Global milk supplies race ahead – how will this impact the UK?

Thursday, 6 November 2025

UK milk supplies have been running at incredible levels, with supplies for the milk year to date up by 6.0% year-on-year. In the UK this has largely been driven by good margins fuelled by well-above average milk prices and cheap concentrate feed. However, the rest of the world is also experiencing strong growth - what is driving this? We look at the biggest two contributors.

The EU

The EU is the biggest global milk producer (of the exporting nations) with the block as a whole making up almost half (48%) of milk production from the big 6 exporters.

GB milk production started on its growth trajectory from September last year with an improvement in milk prices which has continued unabated since. However, the EU as a total has remained either in very low levels of growth or decline throughout that period until August. Although there have been pockets of growth in some markets such as Ireland and Poland this was outweighed by decline in other larger milk producers such as France, Germany, and the Netherlands. This was in spite of good milk prices and low feed costs.

So why was production low? These markets were impacted by Bluetongue virus quite badly in 2024. Bluetongue, which is transmitted by midges, can reduce milk production quite substantially in afflicted herds and also impacts on cow fertility. Although incidence of disease dropped substantially in 2025, the impact on fertility lingered. StoneX believe that cows that would have been calving in April-June took longer to get in calf and were then calving with a three-month delay so between July and September. This has skewed European milk supplies so there has been less milk in H1 and more in H2.

StoneX estimate that the impact of that on production growth seen from August has been around one third due to shift in calving pattern and two thirds due to improved margins.

The latest Eurostat figures for September show that European milk production is up by 6.0% year-on-year. With the exception of Ireland, this is being driven by growth in those markets which were most impacted by Bluetongue virus - Germany up by 120 million litres (4.9%); France up 104 million litres (5.9%), and the Netherlands up by 71 million litres (6.9%). Poland have also added to the growth with 47 million extra litres although the latter driven by margins rather than effects of Bluetongue recovery.

If the change in calving pattern is indeed a driver it may be that growth slows as we head into the winter months – the additional volumes then, would just be margin related.

Milk prices have been falling in the EU as well as the UK so margin pressures will begin to emerge in the coming months.

The US

The US is the second biggest global milk exporter making up one third (33.9%) of milk production from the big 6 exporters.

The US is also in an over-supply situation. As a result of good milk production margins last year, the industry has expanded. A large increase in cheese and whey processing capacity has come online with 15 new cheese making facilities to service increased per capita consumption of cheese in the US and export markets. Rabobank report that $9 billion has been invested in these plants and that this will increase cheese capacity by 410,000 tonnes per annum. (This is only very slightly less than total estimated annual UK cheese production). This has led to farms in the region of these plants expanding or new farms being set up to service this demand. Indeed, according to StoneX, the US dairy herd size has risen by 200,000 head over the past 18-months which is a 25-year high in the growth rate. The US has also seen some of its disease risk diminish as 2024’s production was impacted by Avian influenza, particularly in the west coast region including California.

Eucolait estimate that US milk production has risen by 3.2% for August.

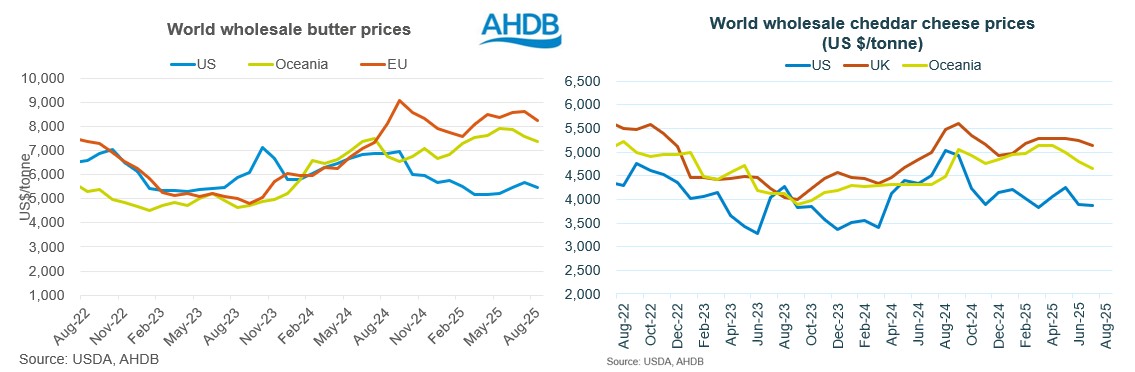

Currently, the US are selling their commodities including butter and cheddar at a considerable discount to the EU, producing lower returns. And with more milk production and more product capacity this is adding to pressure on commodity prices within the US. As with the EU and UK milk prices will now come under pressures as global commodity values decline.

The outlook

Fundamentally milk supplies are running too far ahead of what global demand can absorb. Demand is notably flat currently with export demand steady. Dairy product inventories are growing globally which means that even after production comes under control commodity prices will take some time to recover.

There could be some upside in that when weaker commodity prices feed through to retail this could stimulate demand. Particularly in butter there is pent-up consumer and industrial demand as consumers and manufacturers have had to substitute more desirable butter for cheaper vegetable oils.

Forage availability following the dry summer could be a brake in the UK.

In addition, once milk price cuts do begin to be felt, very strong beef prices – in the UK average deadweight price for cows is sitting over £5/kg compared to £3.50/kg this time last year - should encourage some reassessments of herd-size.

In the EU and US, although diseases such as avian influenza and Bluetongue viruses may have partially receded, these diseases have not gone away and are joined by new threats including Lumpy skin disease and Foot and Mouth in Europe and a possibility of New World screwworm crossing the border to the US from Mexico. These have the potential to slow production.

On balance this points to supplies in the largest milk producing regions putting pressure on the global outlook well into 2026 at which point equilibrium will resume. Until then farmers may expect a bumpy ride.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.