Q3 2025 UK dairy product available supplies paint mixed scenario

Thursday, 22 January 2026

Key trends

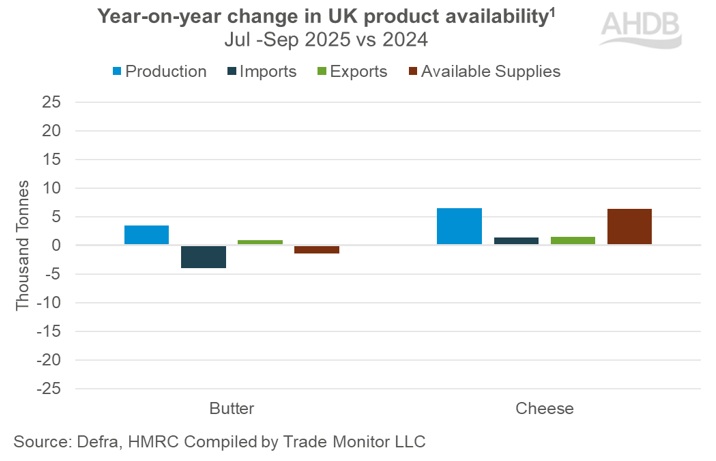

- Production of dairy products continue strongly amid record supplies of milk

- Butter supplies tighten slightly due to lower imports

- Supplies of cheese build following higher production and imports

- Good export demand for cheese continued in the global market.

GB milk volumes continued the upward trajectory in December following favourable economics. Record milk volumes have favoured increasing supplies of dairy products. UK milk deliveries in the third quarter of the calendar year (Jul-Sep) totalled 3791m litres (5.6%) higher year-on-year.

Supplies of cheese edge up

Cheese supplies continued to build following a boost in production by 5% (6,500 tonnes) compared to the previous year. Imports from New Zealand increased early in the year following the trade deal but eased later in the year. Overall imports grew due to an increase in imports from the EU (France, Germany, Belgium).

Exports also ticked up during the third quarter compared to the previous year. Overall demand remained supportive despite the higher prices of UK cheese in the global market demonstrating high regard for British quality and heritage. Cheese production and imports continued to grow coupled with an increase in exports by 3% (1500 tonnes). Accordingly, available supplies of cheese grew by 3% (6,400 tonnes).

Butter supplies nudge down

Butter production increased by 8% (3,400 tonnes) year-on-year in Q3 following record milk volumes in the domestic market. Imports declined by 24% (3,900 tonnes) whilst exports picked up by 8% (900 tonnes) during the period. Though exports picked up, volumes were limited due to uncompetitive price in the global market compared to the US. Overall higher production and exports and lower imports nudged down available supplies by 3% (1,400 tonnes)

N.B. – Supplies of milk powders are not available due to lack of data on production issued by Defra

GB milk deliveries have recorded new highs and are expected to be 4.9% more than the previous milk year according to our December dairy production forecast update. This has created additional stocks of dairy commodities thereby pressuring prices. How much prices fall in the coming months, and how quickly farmers respond, will be directional in determining the level of output. Overall demand looks uncertain amid inflationary pressure and a gloomy macro-economic environment.

According to Rabobank, production growth of milk will roll into early 2026 thereby pressurising prices. Trade dynamics following the recent development of US tariffs, EU-China tariffs will be key watch points influencing trade flows.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.