Russian pig meat exports soar on back of strong production growth

Thursday, 12 November 2020

By Felicity Rusk

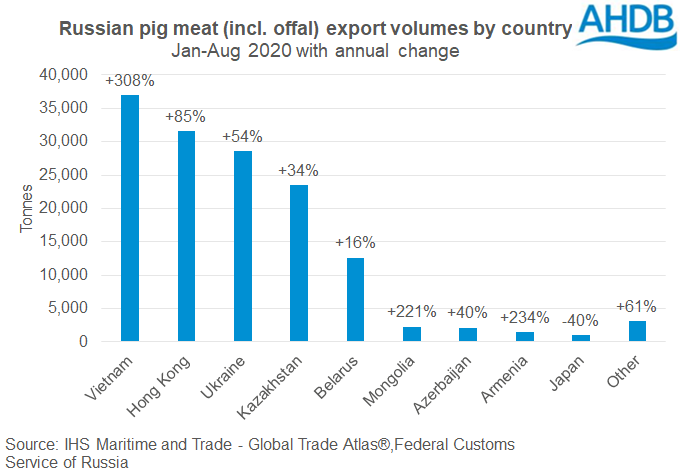

Russian exports of pig meat (incl. offal) have continued to perform well this year, reflecting the growth in production. Russian exports between January and August totalled 143,300 tonnes, 80% more than the same period in the previous year. The nation has gained access to several export markets in recent years, including Mongolia, Hong Kong and Vietnam, while negotiations with China are still ongoing. The Russian Union of Pork Producers (RUPP) suggests that exports of pig meat could surpass 200,000 tonnes by the end of the year, which if realised would put volumes up 45% on the year.

The rise in exports reflects a significant growth in the nation’s domestic production. In the year to September, Russian pig meat production totalled 3.55 million tonnes, 12% more than in the same period in the previous year, according to Rosstat.

Prices have not been particularly strong this year. In the week ending 4 November, liveweight pigs averaged 97.80 rubles/kg, 4% below the same point in the previous year. Reports suggest that retailers are increasing shares of fresh and chilled pork to reduce the additional costs associated with handling frozen pork. This has enabled consumer prices of pork as well as chicken to come down, with pork actually pricing below chicken in some instances.

ASF is an ongoing threat to the Russian pig herd, as well as a barrier to opening new export markets. Reports suggest that the disease is primarily within the wild/feral pig population. However, in late October, traces of ASF were identified in pork products in several regions of Russia. While not harmful to humans, the genetic traces of the virus are highly contagious among pigs. As such, the disease remains an ongoing risk for the Russian pig sector.

Reports indicate some regions within Russia have been handing out piglets to the population in order to mitigate the negative impacts of COVID-19. Unemployment rates have soared as a result of the pandemic. As such, citizens in certain regions are eligible for two piglets per person, as a means of financial and nutritional support from the state.

This could potentially lead to a resurgence of backyard farming, which has been in decline in the last two decades. Furthermore, there is also concern about biosecurity, particularly with the potential transmission of ASF into domestic pig populations. The consequences of this policy remain to be seen; low prices and some regional biosecurity restrictions might still mitigate any potential for growth from the informal sector.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.