Feed remains largest contributor to dairy production costs

Wednesday, 9 November 2022

Input costs continue to be a primary concern for farmers as we make our way into the second winter of high prices. The sharp rise in energy prices seen last autumn, combined with the ongoing war in Ukraine, has driven up agflation for over a year now. While all farmers have been affected, the extent of the impact will vary across sectors depending on their cost structures and exposure to different input costs.

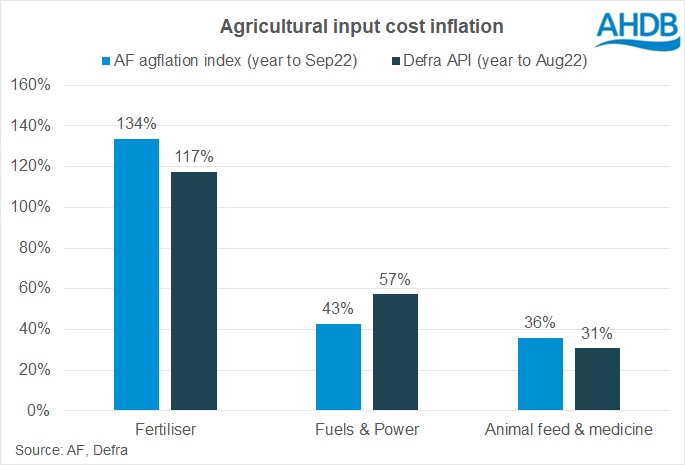

The extent of the problem across the agricultural industry has been commented on widely with several figures reported by different sources. Defra’s Agricultural Price Index (API) puts input costs (all inputs, all sectors) at 30.7% higher than last year as of Aug22. Anglia Farmers (AF) latest measure of agflation puts the cost of inputs up 34.15% in the year to Sep22, slightly higher than the API.

In both indexes, the biggest contributor to agflation over the past year has been from fertiliser, fuels and animal feeds.

For dairy farmers, concentrate feeds, fertiliser, fuel and power account for around a third of total full economic production costs, when averaged over a 5-year period. Concentrates make up the largest share by far, with around a quarter of total production costs. Fertiliser, fuel and power together account for 7% on average. Full economic production costs include the value of unpaid labour, machinery and buildings depreciation and the rental value of owned land.

Based on the latest AHDB estimates, the middle 50% [1] of dairy farmers have seen average annual full economic cost of production increase by 10% in the 12 months to Aug22 [2]. The figure is lower for dairy farms than that reported for other sectors such as arable, largely due to the relatively low share that fertilisers and fuel contribute to overall dairy production costs.

Of course, the actual picture of farm finances is more complex than national annual averages can show. Many elements will impact individual farm costs. The timing of purchases will have been particularly influential this year, given how volatile prices have been. Those who managed to arrange fixed deals early on key inputs such as feed and fertiliser have likely fared better in the past year. AHDB’s estimated milk production costs are calculated as 12-month averages, to allow for this variability.

However, this also means that the full extent of price rises is yet to be realised for some, particularly those whose fixed energy contracts have recently (or have yet to) come to an end. More farmers will become exposed to the new, higher prices of their inputs over the months.

[1] Ranked by the ratio of full economic outputs to inputs in pence per litre terms

[2] Estimates are updated each quarter, with the next update in Jan23.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.