Northern Ireland milk production experiences staggering growth

Thursday, 23 October 2025

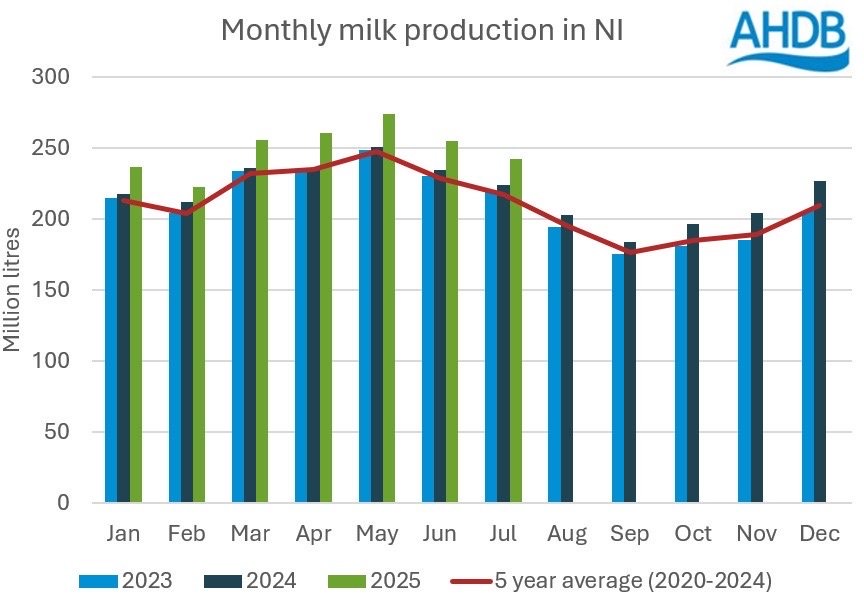

Following last season’s record high milk deliveries, Northern Ireland has experienced another jump in production. April-July deliveries increased by 9.2% year-on-year, equating to an extra 86.8 million litres, in comparison to an additional 225.6 million litres produced in GB during the same period (+5.3%).

Like GB, much of this growth can be linked to the attractive milk to feed price ratio.

According to the Ulster Farmers’ Union, NI accounted for approximately 18% of total UK milk deliveries in April, playing a significant role in the UK dairy market.

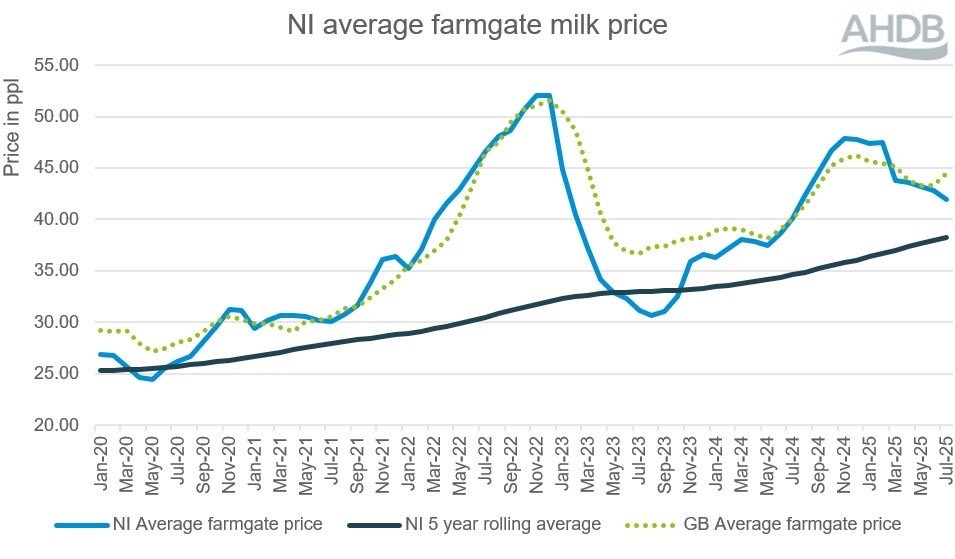

With an estimated 80% of the dairy output in NI being exported, NI prices are largely impacted by the global market dynamics. Favourable prices through the summer have been influenced by good global demand, particularly from the EU.

Source: AHDB, DAERA

While much of the UK has had to eat into winter forage early, reports suggest that NI has generally fared better for forage levels this year.

However, the surge in milk supply has strained processing capacity, and the recent growth in EU milk deliveries has put downwards pressure on prices.

Although Northern Ireland farmgate milk prices follow a similar trend to the GB average, they tend to experience steeper peaks and troughs as they are more exposed to global markets. Average farmgate milk price data in Northern Ireland shows steeper declines than GB from February to July 2025, whilst more recent milk price announcements suggest a continuation of this trend.

The latest UK wholesale prices have declined, particularly for butter, indicating further milk price corrections to come. With greater exposure to the market, Northern Ireland prices could fall more rapidly, although prices in GB are also under growing pressure.

Source: AHDB, DAERA

Herd size will be a watchpoint as milk production becomes less profitable and strong beef prices may attract greater culling levels heading into winter. Additionally, potential changes to nitrogen derogations in the Republic of Ireland could force reductions to stocking rates in the south order to comply with new rules. This could change some of the market dynamics in Northern Ireland but remains an uncertainty for now.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.