Lamb market seeks demand

Thursday, 2 April 2020

By Rebecca Wright

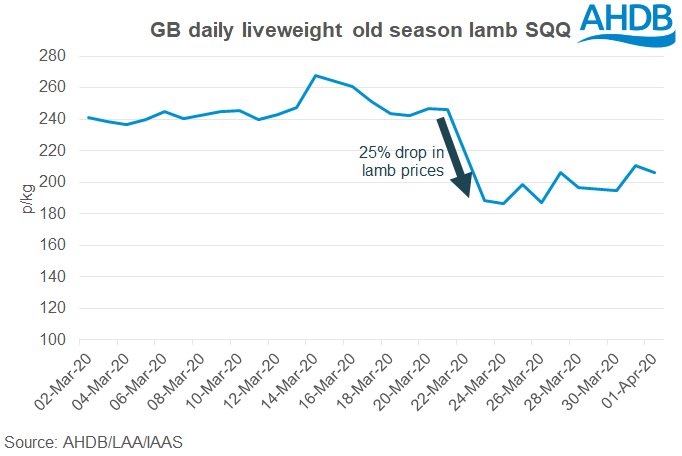

Liveweight lamb prices have been a mixed bag this week. Following sharp declines last week, this week the GB daily prices have been stable to slightly higher. Despite these small rises, prices remain below levels seen before Monday 23 March. Throughout the week throughputs have been subdued. The GB liveweight OSL SQQ fell a further 18.6p, to 202.15p/kg, in the week ending 1 April. Taking the last two weeks together, prices have dropped by 47.9p/kg. Cull ewe prices were equally subdued, down week-on-week by £30, to £60/head.

Lamb throughputs were down, even compared to last week’s exceptionally low levels. They were just a fifth of the levels typical at this time of year, just shy of 30,000 head. Cull ewe throughputs were also low at around 4,000 head.

During the week ending 28 March, the GB deadweight OSL SQQ fell 34.8p, to 516.6p/kg. The estimated kill dropped both week-on-week (-17,000 head) and year-on-year (-35,000 head) to 204,000 head*.

The key drivers are largely the same as last week; much of Europe as well as the UK, will be in ‘lockdown’ over Easter (and potentially the start of Ramadan), reducing demand.

This week the French government announced a policy that French food retailers are to prioritise French products, before looking towards imported products. This could put demand for UK export lambs under even further pressure. However, the French weekly lamb kill is reported to have dropped to almost an eighth of its typical level for the time of year. Under ordinary circumstances one would expect this to support UK export demand, but demand for lamb in France in currently exceptionally low. Reports suggest some consumers either suffering directly from a loss of income, or having concerns over the potential of a reduction in income in the future.

Depending upon how long the UK (and other European countries) remain in lockdown, Ramadan could also be affected. This year, Ramadan starts around two weeks after Easter. Although many think of Ramadan as a fasting festival, Muslims fast during the daylight and then typically would break the fast by having large meals, inviting friends and family over each night. If we are still in lockdown during this period, during which lamb usually does well, then sales of lamb are unlikely to receive the same boost.

Domestically, consumers’ financial concerns mean they are trading down rather than looking to the more expensive proteins. This is the main reason why lamb may not transfer into retail as well as other proteins. Lamb typically over-indexes in pubs and independent restaurants compared with retail sales. However with those outlets closed, lamb potentially lost out to other proteins. When eating at home, consumers do tend to go for slightly different food choices, as well as having smaller portions.

Key dates for UK lamb demand coming up

12 April – Easter - The UK and most of Europe will be in lockdown, removing any large family gatherings

23 April to 23 May – Ramadan – Potential for the UK and Europe to be in lockdown, at least for the beginning of Ramadan

23/24 May – Eid al-Fitr – A feasting festival at the end of Ramadan

20 July to 3 August – Eid al-Adha – A festival where Muslims follow in the footsteps of the Prophet Abraham and have an animal slaughtered as an offering to God. Called the Qurbani, meat is received in three portions – one for the person buying, one for friends and neighbours, and one for charity, helping drive a spike in demand. During this period, the community looks for mature animals, aged six months or older that are fit, healthy and lean.

*estimated slaughter figures should be treated with caution, as a larger share of animals than usual may have been sold deadweight, given the temporary disruption to some live markets. This would reduce the accuracy of the estimate.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.