Falls in milk prices expected due to tumbling commodity prices and a surplus of milk

Thursday, 2 October 2025

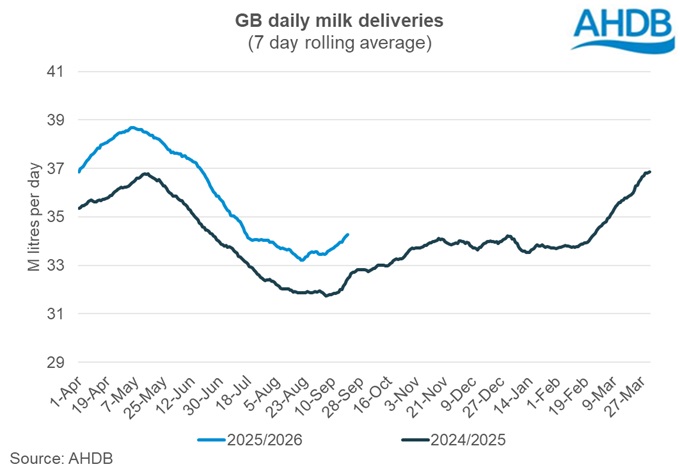

GB milk production for the milk year to date has reached 5.53 billion litres, 217 million litres ahead of this time last year (or 5.2%) and 4.1% ahead of the 5-year average. To put that into context that is still 110 million litres ahead of the next highest year (2019/2020) and is by far the highest point seen in the past decade. This is despite some of the dryest conditions ever seen in the UK, causing grass-growth issues in many areas of the country.

Booming milk supplies

Milk supplies have been so buoyant due to an almost 20-year high in the milk to feed price ratio and record levels of compound feed have been produced and sold.

But British dairy has been in a unique situation for the majority of this year. Ordinarily, such high milk supplies would build up supplies of dairy products and cause commodity markets to fall. However, a number of factors stopped this from happening:

- A shortage of global milk supplies, particularly EU milk supplies, driven by the prevalence of Bluetongue virus in markets such as the Netherlands, France and Germany driving both an increase in cow culling and a fall in production.

- Strong seasonal demand for cream driven by excellent weather domestically and a bumper berry crop, tightening butter production and stocks.

- Strong short-term export demand for Irish butter and other commodities destined for the US ahead of incoming tariff impositions

However, milk supplies are now building globally, and commodity stocks are following suit. According to Fonterra, in August US milk volumes were up by 3.3% year-on-year due to growing cow numbers and yields. New Zealand is also off to a positive start to their season of 1.8% due to improved margins and exceptional weather. GIRA predict that 2025 full-year milk collection is likely to reach +0.8% on the previous year in volume terms, while milk solids supplied will pass 1,950 kt, setting a new 12-month record supply for manufacturing. The EU has recovered to some extent and is now seeing very modest growth but not exhibiting the previously seen weakness.

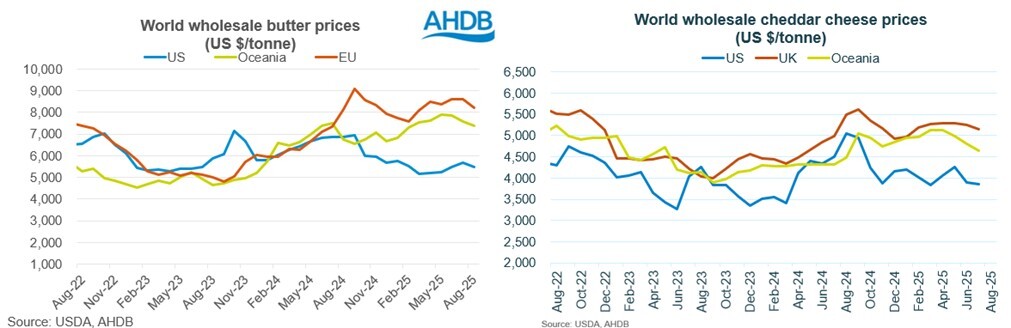

European premium

A large price differential has also emerged on commodities between the US / Oceania and Europe with European prices at a considerable premium. As an example, the US butter prices sat at the equivalent of $5,463/tonne compared to EU butter price of $8,225 for August: a premium of 51%. It is a similar tale for cheddar cheese which is at a 33% premium over US cheddar. Whilst this does not take account of differing exchange rates, quality and production standards it is an indication that there is currently a high degree of imbalance in the global market and we should expect a price correction.

Pressure on UK commodity prices

This situation is already putting pressure on commodity prices. AHDB’s September UK wholesale prices showed prices slumping through the month. Butter prices recorded the most dramatic change losing over £500/t in September on average but with bigger drops towards month end. Mild cheddar prices saw a substantial drop of £410/t month on month. Sellers are actively looking to shift product but still require pricing that covers higher milk costs.

Increased supplies of competitively priced US cheddar has been shifting dynamics. There are already some reports of US butter coming into the EU, as the price differential is so great, even accounting for the substantial tariffs and export costs it is still cheaper than European butter.

These pressures have already seen AMPE fall by 3.5ppl (to 41.3 new AMPE) and MCVE by 4.8ppl (to 38.5 new MCVE).

Milk prices likely to fall – but by how much?

AMPE and MCVE provide us with an indication of the value of milk processed into dairy commodities. With their value dropping it is likely that milk prices will follow suit. Announced milk prices for October have been inconsistent with some rises in aligned contracts but with no big falls. However, at the time of writing, one processor in the South West had announced a severe drop of 8ppl for November. That region is facing less pressures on forage so perhaps requires a sharper market signal than some others in the country. The processor in question reported their farmers were forecasting a 16% growth in milk volumes for the next year. Other chunky falls elsewhere have been announced for November with one fall of -6ppl and -4ppl and spread of other small ones.

Based on the falls seen so far in AMPE and MCVE based on September pricing we can predict a fall in average farmgate milk price of 3.3ppl from 43.7 to 40.4ppl by December with the possibility of more to come if commodity prices fall further.

Some areas, such as organic, that are still trying to rebuild milk supplies, will be insulated from some of these price pressures and have seen price holds in latest announcements.

Cheap feed – but rises in other costs

As concentrate feed prices are low, the milk-to-feed price ratio suggests that milk prices would need to fall by a larger amount before production will start to fall year-on-year. However, the milk-to-feed price ratio is based on concentrate feed prices and does not account for the increasing costs for bought-in forage that many farmers are facing or for other increased costs such as straw and labour. Processors must consider these additional costs in their calculations.

Outlook

In light of forage shortages (for some) and falling milk prices we may see increased herd culling decisions over the winter months, especially as beef prices remain extremely strong. Farmers should ensure they are prepared for a period of tightening margins and are taking advantage of the current availability of lower priced feed by purchasing ahead where possible.

AHDB will be monitoring the market situation closely to keep our levy payers informed and ready.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.