UK dairy product availability Q3 2024

Thursday, 23 January 2025

Key trends

- Milk powders continue to be in surplus for another consecutive quarter due to lower exports

- Butter supplies continued to decrease, further pressuring stocks

- Available supplies of cheese at par with the same period previous year, however, exports and imports continue to be in growth

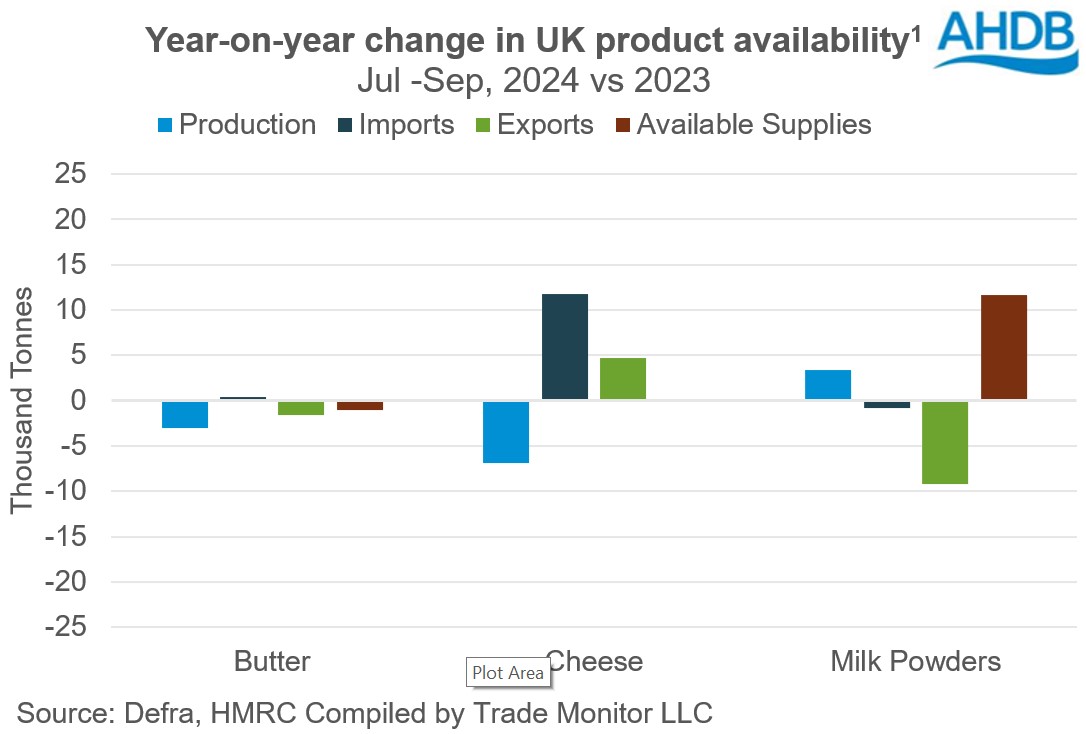

The availability of manufactured dairy products was mixed in the third quarter of 2024 compared with the previous year. UK milk deliveries in the third quarter of the calendar year amounted to 3,593m litres (0.5%) higher year-on-year. Last milk year was divided into two halves, with the first half lagging behind last year’s production. However, firm milk prices paired with improved margins and good grass growth increased milk flows in H2. Despite slightly higher deliveries, production of butter and cheese declined during the period while milk powders increased year-on-year.

Supplies of cheese at par following increase in imports, exports and lower production

Cheese availability was supported by increasing imports. However lower production and increased exports nullified the effect in the third quarter year-on-year. Most of the imports were reported from the EU followed by New Zealand (NZ). NZ imports started picking up from the beginning of 2024 following the trade deal. Cheese production was down by 7,000 tonnes (-5%) whilst imports and exports picked by 12,000 (11%) and 5,000 (11%) tonnes respectively year-on-year. Cheese prices in the domestic market were higher compared to the US and Oceania.

Lower production and exports drag down butter supplies

Butter production declined by 6% (3,000 tonnes) year-on-year in Q3, further pressurising stocks. Exports fell by 13% (2,000 tonnes) while imports grew by 3% (500 tonnes) during the period. Lower production and higher prices contributed to higher imports and lower exports respectively. Prices touched record highs in the third quarter on the UK wholesale markets. Stocks continue to be tight in the domestic market, adding pressure on prices. Lower production dragged down available supplies by 2% (1,000 tonnes).

Declining exports build the supplies of powders

Milk powders were an exception in the basket, seeing an increase in available supplies for another consecutive quarter. Production increased by 18% (3,000 tonnes) but imports declined by 11% (1,000 tonnes) in the third quarter year-on-year. Exports fell by 34% (9,000 tonnes) which, paired with production growth, led to an increase in available supplies of 12,000 tonnes.

The biggest decline in exports was reported from the EU, followed by Asia and Oceania and Sub-Saharan Africa. In the Asian region, demand from China in Q3 remains muted following the challenges of surplus milk availability in the domestic market and a stagnating economy. Government stimulus has not been able to uplift the market sentiment. Although SMP is price competitive in the global market, it could not capitalise on exports and are yet to find sound footing. Demand remains subdued, with consumers adopting a cautious approach. Uncertainties pertaining to geopolitical factors like tensions in the Middle-East, China-EU trade war and the newly formed government in the US will weigh on exports.

1Product availability is defined as production + imports – exports

Moving forward, milk deliveries are expected to increase and this is likely to boost the product supply pipeline. Whether this additional stock creates pressure on the market will depend on the magnitude of demand. Currently the market seems to be finely balanced between supply and demand factors. Any trigger on either side will influence prices accordingly.

Rabobank paints a positive picture of Chinese demand returning to the market in 2025. However along with this, geopolitical factors influencing trade flows will remain important watch points. This will determine future available supplies of dairy products in the market.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.