GB pig prices: edge down as slaughter numbers gain

Wednesday, 2 October 2024

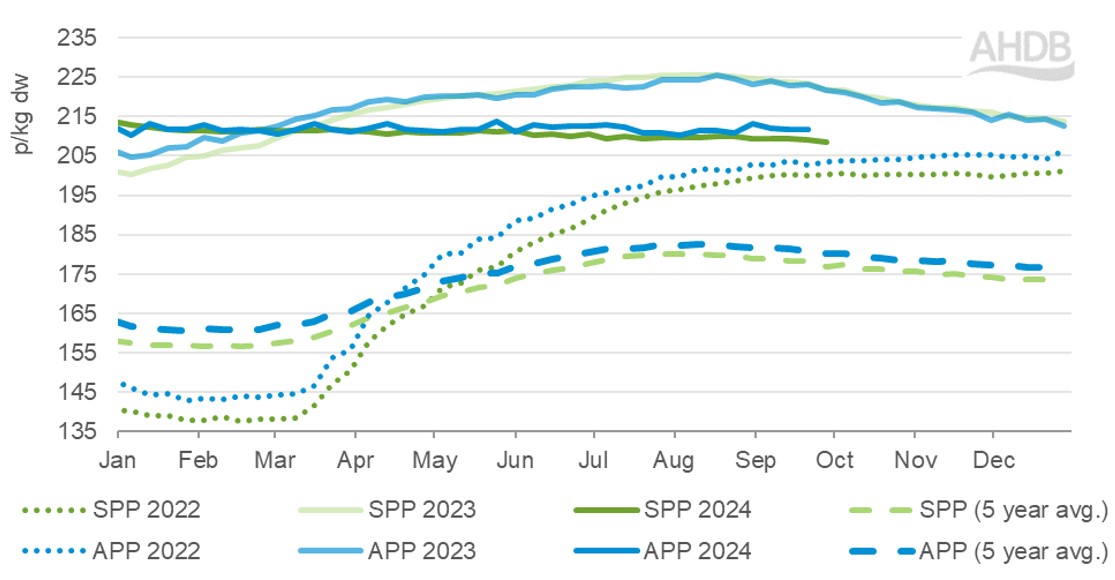

For the week ending 28 September, the EU spec SPP stood at 208.64/kg, a minor loss of 0.33p on the previous week. Prices have been easing since the start of the month, though weekly movements varied during the period. Since the beginning of the year, the SPP has lost 4.15p/kg. However, prices still continue to move in the broad band of 208.50 -211.50p/kg levels witnessed from June onwards. Increasing slaughter numbers, a slight softening in retail demand and widening price differentials between the UK and EU prices remain key drivers.

The EU spec APP stood at 211.77p/kg for the week ending 21 September, losing 0.10p/kg on the previous week. This represents some stability following changes seen in the previous two weeks. Although the APP sees more volatile weekly movements, overall, the price series has seen little change since the start of the year, gaining 1.40p.

The latest price differential between the UK and EU reference prices has increased to around 34.68p/kg compared to the average spread of 26.9p/kg during January -September this year , thereby making EU imports competitive, a key watch point in the current market

Supplies are growing

GB estimated clean pig slaughter for week ending 28 September stood at 158,750 head. For the four week period ending 28 September, GB estimates totalled 648,300 head, an increase of 5700 head compared to the previous four weeks and 3.89% higher than the same period last year. Along with an estimated increase in clean pig slaughter, increase in the average carcase weights are supporting pigmeat production. The average carcase weight (EU spec SPP) in September increased to 90.66kg, however year-on-year average carcase weights continue to sit higher.

Demand is softening

Domestic retail demand remains down year on year. According to the latest retail data from Kantar, pig meat purchased volumes fell by 0.9% year-on-year in the 12 weeks ending 01 September. Volume changes did see some variation by category. Primary pork saw volumes fall by 3.8% year-on-year. Overall volumes of processed pig meat declined by 2.3% during the period. However, sausages saw an increase in volumes mainly driven by increased volume per shopping trip.

The wet weather has dampened the seasonal barbeque demand during the summer. This, alongside the wide price differential between the UK and EU pricing and continued challenging retail demand picture, may continue to present some downside risk in the weeks to come. A seasonal uptick in demand for the Christmas period may limit the risk of downside movement. Recently increased geopolitical tensions and exchange volatility are key watch points which will direct future trade flows and price movement.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.