Q4 2024 Dairy market review

Thursday, 16 January 2025

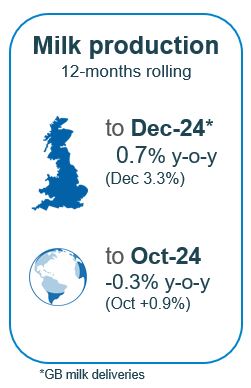

Milk production

GB milk deliveries through Q4 grew sharply, reaching 3.5% up on the same quarter in 2023. October increased by 2.7%, November 4.5% and December by 3.3%. We need to remember that we are not annualising on a good year. The 2023/24 milk season was the lowest milk-year volume recorded since the 2016/17 season. It does represent a turnaround from the challenging conditions seen earlier in the year following an extremely wet Autumn through Spring. Higher farmgate prices, creating a favourable milk-to-feed-price ratio and much improved weather extending the grazing season have led to much greater milk flows.

This is reflected in the latest forecast as an increase is now expected in GB milk production for the remainder of the 2024/25 season and going into 2025. To reflect the slow start and challenges of the weather we expect production for the milk year to increase by 0.9% year-on-year.

For the milk season so far (Apr-Dec), GB organic milk deliveries are estimated to have totalled 266 million litres, this is down by 6.9% compared to 2023/24. This decline appears to have slowed and by December production was only back by 0.8%. According to Nielsen, consumer demand for organic dairy is continuing to firm which could lead to some lack of availability.

The GB milking herd totalled 1.64 million head as of October 2024, the lowest October number recorded, and a 0.9% decrease compared to the same month the previous year. The GB herd total came to 2.55 million head, a year-on-year decline of 1.5%. A fall was seen across all age groups, with the exception of the 2–4-year age bracket. Culling of older cows helped to maintain the average age of a cow in the GB milking herd at 4.55 years, very slightly younger than last year’s figure.

Births to dairy dams in the third quarter of this year (July – September) have totalled 458,473 head, according to the latest BCMS data. This marks the highest recorded figure for Q3, and an increase of 3.0% compared to the same period in 2023. However, year-to-date (Jan-Sept) total registrations are up by only 0.8% whilst looking at the preceding 12 months show that registrations rose by only 0.9%. This would indicate a change in the months of calving (reflective of a shift towards Autumn block) but also a slight increase in calvings overall could indicate a small degree of herd expansion and less culling as a result of better prices.

In our latest survey of milk buyers, it is estimated that there were 7,200 dairy producers in GB as of October 2024. A small reduction of 30 producers was estimated since our last survey in April. In contrast, there was an estimated annual loss of 300 producers (-4.0%) since October 2023, indicating that the majority of industry exits took place last winter. Continued pressure on margins may have incentivised some of the decline last winter, alongside robust cull cow prices. However, better prices through the summer this year may have stemmed the flow of people exiting the industry for now.

Global milk production in October continued the return to growth and now sits at 0.9% ahead year on year with all regions apart from Argentina in growth. This means milk supplies are now beginning to ease.

Milk deliveries in the EU averaged 362.4 million litres per day, an increase of 2.3 million litres per day (0.6%) year-on-year. Looking at this EU figure in detail, we saw the greatest year-on-year volume increase. This was driven by Irish milk production, up by 87 million litres (14.8%). Production volumes in Poland and France were up by 34 million litres (3.3%) and 20 million litres (1.1%) respectively. Conversely, Germany declined 59 million litres (-2.3%) and the Netherlands, by 18 million litres (-1.6%). Both markets were restricted by the spread of BTV.

Looking forward, Rabobank predicts the momentum is expected to continue in all seven key exporting regions in 2025. For the coming year as a whole, milk supply growth of 0.8% is forecasted against 2024.

Wholesale markets

Overall price movements on UK wholesale markets have begun to ease after some of the record-breaking movements we saw in fats in Q4. Constraints on milk supplies earlier in the year and growing demand on the continent for cream caused a surfeit of dairy fats which led to remarkably high prices in both butter and cream, peaking in September.

Since then, growing milk supplies, both domestically and on the continent, combined with better coverage have eased pressure on commodity prices for fats through December. Prices remain very high though. Bulk cream prices came back by £131/t or 4.2%, butter back £260/t or 3.9%. SMP continued the 2024 trajectory of minimal movement in Q4 and ended the year at £2,100/t, having displayed very little range over the course of the year. Cheddar also eased by £220/t from the peak although it had not peaked until October. There was some end of year discounting reported in December however the market was quiet. Sellers and buyers appear to be at an impasse on prices with buyers showing caution on higher pricing, but sellers not willing to negotiate lower due to strong milk prices.

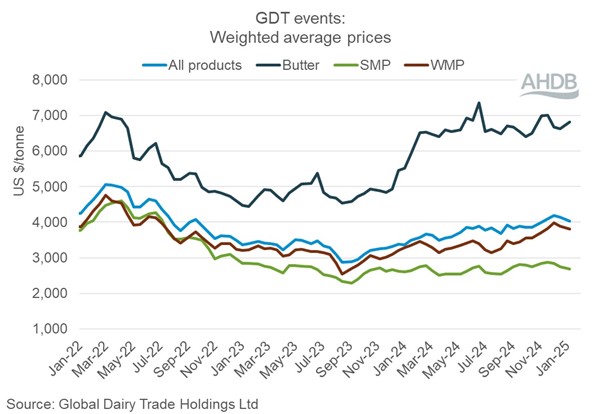

The GDT has been fairly steady over the quarter, with less price growth on fats compared to the northern hemisphere. The overall direction has been generally positive.

As of December, milk market values (which is a general estimate on market returns and the current market value of milk based on UK wholesale price movements and typical milk utilisation) have stagnated. AMPE fell slightly by 2% to 45.3ppl, MCVE fell by 2% to 44.4ppl. AMPE and MCVE are now significantly ahead of this time last year by 22% and 20% respectively.

Farmgate milk prices

The latest published farmgate price was for October, with a UK average of 45.2ppl. Latest announced farmgate prices have held firm going into 2025, with all but four contributors of the AHDB league table making no change to milk prices in January.

On retail aligned contracts Waitrose, Tesco, Co-op and M&S all continued to hold their prices for another month. Sainsbury’s however moved their price lower for the second month in a row, down 0.05ppl in January.

Non-aligned milk contracts were also stable over all month on month. Muller Direct, Freshways, Paynes, Grahams and Yew Tree all announced no change to their milk price this month. But there were slight increases made for those supplying Crediton (+0.10ppl) and Pembrokeshire Creamery (+0.22ppl).

Cheese contracts followed the stability seen in liquid milk contracts. At the time of reporting Lactalis had not made a public announcement, all other league table participants confirmed no price change in January (Barbers, Belton, First Milk, Saputo, SCC, Wensleydale and Wyke).

Movements on manufacturing contacts were a little more mixed. Pattemores and Meadow both continued to hold their milk price. Meanwhile Arla Direct moved up 0.86ppl, however Arla UK have made a ‘quarterly currency smoothing adjustment’ of -0.27ppl.

Demand

Dairy demand has been mixed, dependent on category. During the 52 weeks ending 28 December 2024, volumes of cow’s dairy declined by 0.6% year-on-year (NIQ Homescan POD, Total GB). Milk volumes declined by 1.9% year-on-year with declines in semi-skimmed and skimmed cow’s milk, while whole milk continued to see volume growth (+2.5%) due to an increase in buyers.

Cow’s cheese remains in volume growth, up 4.5% year-on-year with yogurt growing by 6.3% as consumers regain a heightened interest in healthy eating.

Cow's butter, on the other hand, saw a volume decline of 3.4% driven primarily by a decline in volume sales of butter spreads (-7.1%). Block butter, however, continued to see volume increases of 6.4%.

Cow's cream volumes grew by 2.5% year-on-year, primarily driven by increased frequency of purchase. Double, sour cream and crème fraiche all experienced volume growth.

See the full data and these insights visualised on our GB household dairy purchases retail dashboard.

Chinese demand may be returning to some extent. Chinese stocks are rebalancing as production growth slows. Low farmgate prices as well as a heat wave in Q3 caused further exits from the industry, dampening down domestic milk supplies. Rabobank estimates a 0.5% year-on-year reduction in production over the second half of 2024 with a steeper 1.5% drop in 2025. However, better balanced production and some demand recovery in 2025 is expected to contribute toward a 2% increase in import volumes

Total export volumes of dairy products from the UK for Q3 2024 were 274,300t, a decline of 7,100t (2.5%) year-on-year. This is the lowest quarterly volume recorded in the last two years. Exports of dairy products to the EU declined by 4,100t and that to non-EU nations declined by 2,900t during the period.

This was primarily driven by a sharp decline in exports of powders which fell by by 9,800t (30.7%). Milk and cream as well as butter also declined by 1,800t (1.0%) and 1,600t (13.3%) respectively, and yoghurt declined by a smaller 700t (7.2%).

In contrast to that, cheese and curd, whey and whey products continued to grow year-on-year. Cheese and curd saw the largest year-on-year increase, up by 4,700t (10.7%) mostly destined for EU nations. This was followed by whey and whey products which grew by 2,000t during the period. In EU, the largest chunk of the exports was to Ireland (9,800t) followed by Netherlands (6,000t). Increasing exports of cheese reflects increased efforts to boost British prospects overseas.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.