What is the potential profitability of store lambs this year?

Wednesday, 28 August 2019

By Rebecca Wright

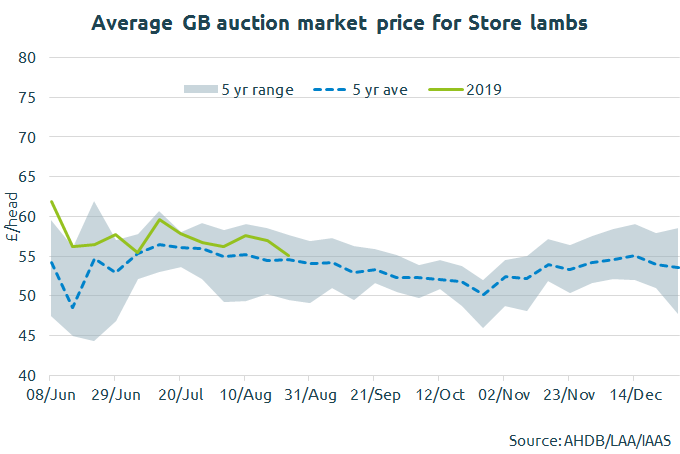

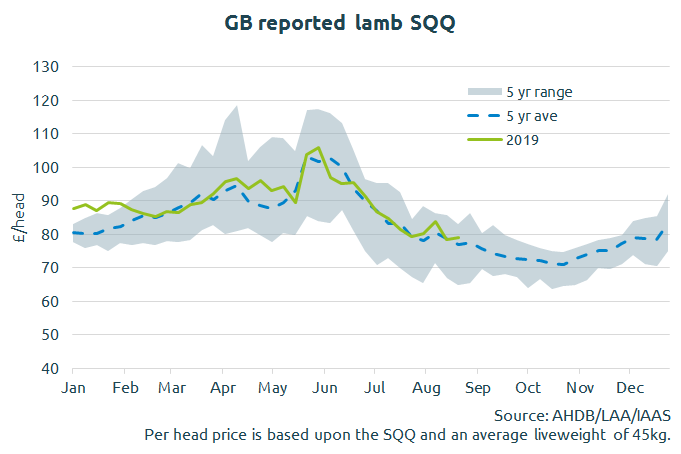

Prices of finished, store and cull ewes have largely been in line with the five-year average so far this year. So with a current GB auction market store lamb price of around £57/head, how much room is there for store buyers to add value?

During the autumn period over the past five years, finished lamb prices have averaged between £70 and £77/head. Based on a purchase price of £57, a finished price at the higher end of this range would leave around a £20/head to cover costs and profit.

While we cannot tell you what the finished price will be, being mindful of a realistic finished price when buying a store is imperative.

Purchase and selling prices are only a part of the equation. In between there is the cost of production. AHDB stocktake for the past few years suggests that for a mid-performing enterprise, the cash-only cost of producing a finished lamb from a purchased store is £15/head. Add to this another £5 of non-cash costs and the total economic cost of production is around £20.

Top 25% economic performing enterprises do however make a full economic profit. So where are the key differences?

- Unpaid labour is half that of the mid-performing enterprises

- Feed and forage costs are also lower

- Lower purchase prices, and higher selling price

Looking at feed and forage costs, there is no denying grass growth has been good this year, and certainty improved from last year. While this could help to reduce the costs of purchasing feed and forage or give the option to increase stocking density, this will need to be carefully balanced. There is a different balance on each farm between maximising output while limiting the costs of inputs. Output alone is not a good measure of productivity; what matters is the ability to turn inputs into outputs. Industry reports suggest that at the moment the amount of grass available is a big driver behind the store lamb price.

A key difference this year though from all previous years is Brexit. Currently due to take place on the 31 October, it falls right in the middle of the year in terms of slaughter, and store market throughputs. Right now, we don’t know whether the UK with leave with a deal or not. The potential risks to the sheep sector if there is a no-deal Brexit have been widely expressed. Potential risks highlighted by analysis from AHDB and other organisations, are trade friction and other associated costs, including tariffs, on products entering the EU. These costs could in turn be reflected in the farmgate price. Is it difficult to know how much the likelihood of a no-deal Brexit is being priced into the market, especially as a weaker sterling typically supports farmgate prices.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.