- Home

- Prospects for UK agri-food exports: Middle East and North Africa (MENA)

Prospects for UK agri-food exports: Middle East and North Africa (MENA)

MENA offers significant opportunities for UK exporters, especially for the lamb and dairy sectors. This is due to the region’s strong population growth, together with limited production capacity, driving food imports higher over the next decade.

This page was updated in January 2026.

Summary of findings

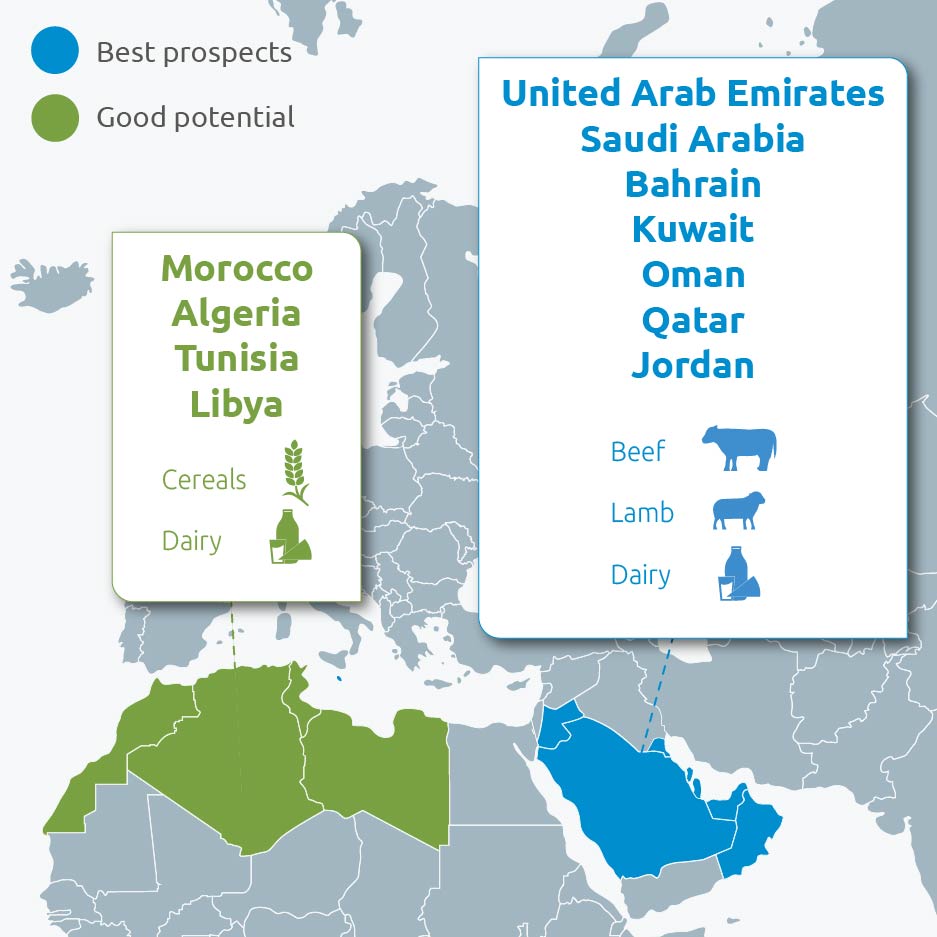

Strong population and gross domestic product (GDP) growth, together with limited production capacity, will increase food import requirements in the MENA region over the next decade, providing opportunities for British red meat and dairy products.

The region is expected to be the second-largest net importer of food by 2034.

The majority of beef consumed in the Middle East is imported, and consumption is expected to increase by 2034.

Sheep meat consumption in the region is relatively high compared with other global regions, with culture and religion playing an important role.

Premium lamb consumption is forecast to continue increasing. This is particularly the case in the Gulf region, where disposable incomes are increasing, the population is young and there is a growing number of wealthy expats.

While pork consumption is low in MENA, there is demand in the hospitality sector and high-end retail for tourists as well as the expat community.

Dairy consumption is forecast to outstrip production, leading to greater dairy imports out to 2034.

UK cheese exports to both Saudi Arabia and UAE have been steadily increasing since the start of the decade, with Cheddar exports leading the way.

The GCC (a trading bloc made up of UAE, Saudi Arabia, Bahrain, Oman, Qatar and Kuwait) is the second-largest export market outside Europe for dairy products from the UK, cementing its status as a critical market for UK exporters.

Halal red meat and dairy are important in the MENA region. For lamb, the UK has export health certificates (EHCs) in place to export to most MENA countries as well as approval from recognised halal certification bodies. For beef, the UK has fewer EHCs in place and halal certification is more of a challenge.

The UK and the GCC will enter the final stages of negotiating a free trade agreement in 2026, which could benefit UK agrifood exports to the region.

Bespoke AHDB consumer analysis across the Middle Eastern market has shown that quality, halal assurance and taste are important factors behind red meat purchasing decisions among consumers. Therefore it is essential to communicate these effectively.

For dairy, health benefits, sustainability and high production standards are all key points of difference for British products. These qualities should be emphasised to MENA consumers as demand grows in line with an increase in disposable incomes.

Where do the opportunities lie?