In Q1 2025 EU butter stocks built while cheese dwindled

Wednesday, 9 July 2025

Key trends

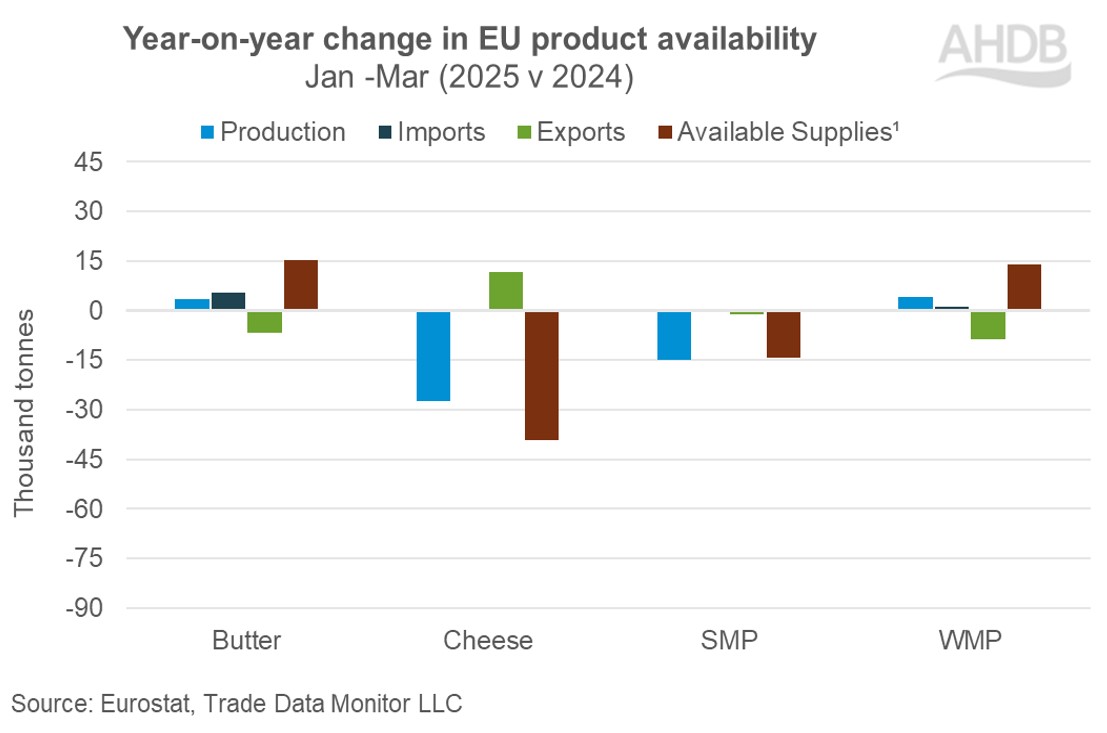

- Production growth and lower exports boost butter and WMP available supplies

- Cheese supplies shrink amid lower production and more exports

Lower milk deliveries (-1.6%) in the EU in Q1 2025 compared to last year resulted in lower production of cheese and SMP, dragging down available supplies.

Higher butter and WMP production paired with lower exports boosted supplies in the first quarter of the calendar year 2025.

Total dairy exports in the EU declined by a marginal 1.5% in Q1 2025 compared to last year’s levels.

The biggest decline in export volumes came from milk and cream followed by powders and butter during the period.

Exports declined to the MENA (Middle East and North Africa) countries and a few countries in Asia including China.

Relatively poor price competitiveness of butter and powders weighed on exports.

Butter stocks continue to grow

The increase in available butter supplies in Q1 resulted primarily from higher production and lower exports.

Buyers are hesitant to buy at higher prices, partially due to the strengthening of the euro.

According to industry sources, buyers are purchasing for immediate requirements and are not interested in long-term cover.

Lower production and higher exports trade down cheese supplies

Cheese supplies fell in Q1 2025 due to lower production and more exports. An increase in exports was reported to the United Kingdom, United States (ahead of tariffs) and some countries in North Africa and Asia.

However, exports to China, one of the major dairy importers, declined during the period, which limited the upside movement.

Overall supplies of powders stable

SMP supplies edged down 7.8% year-on-year in Q1 2025. While exports declined marginally by 0.6% year-on-year, both production and imports declined by 4.1% and 3.1% respectively, year-on-year.

Countries in the MENA (Algeria, Morocco, Egypt, Saudi Arabia, Yemen) were the major contributors to the decline.

WMP production increased by 3% in Q1 2025 and was in-line with contract fulfilment.

Industry commentators report lower export activity following outbreak of foot and mouth disease and strengthening of the euro.

Increased price competitiveness from US and New Zealand also dampened exports. Exports declined to MENA and some Asian countries including China. Available supplies increased by 16% on higher production and lower exports.

According to Rabobank, milk deliveries in EU and UK are expected to increase modestly by 0.3% in 2025 year-on-year.

This is lower than the earlier production forecast of 0.5% growth. Animal diseases (Bluetongue, Foot and Mouth, Lumpy skin disease) remain one of the major challenges for the sector coupled with economic and environment factors.

Policy decisions pertaining to 50% tariff on EU dairy products by the USA and Ireland’s request to the European Commission to hold its nitrate derogation will be vital for the dairy sector.

Looking forward global economic and geopolitical factors will influence trade flows and shape the available supplies of dairy products.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.