- Home

- Europe: How much do they consume?

Europe: How much do they consume?

The EU is a developed market and has high levels of meat and dairy consumption across a range of different cuts and products. It is important to bear in mind that per capita consumption and levels of trade vary across the member states.

Pork

Pork is the most consumed of all red meats in the EU, at 28.1 kg per person (retail weight), based on the 2022-2024 three-year average. According to OECD data, total pork consumption is expected to reduce by 809K tonnes (carcase weight equivalent, CWE) by 2033, driven by changing consumer diets. However, pig meat will still account for half of total per capita meat consumption (red meat and poultry).

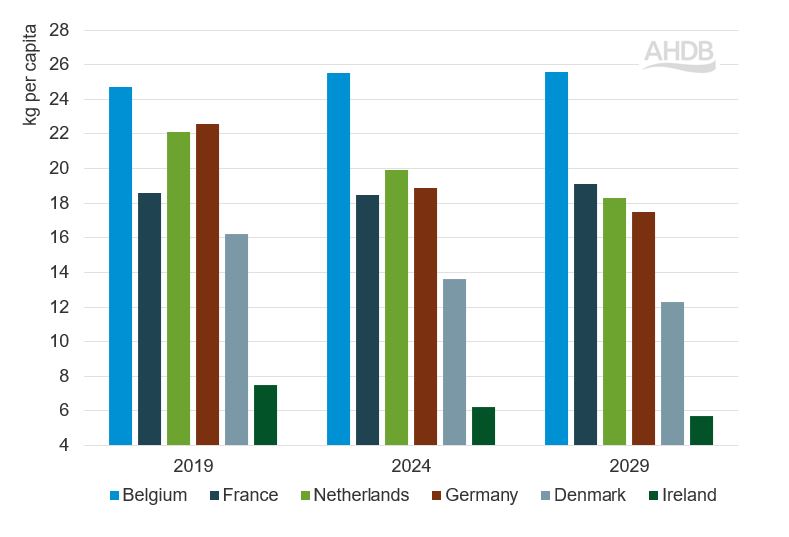

Data from Euromonitor International shows some of the largest pork-consuming nations in the EU are Belgium, the Netherlands, Germany and France (Figure 1). Forecasts up to 2029 generally indicate a reduction in per capita consumption – with the exception of France, where a small increase may be seen, and Belgium, which is anticipated to remain stable.

Figure 1. Per capita pork consumption in select EU countries

Source: Euromonitor International, Fresh food edition 2024

EU pork production is high at 21.5 million tonnes (CWE), based on the 2022–2024 average. The top five producing countries within the region are: Spain, Germany, France, Poland and Denmark. Production is expected to fall by 959K tonnes (CWE) by 2033, largely driven by environmental targets.

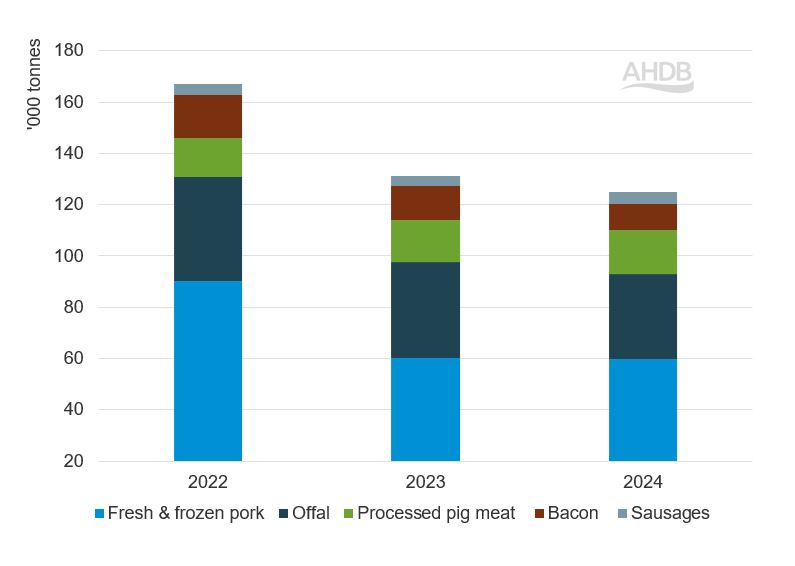

Imports to the EU are limited as the EU produces more pork than it consumes, which supports export trade. Import volumes are expected to decline by 19K tonnes (CWE) over the next decade. The majority of pig meat imports are sourced from the UK. While the UK’s main exports to the EU are fresh carcases and loins, the EU also provides a strong market for cuts of pork less popular with UK consumers, important for ensuring carcase balance.

Figure 2. UK annual pig meat export volume to EU27

Source: HMRC compiled by Trade Data Monitor LLC

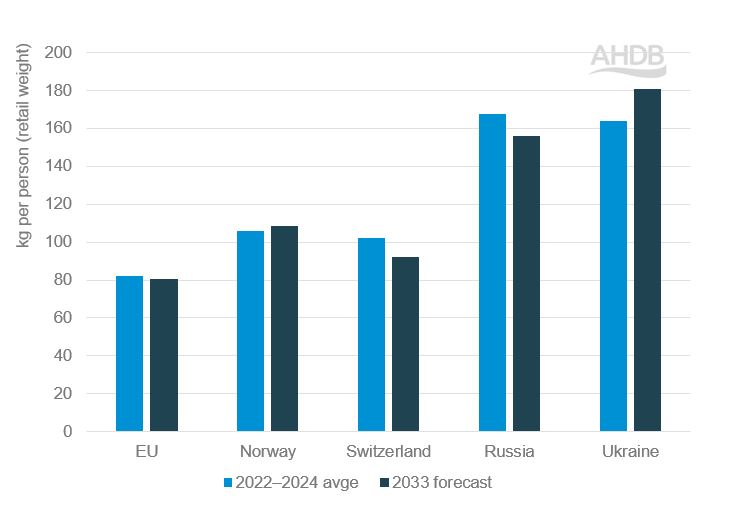

Non-EU

Countries outside the EU also maintain strong pig meat consumption, notably in Eastern Europe.

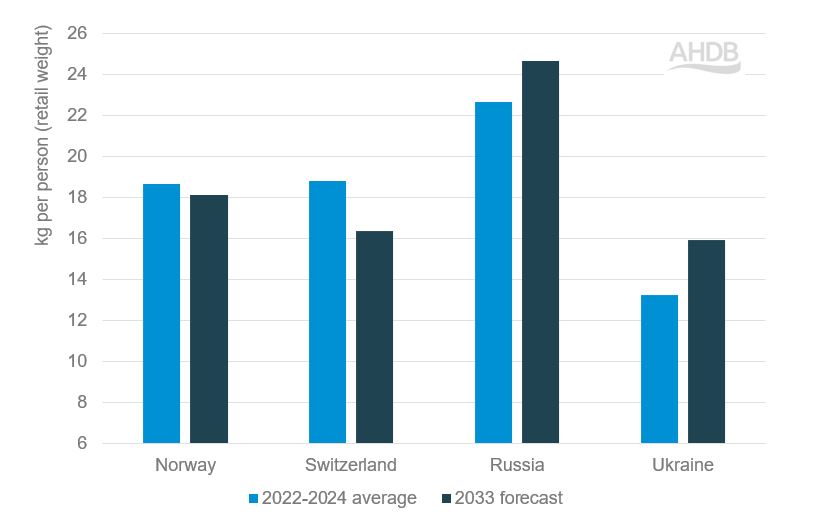

In Eastern Europe, protein consumption derived from animal products is expected to increase by 7.5% by 2033. OECD forecasts anticipate pig meat consumption growth in Ukraine and Russia of between 2 and 3 kg per person (retail weight) over the next decade (Figure 3).

Meanwhile, more Western nations, such as Switzerland and Norway, are expected to see pig meat consumption ease as plant-based protein sources strengthen.

Figure 3. Pig meat consumption in select non-EU countries

Source: OECD-FAO Agricultural Outlook 2024–2033

Russia and Ukraine are relatively self-sufficient in pork, with domestic production covering most consumption needs, resulting in minimal import volumes. OECD data forecasts growth in both countries’ pig production over the next decade, albeit limited by the ongoing war.

By contrast, neither Switzerland or Norway produce a significant amount of pig meat domestically and rely on imports to meet consumption requirements, primarily sourced from the EU.

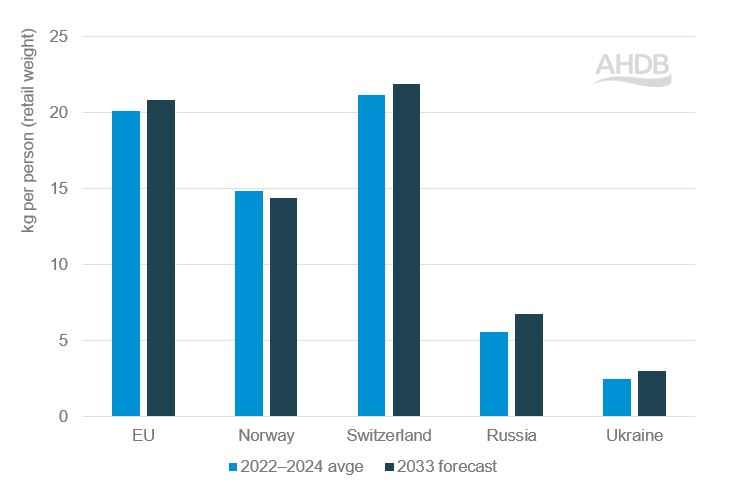

Beef

Beef is the second most widely consumed red meat in the EU after pork, although there is a considerable gap between the two types of red meat. Based on the 2022–2024 average, per capita consumption levels of beef in the EU were only a third of those for pork.

Figure 4. Beef and veal consumption per capita per year

Source: OECD

Per capita beef consumption in Norway and Switzerland is higher than in the EU (Figure 4), while in Russia and Ukraine, it is lower.

In the EU, production and consumption are expected to fall by 6% and 5%, respectively, over the next decade. Subsequently, imports are projected to increase by around 32,000 tonnes (CWE).

OECD data shows a 2.2% decline across Europe in per capita consumption of beef and veal, falling from 8.9 kg per person (2022-2024 average) to a projected 8.7 kg per person in 2033.

Europe is expected to continue to produce more beef than it consumes in 2033, with the surplus rising slightly from 1.1% to 1.6% in 2033. However, actual production is expected to drop from 10.3 million tonnes to 9.95 million tonnes. Imports are expected to decline by 5% (50,000 tonnes) over the same period.

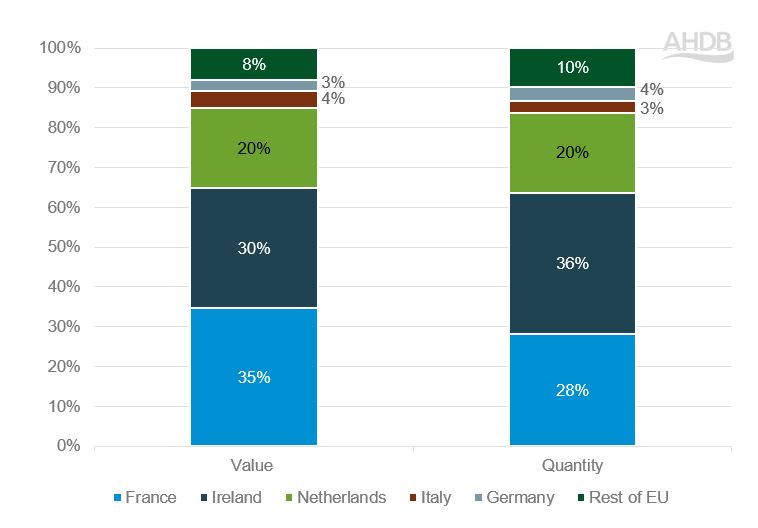

UK exports to the EU

The UK remains a key beef supplier to the EU, accounting for 21% share of imports by value (2022-2024 average). Between 2022 and 2024, the UK’s beef exports to the EU have generally increased in value terms while falling in quantity, suggesting that higher-value, premium cuts are exported to the EU. Based on the 2022–24 average, the UK exported 97,800 tonnes of fresh/chilled and frozen beef to the EU.

The UK’s beef exports to the EU mainly consist of fresh boneless beef (55%), driven by strong demand in France and Italy for premium cuts. Frozen boneless beef (16%) is the second-largest category, likely for processing and wholesale. Fresh bone-in cuts and carcases each make up 14%, serving further processing needs. Frozen bone-in beef (1%) has a minor role, showing the UK’s focus on fresh, high-quality exports over frozen products.

The biggest challenge ahead is the EU–Mercosur trade deal, which could boost competition for the UK from South American suppliers like Brazil and Argentina. To remain competitive, the UK may need to emphasise quality, traceability and sustainability in its beef exports.

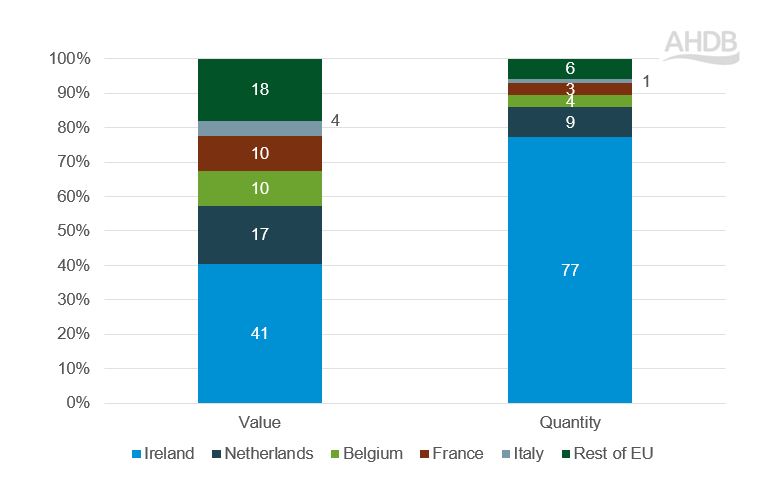

Figure 5. Export destinations of UK beef by percentage share of export value and quantity, 2022–2024 average

Source: HMRC via Trade Data Monitor

UK beef exports to the EU grew from £452 million in 2023 to £510 million in 2024. France remains the top market driven by demand for premium cuts. Ireland remains a key trade partner, mainly for intercompany trade.

Eastern Europe as a developing market

UK beef exports to Eastern Europe have grown, especially to Poland, due to a strong economy, rising demand and trusted food safety standards. The UK–EU Trade and Cooperation Agreement (TCA) has kept trade tariff-free, boosting competitiveness.

Exports to Poland jumped from £2.7 million in 2022 to £6.9 million in 2024. Poland remains a key market in Eastern Europe, offering major opportunities for UK farmers and exporters.

Sheep meat

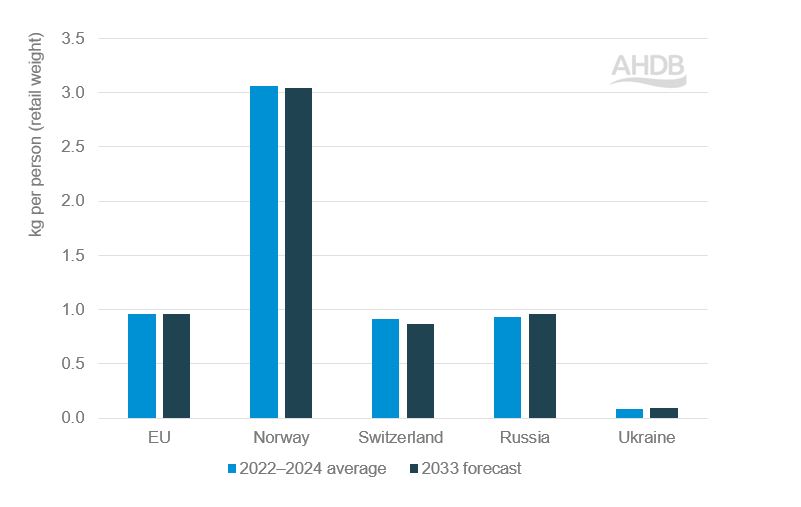

Sheep meat is the least-consumed red meat in Europe. Figure 6 shows that, apart from Norway, sheep meat consumption per capita is less than 1 kg per person per year (retail weight).

Figure 6. Per capita sheep meat consumption in Europe

Source: OECD

The OECD forecasts European sheep meat consumption to remain static over the next decade. While a slight increase is expected in Russia and Ukraine, small declines are projected in the EU, Norway and Switzerland.

Sheep meat production is predicted to increase by 35,000 tonnes (3%) to 1.27 million tonnes over the next decade in Europe, while consumption is forecast to fall by 1% (29,000 tonnes) to 1.25 million tonnes.

Europe’s sheep meat imports are expected to be 29,000 tonnes (12%) lower in 2033 compared with the 2022–2024 average.

EU sheep meat consumption is expected to be higher than production in 2033 (661,000 tonnes versus 636,000 tonnes). However, EU sheep meat imports are forecast to be 25,000 tonnes (16%) lower over the same period, reflecting the issue of carcase balance.

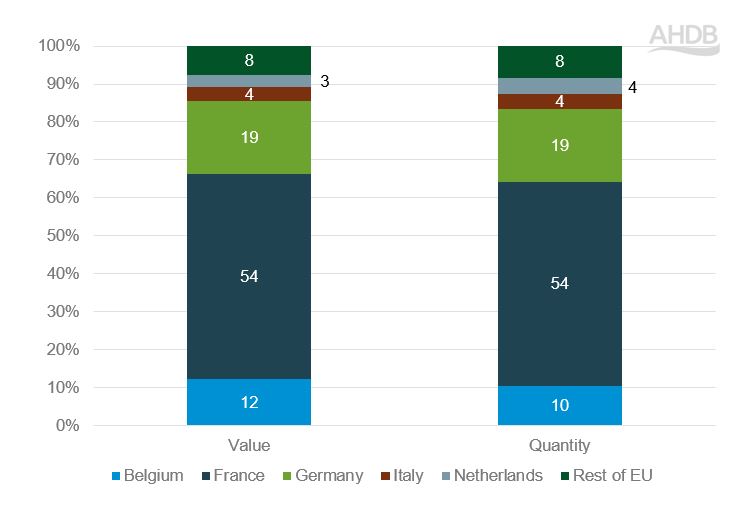

UK exports to the EU

The UK was the top lamb and sheep meat supplier to the EU, based on the 2022–2024 average comprising 49% of imports by value (£515 million) and 53% of imports by quantity (76,300 tonnes).

UK lamb remains popular in the European market due to strong consumer demand, established trade routes and competitive pricing.

The growing halal market, especially in France, Germany and the Netherlands, drives demand. Expanding halal certification and enhancing the reputation of the UK’s halal credentials could further boost UK exports.

Figure 7. Export destinations of UK sheep meat by percentage share of export value and quantity, 2022–2024 average

Source: HMRC via Trade Data Monitor

France and Germany are the top importers of UK sheep meat, with imports valued at £283 million and £100 million, respectively (2022–2024 average), driven by retail, halal and food service demand.

The value of UK sheep meat exports to Belgium grew from £60 million in 2022 to £76 million in 2024, serving as a redistribution hub; exports remained stable for Italy at £20 million, catering to premium markets.

The Netherlands’ share doubled from 3% to 6% (2022-2024), with imports rising to £26 million, reflecting increased demand for direct consumption and re-export processing.

What cuts are in demand in the EU?

UK sheep meat exports to the EU were worth approximately £542 million in 2024, with the vast majority in the form of fresh or chilled lamb carcases, comprising around 81% of the total value. This reflects strong demand from key markets like France and Belgium for high-quality whole lamb.

The next largest category was bone-in fresh or chilled cuts, accounting for 14% of total value. These cuts are popular among traditional butchers and in halal markets, where bone-in meat is often preferred.

The UK’s established halal certification infrastructure supports this demand across diverse EU communities.

Boneless fresh or chilled sheep meat contributed to 2% of the total value, typically serving the foodservice and ready-meal sectors. All frozen products combined - including carcases, boneless and bone-in cuts - made up less than 5%, suggesting limited EU demand for frozen imports given the availability of fresh alternatives.

Sheep meat (mutton) represented a very small share of value, indicating lower overall market interest, except in niche ethnic and halal segments.

Northern Europe

Exports to Northern Europe have fallen overall, though high-value markets remain key.

Switzerland remains the main export destination for UK lamb in northern Europe, despite the drop in value of exports from £5 million in 2022 to £2.5 million in 2024.

Norway imported an average of 2,500 tonnes in the early to mid-2010s, but since 2015, there have been negligible exports apart from a small shipment in 2024.

Dairy

Fresh dairy products have higher consumption per capita in Europe compared with processed dairy products such as cheese, butter and milk powders.

However, out of the countries shown in Figure 8, growth in per capita consumption over the coming decade is only forecast for Norway (2%) and Ukraine (17%).

Figure 8. Fresh dairy consumption per capita in Europe

Source: OECD

Cheese consumption per capita is forecast to increase in the EU, Switzerland, Russia and Ukraine, but it is forecast to decline by 3% in Norway (Figure 9).

Figure 9. Per capita cheese consumption per year in Europe

Source: OECD

A gradual shift from fresh dairy consumption across Europe to processed dairy products reflects changing consumer preferences.

The EU dairy sector is 101% self-sufficient, consistently producing slightly more than it consumes.

Production and consumption of fresh dairy products in Europe is expected to fall by around 4% by 2033 compared with the 2022–2024 average, driven by changing demand and sustainability policies.

Although cheese production is forecast to continue to outstrip consumption out to 2033, Europe’s cheese imports are projected to increase by 5.5% to 1.12 million tonnes.

EU dairy exports averaged £15.4 billion by value between 2022 and 2024, while imports averaged £1.9 billion.

Cheese is the top dairy product the EU exports as well as imports; however, EU cheese imports by value were £6.9 billion (2022–2024 average), while exports were £0.9 billion.

UK dairy exports to the EU

Based on the 2022–2024 average, the UK accounted for 62% (£1.16 billion) of total EU dairy imports by value and 85% (1.02 million tonnes) by volume.

Milk and cream comprised the majority of EU imports from the UK by quantity, while, on value terms, cheese was the top UK dairy product (£603 million based on 2022–2024 average).

This reflects strong demand for UK cheese, including mature Cheddar, Stilton and other regionally protected products. Many of these cheeses benefit from strong branding and quality recognition across the EU, particularly in markets like France, Germany and the Netherlands. The high value-to-volume ratio suggests UK cheese is well-positioned in the specialty and added-value segments, including organic, speciality and artisanal categories.

Butter and dairy fats were the third-highest value product (£211 million based on the 2022–2024 average), after cheese and milk and cream, despite accounting for only 4% of UK dairy exports to the EU (2022–2024 average).

UK butter is well-regarded for its grass-fed origin, richness and suitability for both retail and food manufacturing.

As consumer preferences in the EU shift back towards natural dairy fats, UK butter is increasingly competitive, especially in processed forms such as clarified butter or fat blends.

Together, cheese and butter highlight how the UK’s dairy export strengths lie in quality-driven, higher-margin products. Their longer shelf life and lower perishability compared to liquid dairy make them ideal for export, while their versatility supports both retail and industrial demand across diverse EU markets.

Figure 10. Export destinations of UK dairy products by percentage share of export value and quantity, 2022–2024 average

Source: HMRC via Trade Data Monitor

Ireland is the main export destination for UK dairy, as shown in Figure 10, driven by the country’s processing capabilities. Fresh dairy products such as milk and cream accounted for 90% of UK dairy exports to Ireland, based on the 2022-2024 average.

Rest of Europe

UK dairy exports to Switzerland have averaged 1,300 tonnes (2022–2024) and £7.2 million in value terms. Most of these exports (88%) were cheese. Cheese accounts for 90% of Swiss dairy imports by value.

At the time of writing, the UK and Switzerland are negotiating a free trade deal (FTA). We have modelled the potential impact of this trade deal in collaboration with Harper Adams University. The model suggests that a UK–Switzerland FTA would increase UK cheese exports to Switzerland by just under 200 tonnes, while Swiss cheese exports to the UK would increase by around 880 tonnes if all else remains equal.

UK dairy exports to Ukraine averaged 390 tonnes (£1.9 million) annually between 2022 and 2024, while exports to Norway averaged under 140 tonnes (£870,000) over the same period. The OECD forecasts Ukraine’s and Norway’s dairy imports to increase by 63% and 32%, respectively, out to 2033, so there may be potential for the UK to take advantage of this uplift.

Cereals

Wheat

The European Union (EU) is one of the largest wheat producers and exporters globally, with France and Germany being the top producers among its member states. In 2024, France and Germany harvested 26.55m tonnes and 18.53m tonnes of wheat, respectively, making up 22.1% and 15.4% of the EU’s total wheat production.

The Organisation for Economic Co-operation and Development (OECD) forecasts that European wheat production will increase by 1.8% from the 2022–2024 average, reaching 277.04 million tonnes by 2033.

Across Europe, wheat production is expected to rise slightly by 1.1% by 2033, primarily due to a boost in wheat output from Russia. This is also reflected in the import projections for 2033, which predict a decrease in wheat imports for both the EU and Europe, with imports dropping by 13.1% and 11.2%, respectively, compared to 2024 levels.

Wheat consumption in continental Europe is projected by the OECD to decrease slightly by 0.1%, reaching 185,640 tonnes by 2033, compared to the 2022–2024 average. In contrast, consumption in the EU is expected to decline by 3.1%, falling to 107,127 tonnes.

Per capita wheat consumption is forecast to rise by 1.7% in continental Europe, reaching 106.35 kg per person per year; meanwhile, in the EU it is expected to grow by 1.3%, reaching 111.96 kg per person per year over the same period.

Although the EU is a net exporter of wheat, it still needs to import certain types to meet the increasing domestic demand. This includes hard, soft, milling and feed wheat. The balance between supply and demand for these varieties can vary from year to year.

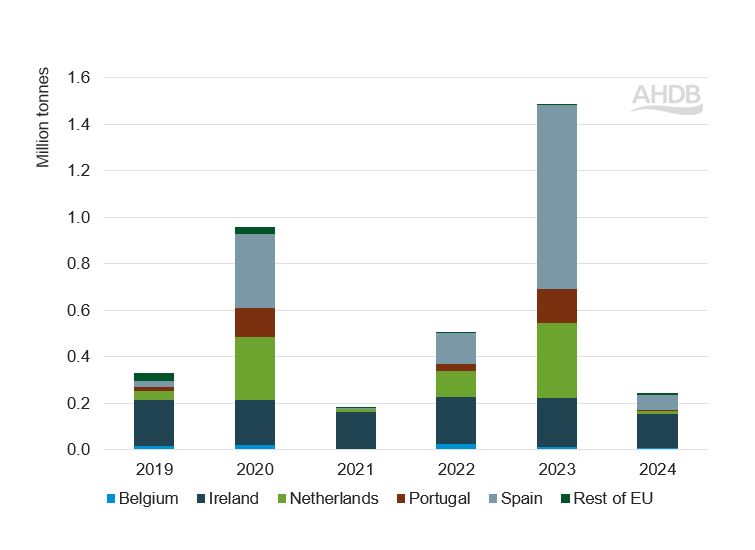

The EU continues to be the main destination for UK wheat exports, with Spain, Ireland, the Netherlands and Portugal collectively importing around 227.4 Kt in the 2023/24 marketing year. This accounts for 94% of the total UK wheat exports, including durum.

Figure 11 shows UK wheat exports to the EU in recent years, highlighting key destinations.

Figure 11. UK wheat (including durum) exports to the EU, 2016–2024

UK wheat exports to Spain were £76m in value terms, based on the 2022–2024 average, while wheat exports to Portugal averaged £14m. The versatility and consistency of UK wheat is favoured in these markets and considered to be reliable.

UK soft milling wheat is highly regarded for its suitability in producing biscuits, specific types of bread and pastries. This makes it a preferred choice in markets such as Spain and Portugal.

Unlike the EU, the UK is not a major wheat exporter, but there are opportunities for niche products. The UK has significant potential for exports to Spain and Portugal, as these markets value UK wheat.

However, maintaining a consistent supply is a challenge. The supply of soft wheat is limited, with weather conditions leading to lower quality, and UK farmers are often choosing to grow other, typically higher-yielding, varieties instead.

Barley

The EU is the world’s largest barley producer; it regularly competes with Australia for the title of top global exporter.

As with wheat, Germany and France are the leading producing member states. EU barley exports averaged 10.3m tonnes between 2020 and 2024, while imports averaged 1.6m tonnes over the same period.

The UK plays a crucial role in EU barley imports, accounting for around 70% of both the quantity and value. Malting barley is the primary export.

Continue reading about the European market

Market access and barriers to trade