How is our July pork forecast shaping up?

Friday, 23 October 2020

By Felicity Rusk

At the start of July, we released our latest forecast for UK pig meat production for 2020 and 2021. Let’s take a look at how our estimates have compared with actual figures since it was published.

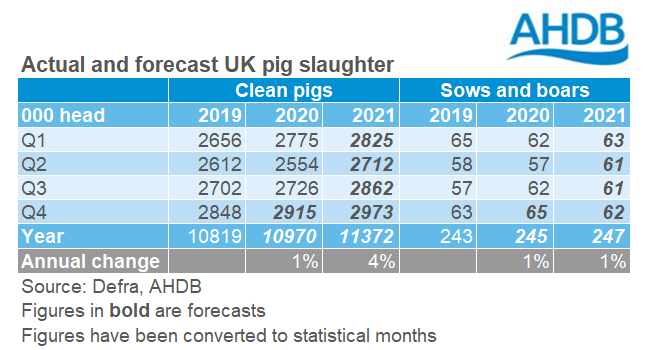

In July, we forecast that clean pig slaughter in 2020 would total 11.1 million, 2% more than in 2019. This was based on a combination of breeding herd growth and improving productivity boosting the number of pigs available for slaughter in the latter half of the year.

Despite this, we were aware of historical disease challenges that would likely have a knock-on effect on pigs available for slaughter in the first half of the year. We estimated that clean pig slaughter in the second quarter would total 2.59 million, 1% below 2019 levels. Actual slaughter over this period was roughly in line with our expectations, at 2.55 million, down 2% year-on-year.

We then expected to see 4% growth through Q3, reflecting the larger breeding herd and improved sow performance. We estimated slaughter at 2.80 million. However, year-on-year growth in actual slaughter was somewhat below expectations at just 1%, reaching 2.73 million head*.

A number of factors could have influenced why the actual figures did not quite line up with our expectations. Reports indicate that, recently, constraints on kill schedules due to COVID-19 restrictions have led some pig slaughter to be delayed. Slaughter in the statistical month of September was 8% down on the year. Of course, any pigs backed up will need to come through the system eventually and so may ultimately boost slaughter figures in subsequent months.

It is also possible that the breeding herd in early 2020 was not as large as we thought. To account for the significant growth in slaughter in late 2019 and early 2020, we believed that there was a 3% increase in the size of the breeding herd last year. A 5% increase in GB breeding feed production in the 12 months to June 2020 also supported this. However, the subsequently more subdued slaughter levels suggest that the earlier spike in production was either more driven by better herd performance at the time, or that the higher sow numbers were not sustained. Pig breeding feed production has fallen a little lately. If sow numbers are lower than we thought, this could mean we also see fewer numbers than we estimated coming forwards in Q4 2020 and Q1 of next year.

Finally, we may not have fully captured the extent to which historic disease/productivity challenges may have affected sow performance and piglet mortality. This could have had some residual impacts on Q3 slaughter levels.

Sow slaughter* for Q2 came out lower than expected, at 56,700 head, 3% below the previous year. Meanwhile, Q3 was in line with our expectations, at 61,800 head, up almost 9% compared to the previous year. We were anticipating slaughter to pick up this year, reflecting an older age profile in the herd.

The cull sow market has been particularly challenging over the last couple of months. Unlike finished pig prices, reports indicate that GB cull sow prices followed trends on the continent and fell significantly as the coronavirus pandemic escalated in the spring. This may have led some producers to delay culling. In June, the closure of the of a key processing plant in Germany also limited demand for sow carcases for a few weeks, which may have impacted on when sows were culled as well.

It is important to note that Defra has had a lower than usual response rate to their monthly slaughter survey since March. As such, they have had to use data from the Food Standards Agency, which may affect classifications of animals within species compared to last year. Data should therefore be treated with some caution.

We expected that carcase weights would continue to track heavier than year earlier levels. This is due to performance gains, particularly in the outdoor herd, as well as adjustments to the upper weight specifications on some contracts. This trend was seen in both Q2 and Q3 finished carcase weights.

Finished weights in Q2 were in line with our expectations, averaging at 85.9kg. We then anticipated that carcase weights would level off in Q3, as they did in 2019. However, actual carcase weights came in heavier, averaging 86.5kg, 2.1kg more than the same period in the previous year. Weights were particularly high in September, which were the heaviest on record at 87.1kg. This additional weight may be a reflection of COVID-19 delaying slaughter.

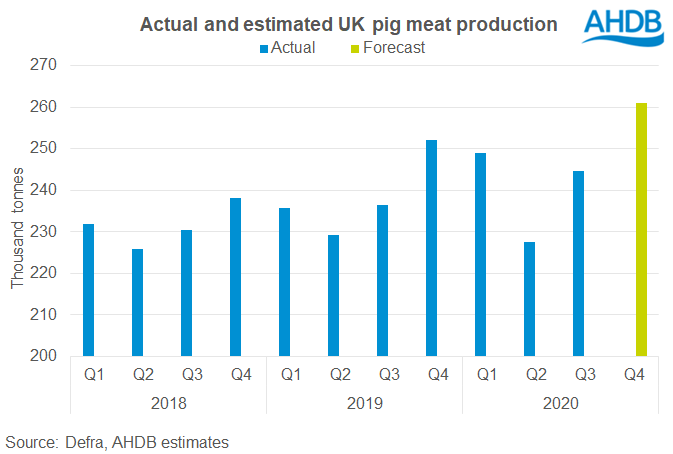

In July, we expected UK pig meat production to reach 989,000* tonnes in 2020, which if realised, would be a near 4% increase compared to 2019 levels. This was due to a cumulative effect of heavier carcase weights and higher slaughter levels.

In Q2, we had anticipated that production would reach about 231,000 tonnes*, a 1% increase on the year. Actual production came in quite similar to this at 228,000 tonnes, though this was slightly below 2019 levels.

Meanwhile in Q3, UK pig meat production reached 245,000 tonnes*, 4% higher than the same period in the previous year. While this is in line with what we were expecting, the growth has come from a more significant uplift in carcase weights, rather than throughputs, which is where we had expected the growth to come from.

In our July forecast, we expected that UK pig meat exports would increase in the region of 6% in 2020, to 307,000 tonnes carcase weight equivalent. This was mainly due to the ongoing opportunities that the Chinese market continues to offer. The export market has performed similarly to expectations. In the year to August, the UK has exported 196,000 tonnes (carcase weight equivalent) of pig meat. This is 4% more than in the same period during the previous year.

Back in July, we forecast that UK pig meat imports this year would be down in the region of 5%, at 898,000 tonnes. This was mainly due to expectations of lower overall demand in the wake of the coronavirus pandemic and limited supply availability in Europe as product is directed to China.

In the first half of the year, we estimate UK pig meat imports totalled 434,000 tonnes carcase weight equivalent**. This is 10% less than in the same period last year. Full data for the third quarter is not available yet, but so far it also seems that volumes will be lower than we expected. It may be that the logistical disruption caused by the first wave of the pandemic was larger than we had anticipated.

Nevertheless, we still could see some stockpiling activity in the final months of 2020 ahead of the Brexit deadline, as we saw leading up to the March 2019 deadline. Interestingly, our latest estimates suggest more pork has actually moved through retail and out-of-home channels in the 24 weeks to 9 August even though the large fall in imports means there has been less pork available on the UK market this year. This suggests stocks have been drawn on to serve the market, which may need to be replenished. Low EU pig prices, and increased availability of German pork now they are unable to supply China, could also boost import levels. Nonetheless, these effects may be countered somewhat by more muted Christmas celebrations this year.

So what does this mean for the rest of the year?

We had anticipated year-on-year pig meat production growth of 4% for the final quarter of 2020. If we have overestimated the breeding herd, or productivity is worse than anticipated, we could see fewer pigs coming forward than we had anticipated. However, if carcase weights remain very high, this level of production growth increase may not be unreasonable.

How slaughter capacity copes, both here and on the continent, will be a key watch point going forward, particularly as we head into the Christmas period where kill levels are usually highest. Demand looks somewhat uncertain this festive period though, with increasingly stringent coronavirus measures currently been implemented across all regions of the UK as well as many EU nations. Alongside Chinese demand developments, these will be the important market drivers in the coming months.

Our forecasts will be reviewed and published in the New Year.

*Note that, to enable comparison with the forecast, the Defra figures have been converted to statistical months.

** Fresh/frozen pork volumes are estimated based on export volumes reported by our key suppliers

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.