EU pork market: Production and trade grow in 2024 but FMD weighs on 2025 prices

Wednesday, 9 April 2025

Key points:

- EU pig prices fell 20p/kg in the latter part of 2024.

- FMD outbreak in early 2025 caused further decline in prices, but market pressure has eased in March.

- EU pig meat production up 2% in 2024, driven by higher carcase weights and Polish output.

- Imports and exports both made slight gains in 2024 but remain below 2022 levels.

- China remained the number one destination for pig meat exports outside of the EU.

Price

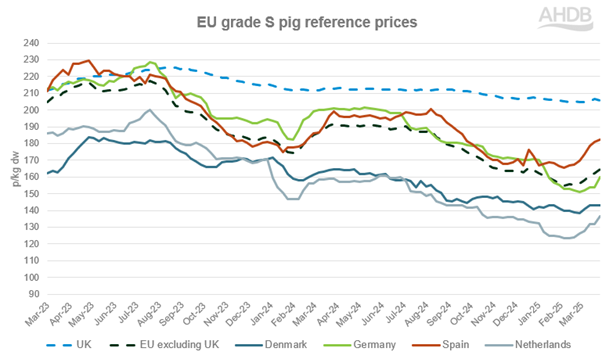

EU pig prices have been falling since the summer of 2024, on the back of increased supplies and weaker domestic consumption. From the start of August to the end of December the EU average deadweight price lost 20p/kg.

European pig prices then saw a noticeable fall in the first few weeks of 2025, with the EU average bottoming out at 155p/kg (-9p) in the 6 weeks ending 09 Feb 2025. However, the price has now recovered somewhat reaching 164p/kg for the week ending 30 March 2025.

This sharp drop followed by recovery seen in Q1 2025 has predominantly been driven by the outbreak of Foot and mouth disease in Germany. This resulted in a ban on German exports from January through to the end of March, when regionalisation was granted. As Germany is a key exporter of pig meat this placed downward pressure on the overall market.

Source: EU Commission

Production

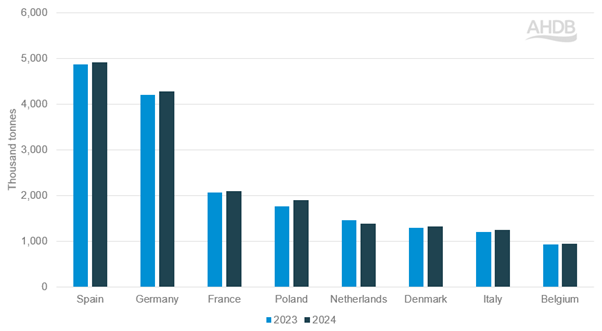

EU pig meat production has continued to show growth for fall year data in 2024 compared to 2023. Production totalled 21.0m tonnes in 2024 compared to 20.6m tonnes in 2023, an increase of 2%.

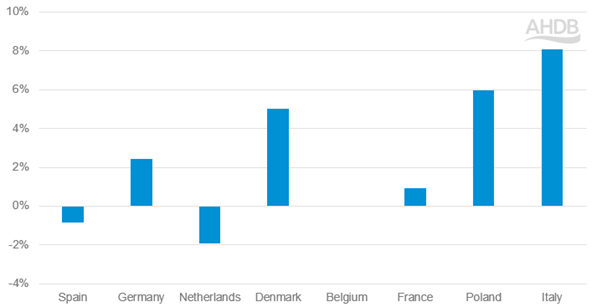

Poland saw the most growth, increasing their production by 7.7% representing an increase of 136,000 tonnes for 2024. Most major producers saw steady growth, Spain up 1.0% and Germany up 1.7%, however the Netherlands saw notable reductions in production, down 5.2% representing a fall of 76,000 tonnes.

Pig meat production of select EU-27 countries

Source: European Commission

Slaughter numbers were also up yet not as large as production figures. Total EU slaughter reached 221m head for 2024, an increase of 0.8% on 2023. Again, Poland saw significant increases of 5.4% with the Netherlands seeing a fall of 5.8%. This reduction in Dutch production is likely a cause of significant breeding herd reductions, down 14% between December 2023 and December 2024, driven by government environmental policy. The main producing nations of Spain and Germany saw modest increases, up 0.8% and 1% respectfully.

This more modest increase in slaughter numbers compared to production has been reflective of the increase in weights at slaughter across all major producers, year-on-year. This was particularly significant outside of the top two producing nations (Spain and Germany), with France, Poland and Denmark recording an increase in kg/head of 1.0kg, 2.1kg and 3.9kg respectively.

Trade

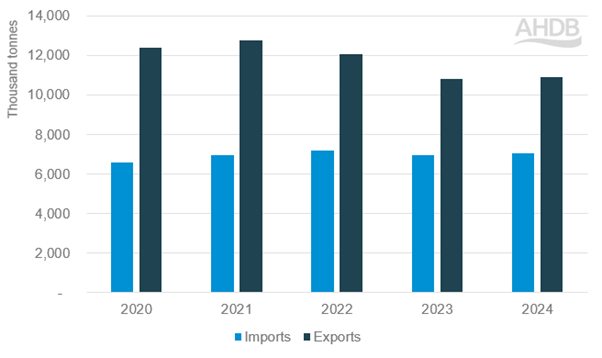

Total EU pig meat (including offal) imports slightly increased in 2024 compared to 2023 reaching 7.03m tonnes (+1.2%) however this is still below 2022 levels by 2.1%. Exports also increased in 2024 compared with 2023 by 1% however this is still significantly lower than 2022 (-9.5%).

Total import and export volumes of EU countries of pig meat including offal between 2020 and 2024

Source: Eurostat compiled by Trade Data Monitor LLC

Although Spain is a relatively small importer of pig meat, making up 2.9% of total imports into the EU, their import volume increased by 16.8% in 2024 compared to 2023. This is reportedly driven by carcass weights not keeping up with domestic demand, as slaughterhouses in Spain have looked to importing from Belgium and the Netherlands to fulfil contracts. Italy, who are the largest importer of pig meat in the EU, also significantly increased volumes imported, up 75,000 tonnes (+6.9%). By contrast, Germany decreased their import volumes by 53,000 tonnes (-5.8%) likely due to their increase in domestic production.

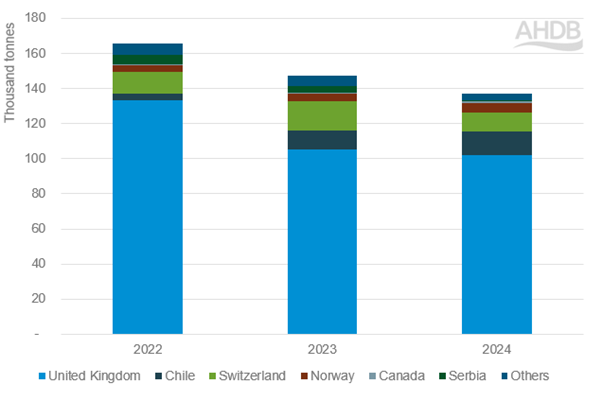

2024 import volumes from outside of the EU totalled 137,000 tonnes, down by 7.3% from 2023. The main importers to the EU remain the UK (75% of total volume), Chile (10%) and Switzerland (8%). Imports from the UK however were down 2.7% in 2024 compared to 2023, likely a combined impact of improved EU domestic supply and the increased price differential making UK pig meat less attractive.

Imports of pig meat (including offal) from outside the EU27 between 2022 and 2024

Source: Eurostat compiled by Trade Data Monitor LLC

With regards to export volumes, Spain, the largest exporter within the EU, reduced volumes by 22,000 (-0.9%). Yet Germany, the second largest exporter of pig meat (including offal), increased their export volumes by 2.4% representing an uplift of 45,000 tonnes compared to 2023. Likely reflective of their increase in domestic production. This is also true for Italy where export volumes were by 8%.

Percentage change in export volumes of pig meat including offal for select EU27 countries (2023 vs 2024)

Source: Eurostat compiled by Trade Data Monitor LLC

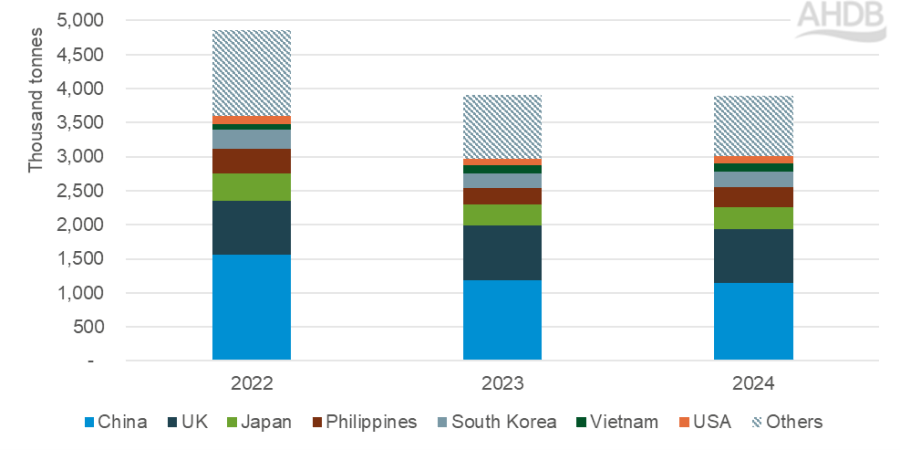

Exports outside of the EU of pig meat including offal totalled 3.9m tonnes in 2024, down 0.3% compared to 2023. China remained the number one destination for pig meat outside of the EU, however shipped volumes reduced by 47,000 tonnes (-3.9%). The majority of this volume was made up of frozen offal (53%).

Exports to the UK also declined, although this was only a marginal decrease of 3,500 tonnes despite the increased price differential in the latter half of 2024. Exports to the UK were mainly fresh and frozen pork (43%) with sausages making up 20%.

Exports of pig meat (including offal) from the EU to non-EU countries between 2022 and 2024

Source: Eurostat compiled by Trade Data Monitor LLC

Sign up

You can subscribe to regular updates straight to your inbox. Create a free account on our Preference Centre and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.