GB pig prices: Q1 2025

Tuesday, 8 April 2025

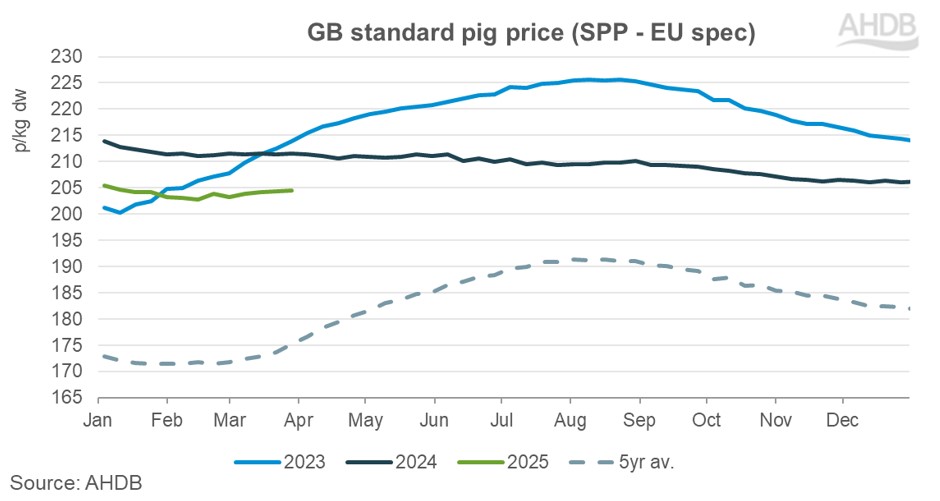

For the week ending 29 March, the EU spec SPP stood at 204.56p/kg, a minor gain of 0.20p on the previous week.

Despite making weekly gains in the last four weeks, prices are almost 1p lower compared to the beginning of the year, with the steady decline seen in the latter part of 2024 continuing through January and February. The SPP has lost over 7p compared to year ago levels, as production volumes have increased. However, GB pig prices remain historically strong, around 29p/kg higher than the 5-year average.

Outbreak of Foot and mouth disease weighs on EU prices

Falling pig prices on the continent widened the gap between the UK and EU reference prices, adding pressure to the domestic market through the back end of 2024 and into 2025. The outbreak of Foot and mouth disease (FMD) in Germany in the middle of January, weighed down EU prices further. Subsequently the price differential between the UK and EU reference prices increased to around 50p/kg in February compared to the historic range of 20-30p/kg, thereby making EU imports more competitive.

The outbreak in Germany has been contained and regionalisation has been granted to German product, providing support to the market, with the German pig price gaining 7p in the week ending 30 March. This has narrowed the gap between UK and EU prices to around 41p/kg.

However, further outbreaks of FMD have been reported in Hungary and Slovakia, which may continue to add some pressure to the domestic EU market.

Uncertainties Ahead

With the UK currently witnessing warmer weather, favourable for barbeques, and with the upcoming Easter bank holiday, we may see a pick-up in domestic demand. However, consumers remain wary of their spending with a number of household bills increasing this April.

Geopolitical tensions on global markets will dictate trade flows and may disrupt demand in the coming months. Trump’s announced tariffs last week are making headwinds across the industry. For the UK, all exports to the US from 5 April 2025 are subject to at least 10% tariffs, making them more expensive with the additional cost likely to be passed onto consumers.

How the market tunes itself to the dynamics of supply and demand, will be key to its success.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.