Q3 2025 EU dairy products available supplies continue to strengthen

Tuesday, 3 February 2026

Key trends

- Butter supplies continued to increase due to growth in production and imports

- Exports of cheese drop, adding to stocks

- Lower exports boost stocks of WMP despite lower production

EU milk deliveries increased by 2.3% in the third quarter year-on-year boosting production of dairy products. Delayed spring calving following the outbreak of bluetongue on the continent and good economics added to milk flows.

Increased production combined with increased imports, strengthened the supplies of butter and cheese. Lower production of WMP capped the availability of milk powders.

Total dairy exports on the continent picked up by 10.2% in the third quarter year-on-year. Good availability of butter and SMP boosted exports while exports of cheese and WMP eased amid subdued demand from the Middle East and North Africa (MENA) and some Asian countries.

The higher price of WMP in the global market limited exports.

Butter stocks continue to scale up

The increase in butter stocks in Q3 was driven by higher production due to strong milk production and high fats in the milk, while imports also rose due to cheap butter coming out of the USA.

Exports picked up by 5.0% during the period, which was dwarfed by a remarkable increase in production levels. Available supplies of butter increased 13.5% (58,000 tonnes) in the third quarter year-on-year.

Cheese supplies continued to grow

Cheese supplies were elevated in Q3, driven by a large increase in production and higher imports. Higher milk fat and protein availability also contributed to higher production.

Exports were reported to be lower during the period, with softening demand noticed from South Korea, Japan, Chile, the USA and Algeria.

Overall supplies of powders were in positive territory

SMP supplies edged up by 15.6% year-on-year in Q3 2025. Production and imports increased by 10.5% and 44.4% respectively, which outweighed the increase in exports by 8.1%.

Exports increased mainly to Asian countries like Indonesia, Malaysia, Singapore, and Morocco, Saudi Arabia, Egypt in MENA.

WMP production declined by 9.5% in Q3 2025 but imports increased by 15.2% to counterbalance this.

Exports were reported to be lower following strengthening of the euro and weak demand from the major importers.

Exports declined to Bangladesh, China, Nigeria, South Africa and some countries in MENA (Algeria, Egypt, Kuwait, Lebanon, Yemen). Available supplies increased marginally by 0.9% during the period due to higher imports and lower exports.

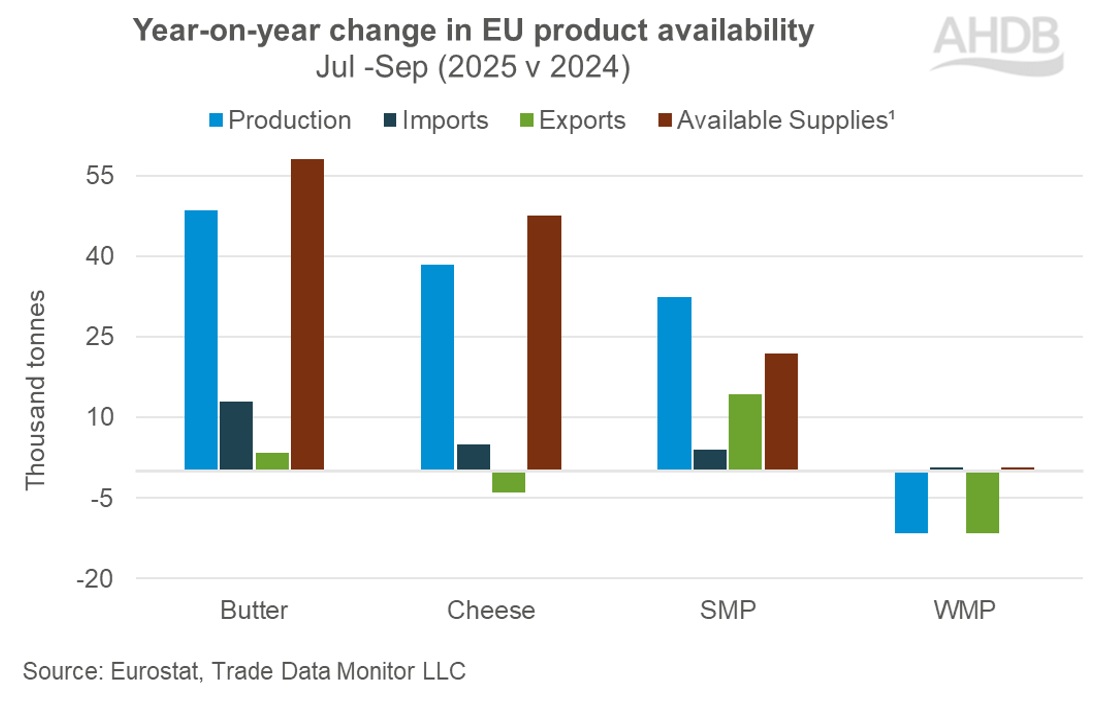

Figure 1. Year-on-year change in EU product availability

The bar chart in Figure 1 shows year‑on‑year change in EU dairy product availability for Jul–Sep 2025 compared with 2024, showing production, imports, exports and available supplies for butter, cheese, SMP and WMP.

The bars read in the sequence of blue = production, navy = imports, green = exports, brown = available supplies.

According to the latest medium-term agricultural report, the EU expects milk fat availability to increase by 2.6% and the availability of protein solids to increase by 1.8% in the coming decade.

This could add to the forecast increase in the production of dairy commodities.

Overall, the medium-term outlook looks bright, with growing demand for proteins and value-added products. However, this will be subject to the ongoing geopolitical situation in global markets.

China’s imposition of import tariffs on EU cheese and high fat milk and cream could have implications on the UK as well as globally.

The European Commission’s approval of a three-year extension of Ireland's nitrates derogation is a temporary relief for the sector amid the growing pressure of environmental regulations.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.