Sheep market update: a look into the Australia FTA

Thursday, 21 December 2023

Key points

- Australia have allocated 4,144 tonnes of sheep meat under the TRQ from the end of May to December

- This is around the five-year average for total imports from Australia

- Australian deadweight sheep prices have been pressured by flock destocking from drought conditions in Q3

Volumes allocated under the TRQ

The Australian FTA allows a certain volume of sheep meat to enter the UK without additional costs to exporters (tariffs). The tariff year for 2023 runs form 31 May – 31 December, allowing volumes of up to 14,726 tonnes to enter at a 0% tariff rate. The current volume (product weight) that the Department of Agriculture, Fisheries and Forestry (DAFF) has allocated stands at 4,144 tonnes as of 18 December. This includes product that may still be on the water for entry into the UK, as lead times on imports stand at around six weeks.

For the coming tariff year (Jan – Dec), the volume of sheep meat that can enter tariff free will increase to 30,556 tonnes. This is the largest increase in quota volume from year to year in the ten-year agreement.

Imports from Australia

The most recent trade data for October shows that the UK imported 1,349 tonnes of fresh/frozen sheep meat from Australia. This is growth of 167 tonnes from September, and the highest volume of sheep meat imports seen since March 2022. Volumes have slowly been increasing as the TRQ has progressed, this could, however, be as a result of changing global trading conditions.

Monthly Australian sheep meat imports

Source: Trade Data Monitor LLC

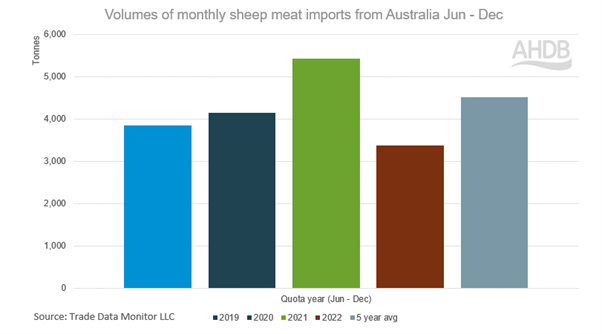

That being said, the volumes of exports submitted under the TRQ, 4,144 tonnes (from the beginning of June to the latest data in December) sits at just under the five-year average for this time period. In 2018 and 2021 volumes imported from June – December sat above the levels we have seen reported under the FTA.

Volumes of monthly sheep meat imports from Australia (Jun-Dec)

Source: Trade Data Monitor LLC

Australian lamb prices

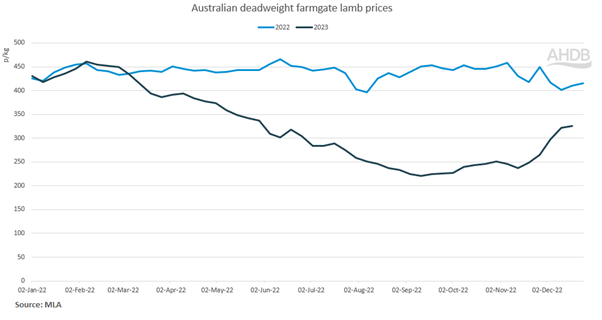

Deadweight Australian lamb prices have seen a period of low prices, with prices falling from February onwards. This resulted in a low of 220.9p/kg in September, before rising again to end the week of 17 December at 325.8p/kg. Industry reports suggest that the low prices seen in Q3 of 2023 resulted from drought conditions that led to downsizing in the overall sheep flock. This increased numbers forward and inevitably pressured prices. Looking ahead, prices in Australia will depend on the extent of drought conditions and flock stabilisation, especially in the breeding flock, moving forward into 2024.

Australian deadweight farmgate lamb prices

Source: Meat Livestock Australia (MLA)

What does this mean for the UK?

As we have seen, the volumes of sheep meat imports coming from Australia have grown, but not to unprecedented levels. We will continue to monitor and update as the new quota year begins in 2024.

The impacts of destocking from the Australian drought in Q3 of 2023 have impacted prices, but these seem to be on the up in recent weeks. While lamb prices in the UK have remained relatively stable, reports from New Zealand suggest that prices have been pressured as a result of the levels of Australian exports onto the world market. Similarly, both Australia and New Zealand compete to import into the same countries such as China and the Middle East. The lower prices in Australia have allowed for growth in imports into these countries at the expense of New Zealand product. Looking forward, with competition fierce between the two key southern hemisphere exporters, we could see some more New Zealand product looking to find a market in the EU and UK marketplace.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.