Long-term global pig meat supply: Asia to drive growth to 2034

Wednesday, 20 August 2025

Key points

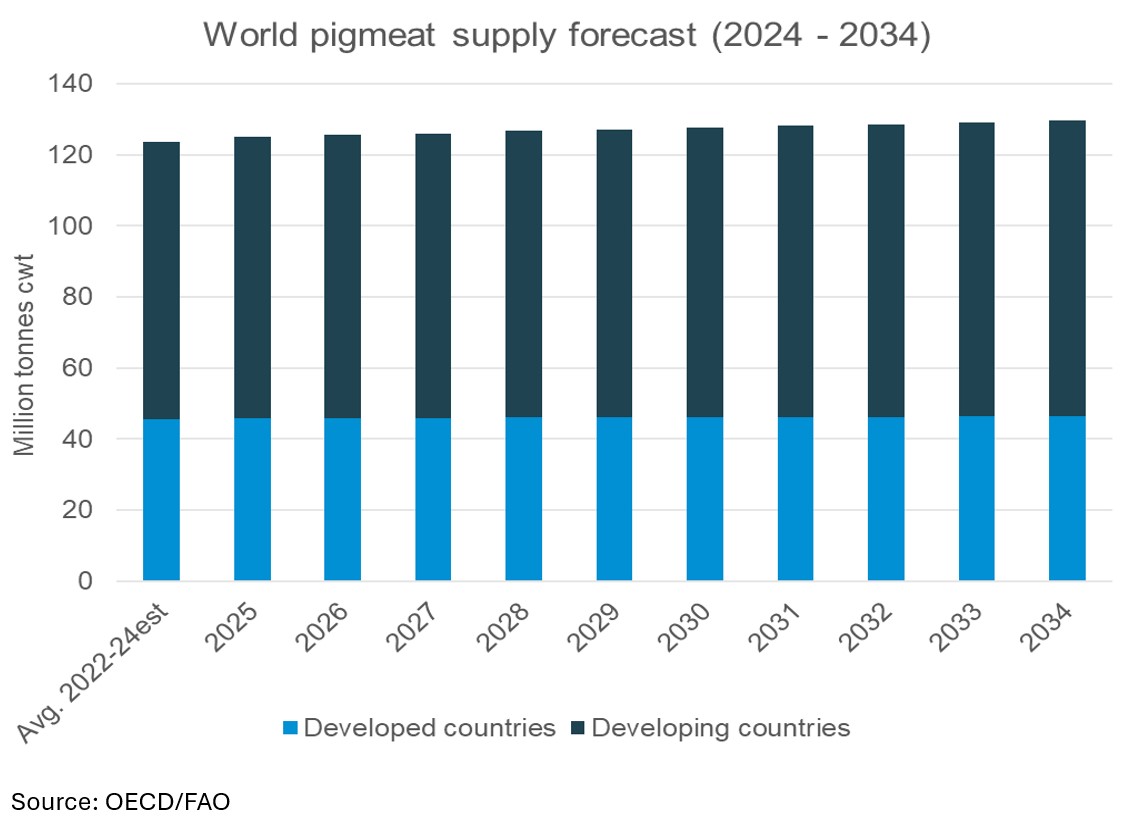

- Global pig meat supply is forecast to increase to 130 million tonnes cwe by 2034, growing by 0.4% per annum.

- Improved breeding efficiency and increased slaughter weights will drive meat production volumes over the next decade.

- Developing countries, are expected to witness significant growth over the forecast period. Meanwhile, OECD member countries are expected to see a minimal growth.

- Disease, climate change and geopolitics will be key watch points for this forecast.

Global supply projections: Pig meat supply is growing

The global supply of pig meat is projected to rise steadily in the next decade. According to the OECD-FAO Agricultural Outlook 2025-2034 (produced jointly by the Organisation for Economic Co-operation and Development - OECD - and the United Nations Food and Agriculture Organisation - FAO), global pig meat supply is forecast to grow from 124 million tonnes (Mt) carcase weight equivalent (cwe) in the base period (2022-2024) to 130 Mt cwe by 2034. This is equivalent to an annual growth rate of 0.4%.

Over the next decade, global meat production is forecast to rise by 13% to 406 Mt cwe, and pig meat will account for around 13% of the total increase by 2034.

World pigmeat production forecast (2024-34)

Source: OECD/FAO

Developing countries fuelling growth

Asia

The OECD-FAO outlook highlights that meat production in Asia will contribute 55% of the total global growth. Most of the projected growth in pig meat production will occur in the developing regions with Asia a major contributor to the increase. According to OECD, Southeast Asia is expected to see rapid growth in countries such as Vietnam, the Philippines and Thailand. It is assumed that recovery from ASF will occur across the region during the first half of the Outlook projection period.

Vietnam’s recovery from the overwhelming ASF outbreak in 2018 will support growth of 2.8% per annum (p.a.) in the next decade. The industry is moving away from small-scale holdings to larger-scale units with an emphasis on bio security.

The Philippines is another major market, where production will witness strong growth (3.8%) over the next decade. Growing demand in the domestic market will drive production growth. However, ASF remains a challenge for the sector.

Indonesia and Thailand are expected to see production increase by 2.8% and 1.1% p.a. respectively over the next decade.

Meanwhile China, which is the world’s largest consumer of pig meat, is forecast to see pig meat production remain stable at current volumes. A stagnating economy and market consolidation is weighing on industry.

Latin America

Latin America contributes 15% of global livestock production. The OED-FAO outlook predicts growth of 1.3% p.a. in pig meat production by 2034, contributing 20% of the regions additional total meat produced in the next decade. A relative decline in feed prices in the medium-term is expected to incentivise expansion.

All countries in the region are forecast positive growth during the period. Brazil, the largest producer of pig meat in the region, is anticipated to grow 0.7% by 2034, with lower feed and labour costs keeping Brazilian pig meat competitive on the global market.

OECD members show marginal growth

Europe

Overall. developed regions are likely to witness marginal growth of 0.1% in pig meat production. However, the European Union it is expected to decline by 0.3% p.a. over the next decade. Fewer breeding sows, outbreak of disease, environmental regulation and changing diets pose a threat to production growth.

Meanwhile, the UK is forecast to see a production growth of 0.4% by 2034. Higher carcase weights and positive farm margin incentivising further investment are the main factors driving production. However, it is underpinned by challenges such as labour shortages.

North America

The intensive nature of production systems in North America means the region supplies 13% of the global value of livestock production. However, feed is a major cost driver and higher pricing for raw materials over recent years has pressured profitability, but productivity gains are outpacing inventory expansion.

OECD-FAO forecasts growth in pig meat of just 0.3% and 0.4% respectively in the US and Canada over the next decade with trade surplus easing by the same amount. Uncertainties caused by increased tariff rates will likely negatively influence trade flows and may impact production confidence.

Challenges and uncertainties for global pig meat supply

- Disease outbreak in the global market is one of the major challenges putting production at risk. Recently we have seen the spread of ASF, FMD and PRRS. This puts pressure on domestic production in infected regions and limits trade. No cases have been reported in the UK, although they remain a significant risk to our industry and highlight the importance of good biosecurity.

- Climate change and extreme weather conditions are also a matter of concern for livestock producers. Adverse weather conditions reduce the quality and availability of feed and water, as well as negatively impacting on animal productivity.

- Sustainability and environmental regulations aimed at reducing GHG emissions and movement towards net zero targets are likely to limit the number of producer holdings in developed regions and increase the cost of production.

- Price volatility of key inputs such as feed, labour and interest rates are likely to increase with market pressure and geopolitical tensions. Feed costs account for 60-70% of the total cost of pig meat production in the UK.

- Labour shortages remain a matter of concern for the sector. Brexit and Covid-19 exacerbated shortages on farm and within processing. We saw large numbers of pigs backed up on farm as a result of reduced capacity and have subsequently seen the cost of hiring and retaining staff increase significantly.

- Geopolitics impacts trade around the world which can distort market supplies. Physical conflict causes timely diversions to trade routes, such as the bypassing of the Suez Canal. Likewise trade policy changes, such as tariffs impact trade flows. The ongoing Trump tariffs have resulted in less US product being traded with key global markets, such as China, due to unfavourable pricing.

Opportunities for the UK

In 2024 the UK was 59% self-sufficient in pig meat production, resulting in a reliance on imported product to meet demand requirements. However, the UK also exports a significant amount of pig meat to the global market, with exports making up approximately 16% of production volume in 2024. With growing demand in the global market, there is potential to for the UK to further increase export opportunities. Emphasis should be given towards Asia and Latin America, where growth is forecasted in both the population and per capita consumption.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.