GDT Price Index: takes a step down at the latest event

Thursday, 9 November 2023

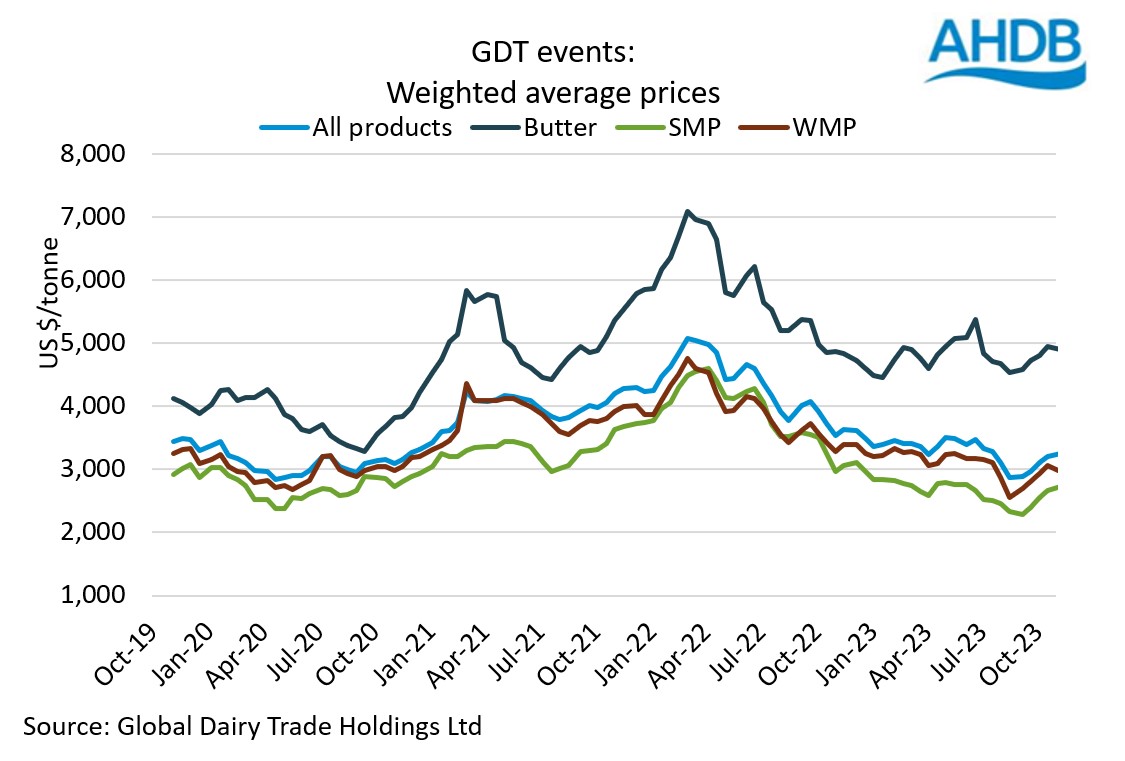

The GDT Price Index took a step down at the latest Global Dairy Trade Event. After four consecutive sessions of growth since September the index has softened by 0.7%. The average price reported at the latest event (7 November 2023) was $3,255. This had been recovering for the previous four consecutive periods, reversing the previous trend of decline seen since March 2022.

At the auction, WMP recorded a decline of 2.7% at $2,971/t, butter declined by 1.6% to $4,890/t while other product categories continued the positive momentum. SMP increased by 2.3% to $2,724/t and cheddar prices increased by 4.5% to $4,042/t. Volumes traded were 4.1% lower at 34,514 t compared to the previous event. Most of the product sold was WMP, which weighed negatively on the index.

Though there has been a marginal decline at the latest event, the current factors denote recovery could be imminent in the coming weeks. Global milk supplies recorded a decline of 0.3% year on year in August. Normally there is an inverse relation between production and prices on the GDT with prices gaining momentum amid lower supplies and vice versa. Despite the recovery in the months of September and October, prices are holding well below the peak of March 2022 levels and are hovering around pre-covid levels barring butter, which is still holding above.

Powders constitute more than 50% of the sales volume on the GDT. China remains one of the major buyers in the powder markets. Along with China, other North Asian and Southeast Asian buying activities were also reported recently. According to the latest Rabobank report, an import deficit of 11.9 M t of liquid milk equivalent (LME) is expected in China in 2023. The deficit is expected to increase over the next ten years as demand in China is expected to increase at a greater rate than domestic supply.

The global picture for the markets seems to be improving. Expected increase in purchases from China and demand ahead of the Christmas holidays presents a brighter picture. Considering lower supplies on the global front and increasing demand, and barring any further shocks, prices are likely return to the more positive momentum witnessed in the previous two months. This would ease margin pressure on producers to some extent, as farmgate milk prices are underpinned by wholesale commodity prices.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.