GB pig prices: edge up as slaughter numbers slip

Wednesday, 5 June 2024

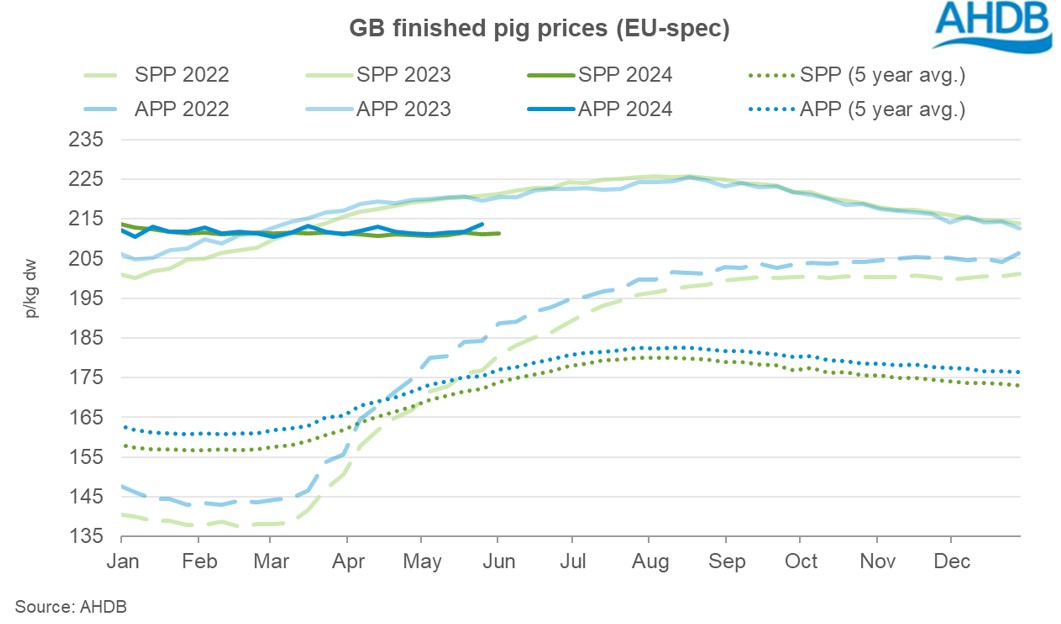

In May the EU spec SPP averaged 211.19p/kg, an increase of 0.29p from April. Weekly movements varied during the period with small declines recorded in the week ending 04 and 25 May. However, these were counteracted by increases through the rest of the month, with notably larger increases in weeks ending 18 May and 01 June to currently sit at 211.39p/kg. This has resulted in the SPP continuing to sit in the range of 210-212p/kg since the end of January.

The EU spec APP stood at 213.71p/kg in the week ending 25 May, gaining 2.42p since the end of April, although weekly changes have fluctuated in size, they have been positive with the exception of w/e 4 May. The APP has remained relatively stable since the end of December 2023, sitting in the range of 210-213p/kg.

Both the price series are sitting below year ago levels by around 10p/kg for the SPP and 6p/kg for the APP.

The price differential between the UK and EU reference prices has stabilised around 21p/Kg, reinforcing stability in the domestic market.

Supplies are tightening

GB estimated clean pig slaughter for week ending 01 June stood at 151,000 head. For the five week period ending 01 June, GB estimates totalled 735,300 head, a 4% decline compared to the previous five weeks and 6% lower than the same period last year. Continued wet weather is reportedly impacting productivity, especially on outdoor units. The average carcase weight (EU spec SPP) in May eased month on month by 470g to 90.71kg, however, year-on-year, average carcase weights continue to sit higher by more than 1kg.

Subdued demand

Domestic demand remains subdued and although inflation has eased, consumers remain wary of their spending. According to the latest retail data from Kantar, pig meat purchased volumes fell by 2.1% year-on-year in the 12 weeks ending 12 May. Volume changes did see some variation by category. Primary pork recorded growth of 4.8%, which was primarily driven by an increase in roasting joints following greater promotional activity over the Easter period. However, over all volumes of processed pig meat declined by 2.8% year-on-year driven by falls in gammon and bacon, although there was strong growth for burgers and grills as consumers look for variety. Some drier warmer weather, bank holidays and upcoming sporting events may provide an uplift to demand in the coming weeks.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.