Q3 dairy trade review: export growth for cheese but powders struggle

Thursday, 21 November 2024

Key trends

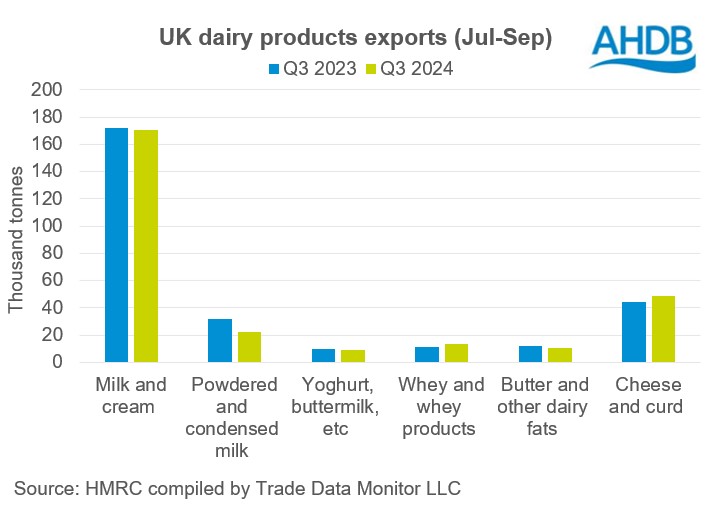

- Total UK dairy export volume for Q3 2024 declined by 2.5% year-on-year at 274,300 tonnes

- Growth in exports of cheese and curd, whey and whey products were outweighed by decline in exports of powders, milk and cream, butter and yoghurt

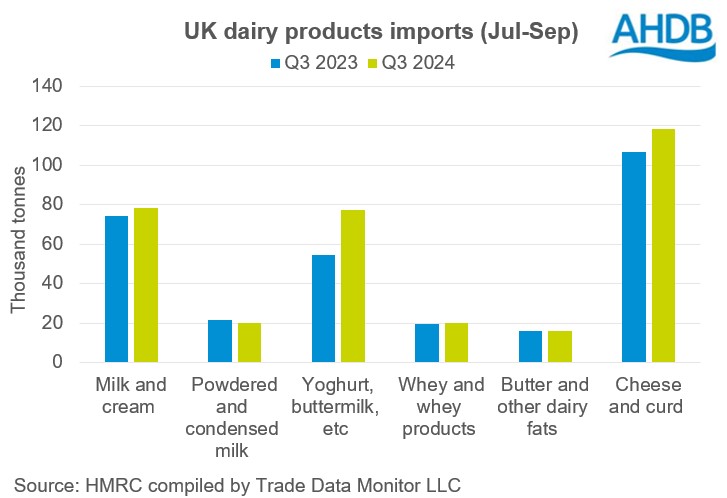

- Total UK dairy import volume for Q3 2024 grew by 13.3% year-on-year at 330,600 tonnes

- Yoghurt and cheese continue to dominate year-on-year increase in the import basket and others also trend up with the exception of powders

Boost in cheese and whey exports while others roll down

Total export volumes of dairy products from the UK for Q3 2024 were 274,300t, a decline of 7,100t (2.5%) year-on-year. This is the lowest quarterly volume recorded in the last two years. Exports of dairy products to the EU declined by 4,100t and that to non-EU nations declined by 2,900t during the period.

This was primarily driven by a sharp decline in exports of powders which fell by by 9,800t (30.7%). Milk and cream as well as butter also declined by 1,800t (1.0%) and 1,600t (13.3%) respectively, and yoghurt declined by a smaller 700t (7.2%).

In contrast to that, cheese and curd, whey and whey products continued to grow year-on-year. Cheese and curd saw the largest year-on-year increase, up by 4,700t (10.7%) mostly destined for EU nations. This was followed by whey and whey products which grew by 2,000t during the period. In EU, the largest chunk of the exports was to Ireland (9,800t) followed by Netherlands (6,000t). Increasing exports of cheese reflects increased efforts to boost British prospects overseas.

At a total dairy level EU nations constitute nearly 90% of the total UK exports. Countries including Ireland, Netherlands, France, Belgium, Poland, Germany are the major recipients. In Q3 2024, exports to Poland declined by 39% to 2,400t, Belgium declined by 22% to 7,200t and the Netherlands declined by 10% to 17,100t on Q3 2023. Exports to Germany increased by 56% to 3,900t and France increased by 11% compared to Q3 2023 to 9,200t. Exports to non-EU countries like Peru, Nigeria, Morocco, Canada and Asian countries also declined during the period.

Imports trend up

Total import volumes were up by over 38,700t (13.3%) at 330,600t in Q3 2024 compared to 2023. This was largely driven by EU nations (34,600t), which constitute the majority of our imports. Major EU nations importing more to the UK are Ireland (+10,800t), Belgium (+8,300t), Greece (+4,800t), Netherlands (+3,200t), Spain (+3,200t), Denmark (+2,100t) and Poland (+1,200t). Imports from non-EU nations increased by 4,100t with New Zealand being the major contributor. Imports from New Zealand continue to climb in the third quarter year-on-year with cheese and curd (3,600t) being the major contributor as New Zealand continues to take advantage of their preferential trade arrangements.

Imports of yoghurt increased the most by 22,800t (41.7%), followed by cheese and curd by 11,800t (11%). Milk and cream followed suit increasing by 4,000t (5.4%). Whey and whey products and butter imports increased by a meagre amount of 800t and 400t respectively in Q3 2024 compared to year ago levels. The increasing consumer demand for cheese, yogurt and cream as reflected in the latest dairy retail data has boosted demand in the domestic market. Powders bucked the trend and imports declined by 1,000t (4.8%) during the period.

Roadmap for the UK

The government is committed in promoting UK dairy produce and our recent dairy showcase is a step towards this. The increasing export of cheese denotes consumer preference for British speciality cheese and we should further leverage on this by increasing our presence in Asian countries. However global geopolitical factors like conflict in the Middle East, EU/China dispute and the newly formed US government continue to be important watch points.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.