What’s the long-term global outlook for dairy consumption?

Wednesday, 9 July 2025

Key points

- Strong global demand predictions are encouraging for UK export prospects. According to the OECD/FAO Agricultural Outlook, global demand for fresh dairy products is projected to increase in the coming decade (2023-2033), with 11% growth per capita.

- The share of processed dairy products, especially cheese, in overall consumption of milk solids are expected to rise.

- Growth is driven primarily by developing regions, as both global wealth and population are increasing.

- In developed regions (such as the UK), consumption growth—both overall and per capita—is expected to be slower.

- Evolving consumer preferences are influencing dairy consumption trends, potentially leading to imbalances in the dairy component mix, particularly between fats and proteins.

Dairy products are key components of consumer diets globally. Income and population increases are expected to drive further growth of dairy product consumption over the next decade.

(Source: Agricultural Outlook from the Organisation for Economic Co-operation and Development/Food and Agriculture Organisation (OECD/FAO)

How global consumption of dairy will change

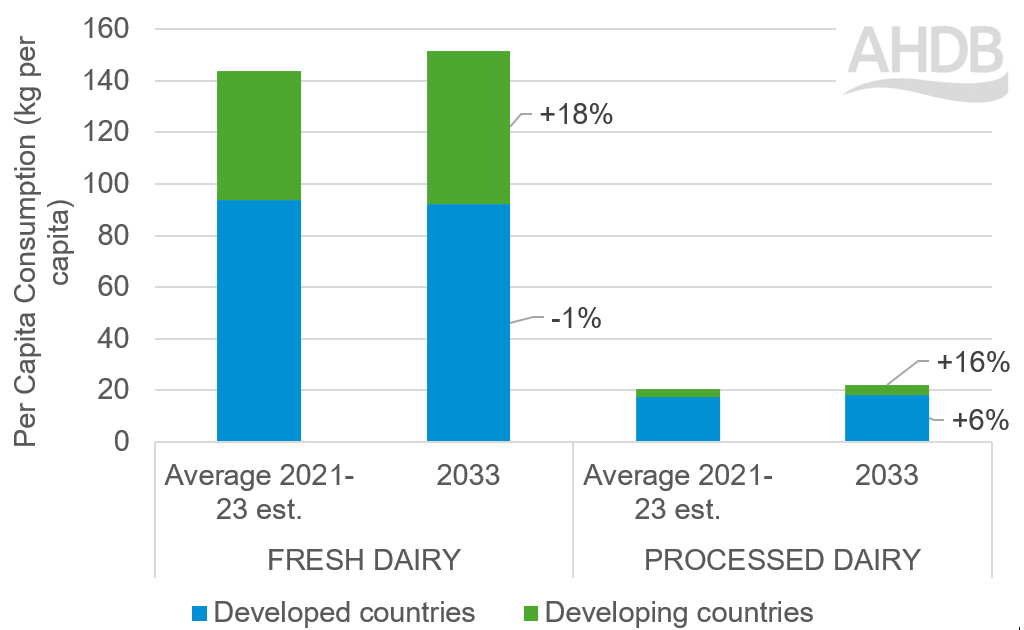

*Fresh and processed dairy product consumption (calendar year)

Source: OECD/FAO

*Fresh dairy products contain all dairy products and milk which are not included in processed products (butter, cheese, skim milk powder, whole milk powder, whey powder and, for few cases casein). The quantities are in cow milk equivalent.

Processed dairy products includes cheese, butter WMP and SMP.

Although processing extends the shelf life of milk, most dairy is consumed in the form of fresh products such as liquid milk and yoghurt (including fermented and pasteurised). In developing counties, consumption per capita of fresh dairy products are expected to rise by 18%, while developed countries are expected to see a small decline of 1% per capita.

Per capita consumption of processed dairy products is projected to increase in both developing (+16%) and developed (+6%) countries.

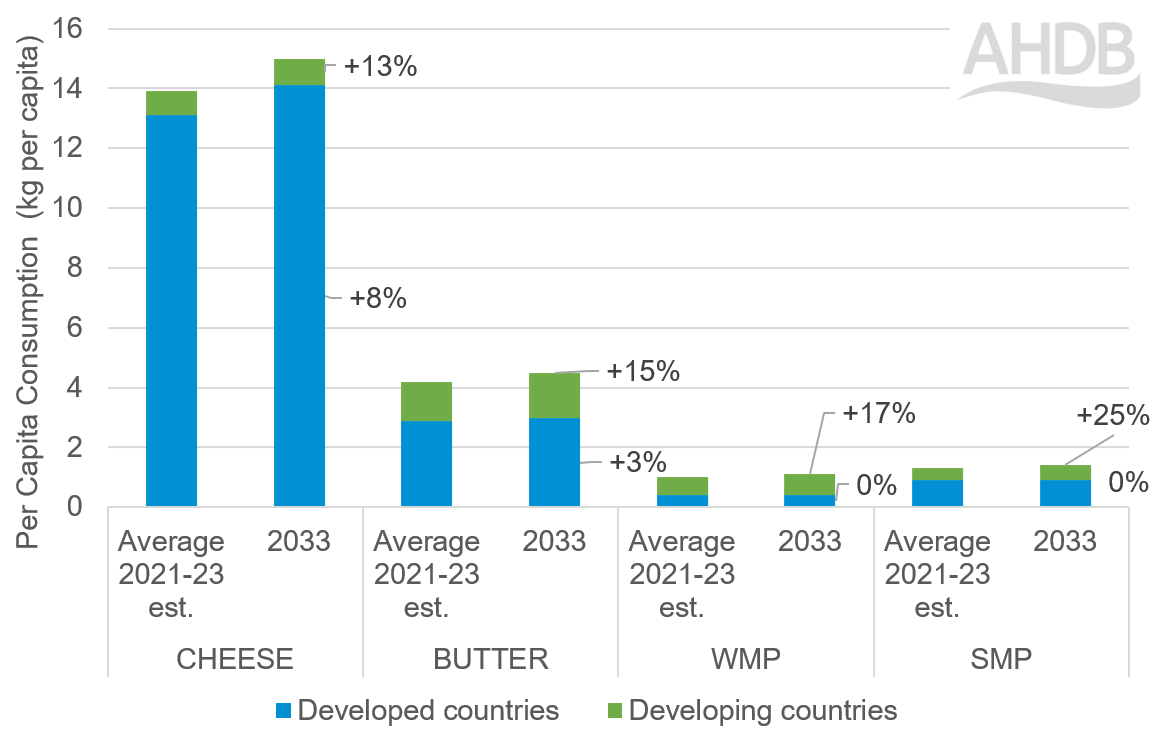

Processed dairy consumption by product (calendar year)

Source: OECD/FAO

Globally, cheese is expected to see the largest per capita growth among processed dairy products, at 13% for developing countries and 8% in developed countries over the next decade. Butter, whole milk powder (WMP) and skimmed milk powder (SMP) are also expected to see significant per capita global increases.

Demographics and economic growth are key drivers

The global population is projected to reach 8.7 billion by 2033, up from 8 billion in 2023. In low-income countries, population growth will be a key driver for increasing dairy demand (OECD/FAO). In the UK, birth rates are expected to slow but migration continues to drive population growth.

In developing countries, rising incomes are a more influential factor than in developed countries in driving dairy consumption. Globally, economic growth is expected to stabilize at an average rate of 3.0% per annum over the next decade, whilst developing economies are expected to see faster growth. Rising income levels correlate to increased demand for higher-value foods and more Western-style diets, including dairy products. Asia will continue to see the strongest growth in demand for dairy products, but the Middle East and Africa are also expected to experience strong growth.

Dairy will remain a key, and increasingly important, component of consumers diets and demand is set to outpace production in many exporting regions. According to the IFCN, over the next decade, to 2035, Europe is decreasing in dairy self-sufficiency from 115% to110% with demand exceeding supply by 2030.

Evolving consumer preferences

Fresh dairy

World per capita consumption of fresh dairy products is expected to grow by 11% over the next decade, primarily driven by India and Pakistan, due to income and population growth. Meanwhile, per capita demand for liquid milk in particular is declining in Europe and North America.

Processed dairy

Total processed dairy products are predicted to see strong growth in developed and developing countries. India and Pakistan also drive the forecasted growth in milk solid consumption, although are largely self-sufficient in dairy supplies.

Global developments in infrastructure for processing and logistics will accelerate this growth. Chinese and SEA consumption are a lot lower than the EU and North America giving headroom for growth, particularly in food service and also in snacking sectors. Cheese consumption is closely linked to income and currently, most is consumed in Europe and North America, where it is set to increase for both regions.

Butter demand has seen recovery in North America and southeast Asia, although most usage is as an ingredient. Significant butter consumption growth per capita will come from developing countries, where it is considered a more luxury product. However, EU per capita cosumption of butter is forecast to flatten over the next decade, linked to growing consumer preferences for lower fat diets. However, this trend may be countered by a growing interest in less ultra-processed foods.

The rise of GLP-1 diet drugs in Western countries could impact demand for high-fat dairy, while opening opportunities for high-protein, low-fat products such as protein powders, yoghurts, and milk.

The manufacturing sector will continue to dominate WMP and SMP use, particularly for infant, and elderly nutrition and as an alternative for fresh dairy products. As developing markets mature and become more economically powerful, moving from cheaper fat-filled (vegetable-fat) milk powders towards whole milk powder and other dairy fat-based products could increase competition for dairy fats with established markets, keeping pressure on prices.

Global demand for protein will continue to grow, with health and wellness trends boosting demand for whey and whey-based products.

Plant-Based Alternatives

Plant-based dairy substitutes are becoming more competitive and expected to displace some of the dairy consumption, namely in Europe where per capita consumption of dairy is set to decline. These products have seen growth in East Asia, Europe, Oceania and North America.

However, views on their benefits are mixed. Some markets, such as the UK, are seeing greater scepticism around ultra-processed foods and, in a very crowded plant-based market, there have been some declines seen in the market.

As competition rises for dairy, prices for commodities like butter are likely to increase. Price elasticity of the dairy demand and the potential for substitution will be a key watchpoint. Manufacturers may have no choose but to reformulate some products such as confectionary and baked goods to remain at a competitive price-point. This could modify demand for real dairy.

Implications for UK dairy

Consumption forecasts are subject to risks and uncertainties, such as changes to the geopolitical landscape, with potential to significantly affect trade flows and global economic growth.

- Export prospects. Import demand for dairy in Asia and Africa is expected to rise, driven by growing populations and rising incomes. Russia, Mexico, and the Near East and North Africa (NENA) region are also projected to see continued growth in dairy imports. Despite a slowdown in growth, China is expected to remain the world’s largest importer of cheese, butter and SMP. The EU is forecast to remain the world’s main cheese exporter.

Read our analysis of global prospects for UK agri-food exports - Unbalanced dairy component mix: There is a strong correlation between economic growth and dairy fat consumption. This could result in a mismatch between supply and demand for various dairy components (such as fats and proteins), affecting trade flows and pricing structures.

- Although liquid milk consumption is falling, other components are booming. Demand for butterfat and protein are likely to rise and there may be greater opportunities to maximise producer contracts.

- Reputational topics, such as health and sustainability awareness are expected to increase, particularly in more developed economies. Plant based dairy alternatives have seen growth, albeit from a low base. Higher availability and lower prices as these products evolve are drivers of expansion.

- Global demand is set to outpace production growth, creating pricing pressures

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.