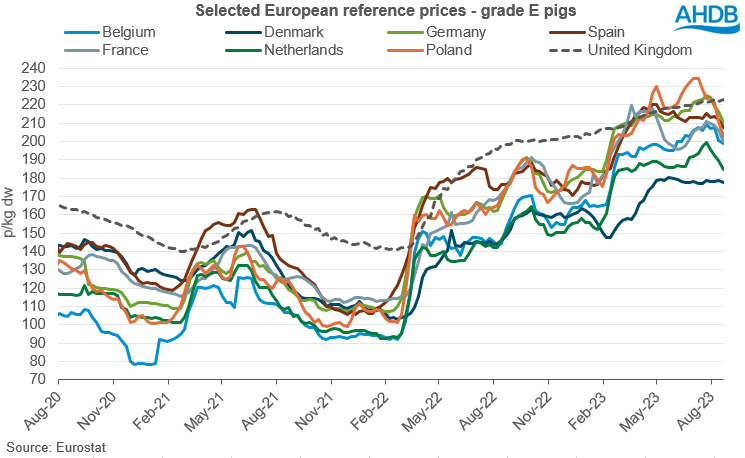

The rate of decline has been mixed across the region. The largest price decline has been recorded in Poland, where prices have fallen by 20.7p over the period (23 July–20 August). Polish pig prices have been falling for seven consecutive weeks having peaked in early July. Meanwhile, Danish pig prices have been relatively flat since the beginning of June. Weekly movements have been both positive and negative in Denmark, resulting in the price only dipping by 1.3p/kg over the reporting period.

Belgium, France, Germany and the Netherlands have all lost between 10–15p/kg in the four weeks ending 20 August, with the most significant changes being recorded in the final week. Spain has seen slightly smaller movements, with prices moving downwards just shy of 8p in the last four weeks – over 4p of this occurred in the most recent week.

Although prices are easing, they remain significantly elevated from those seen a year ago.

Pig producers on the continent have been suffering similar financial pressures to those in the UK, due to the input cost inflation skyrocketing last year. The cost of key inputs has eased in recent months, relieving some of the pressure on farm margins, however costs are likely to remain historically high for the foreseeable with the global economy recovering after COVID-19 and geopolitical tensions continuing to run high. This also impacts processors as many of their running costs have substantially increased – pair this with lower kill volumes and margins are tightened. This has led to some large adjustments in the structure of the industry, such as abattoir closures.

Impact on UK

There are some concerns that the UK market will start to follow the price trends seen in the EU, which are not unjustified with the two markets very closely connected.

However, it appears that the UK market may be more balanced. Supplies remain tight and demand seems to be holding up, although purchased volumes vary by product, with the peak pork demand period of Christmas still a little way off.

But lower EU prices does increase the competitiveness of the region’s exports. If UK prices remain steady, easing EU prices could attract more import demand, both domestically here in the UK and from elsewhere in the world.

A key factor will continue to be supply, with EU production forecast to end 2023 down year-on-year for the second consecutive year. This may limit EU value declines, especially when compared with key international producers such as the USA and Brazil, who currently have prices well below the EU and UK.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.