Is declining domestic demand contributing to the drop in GB pig prices?

Tuesday, 24 October 2023

GB pig prices are influenced by a number of factors, with domestic demand being one that has seen changes in the past weeks. In this article we explore demand data for the past 12 weeks and look into pig prices.

Key points

- Volumes purchased through retail have fallen 3.7% in the 12 weeks ending 03 September 2023 (Kantar)

- Average price of total pork grew by almost 13% in the same period (Kantar)

- Overall foodservice volumes have grown by 7.2% in the year to 03 September (Kantar)

- Pig prices have dropped from historic highs in the past few weeks due to a number of factors

What’s the latest in demand data?

Our dashboards shows that overall volumes of pig meat purchased through retail and food service has fallen by 1.3% year-on-year for the 52 weeks ending 03 September 2023 (AHDB estimates based on Kantar data).

In the 12 weeks ending 03 September 2023, volumes of pig meat purchased in a retail setting fell by 3.7% (Kantar). The frequency of shops, and volumes purchased per trip are down from the same period in 2022. The biggest fall in volumes came from typically more expensive cuts, such as roasting joints and chops. There has similarly been a fall in the percentage of households buying other pork products such as sausage rolls and pork pies, which may be due to a reduction in picnics, resulting from bad weather. However, areas that have seen growth include bacon, sausages, and mince, with lower average price per kg. Growth in these products could be from consumers being very money conscious as they tend to have a cheaper price point. These cuts are also family favourites and tasty which consumers look for in times of economic uncertainty.

However, primary pork is declining while primary beef and lamb have seen growth. This is likely because retail price growth in pork year-on-year was the largest of the three red meats at 12.6%, compared to lamb at 4.1% and beef at 11.5% (Kantar).

In the 52 weeks ending 03 September 2023, pig meat volumes in foodservice grew by 7.2%, with growth of 13.2% year-on-year for dine in/on the go, compared to a decline of almost 2% in the takeaway category (AHDB estimates based on Kantar OOH data). Sandwiches alongside breakfast items, burgers, and savoury pastries such as sausage rolls provided the uplift in dine in/on the go category. The growth in dine in continues as consumers return to the eating out market after covid, however pork volumes remain lower than pre-covid. This would suggest that stretched budgets mean consumers are still eating more meals at home and taking more food from home to eat on the go or at school and work. While pork volumes in takeaways saw small declines, volumes are still up more than 200% on 2019.

Pricing in both retail and foodservice settings remains an important factor in determining demand for red meat. Volumes of pork have declined mainly due to a fall in volumes purchased per shop in 12-week data and falls in takeaways such as pizza and Asian cuisines.

Pig prices round up

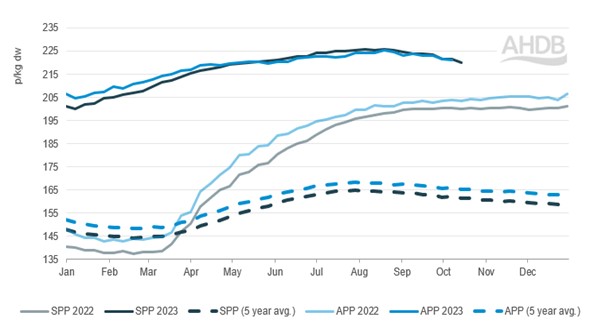

Pig prices have seen some changes, as the EU spec SPP has fallen from its historic highs down to 220.12p/kg for the week ending 14 October. This week represented the second week of large falls in prices, down by 1.62p from the previous week. Domestic demand is one factor influencing this drop, as fewer consumers purchasing pork reduces pressure on the market.

GB pig prices are also influenced by EU prices, which have fallen for longer and with larger price drops, impacted by falling consumer demand and industry restructuring. EU prices are now establishing a more typical discount compared to GB prices as a result, which could make EU product more attractive to buyers. This could be the main driver in recent GB price declines, as the EU is our main supplier of pig meat imports. Overall imports of pig meat did grow from July to August, which could indicate that more product was available to the market during this time. Similarly, pig production was higher in August, the highest seen so far this year, which likely increased supplies available for consumption, placing pressure on prices.

Whilst prices have been falling, the overall cost of inputs has been easing from the peaks seen last autumn/winter. The Agricultural Price Index shows the rate of inflation has fallen which may ease the cost of production and improve net margins, although there still remains some challenges with increased interest rates and continued volatility in feed, oil and gas markets.

GB finished pig prices (EU-spec)

Source: AHDB

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.