2021 proves a record year for US beef market

Thursday, 24 February 2022

Production & prices

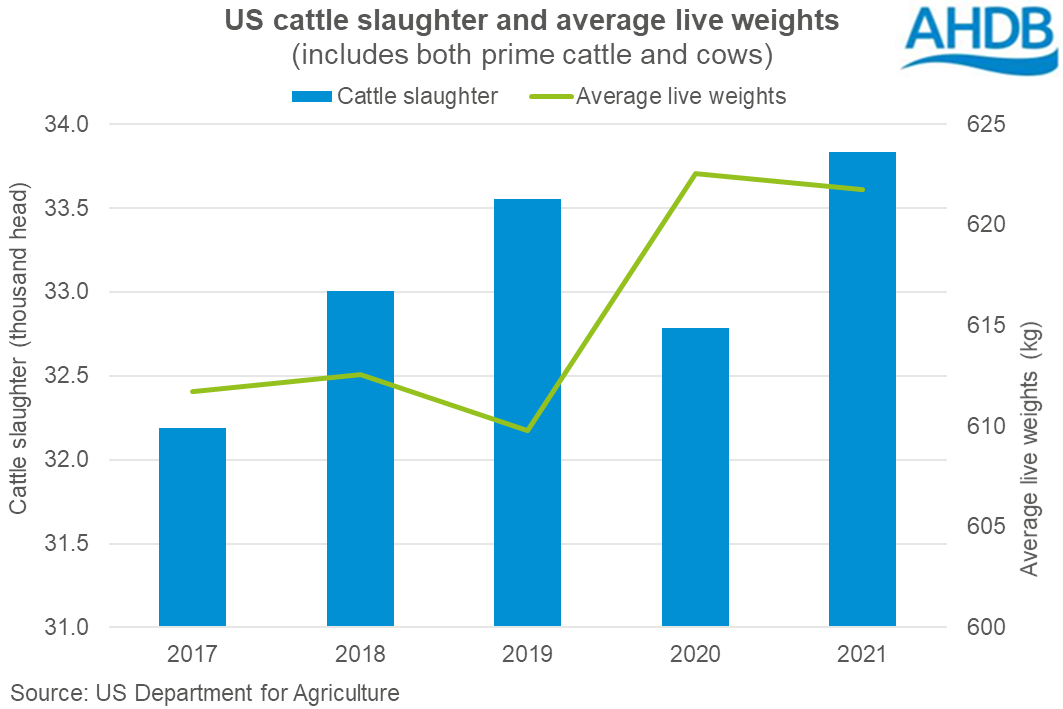

According to data from the USDA, US beef production reached 12.7 million tonnes in 2021, 3% above the quantity produced in 2020 and the highest production level for some time. The uplift came largely from greater cattle throughput, as average carcase weights remained relatively unchanged. A total of 33.8 million cattle were processed during the year (including prime cattle and cows), 3% more than the year before.

The US cattle industry has been hard-hit by the COVID-19 pandemic. Reports of virus breakouts among meat packing plant staff have been widespread over the last two years, which curtailed processing capacity and caused a sizeable backlog of cattle on-farm. Cattle prices came under pressure as a result in 2020, and average carcase weights increased.

In contrast, wholesale beef prices rocketed during early 2020, as demand for beef reflected trends seen in the UK; initial panic buying, followed by lockdowns and foodservice closures, meaning more consumers buying beef to eat at home.

During 2021, both US wholesale and farmgate prices have been on an upward trajectory, as processing capacity and foodservice demand have continued to recover. Strong returns are expected by the US cattle industry in 2022, against a backdrop of lower production.

Imports

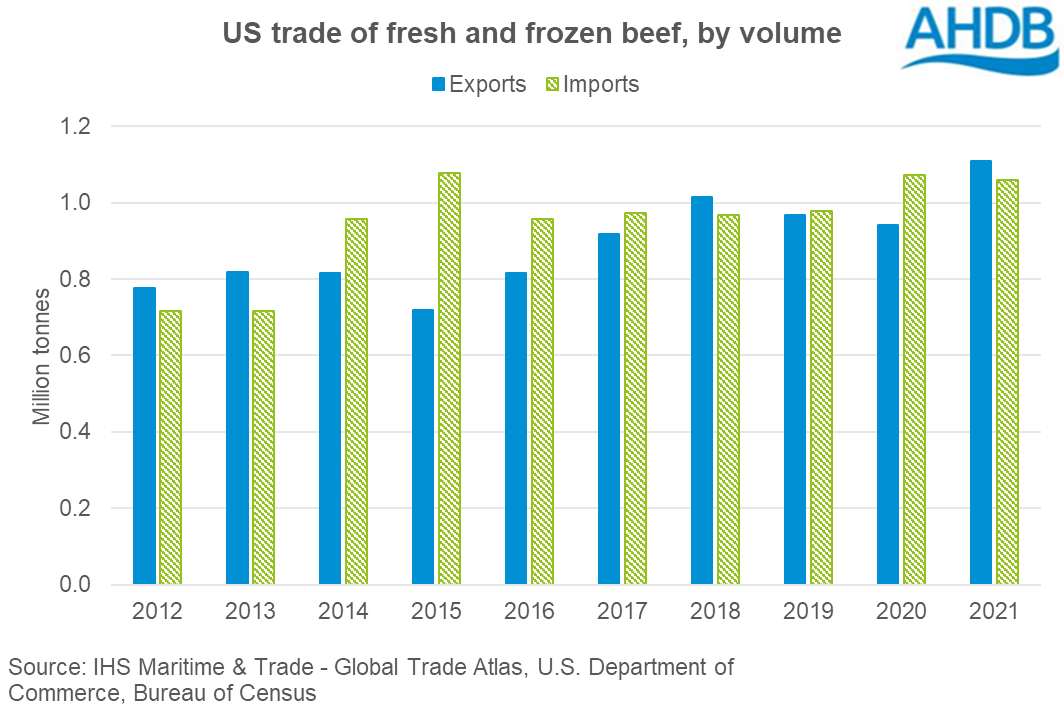

The US is a significant importer of beef, taking in 1.1 million tonnes of fresh and frozen product in 2021 (-1% year-on-year). Lower volumes from Australia were the main downward pressure, as herds rebuilt following drought conditions, limiting production. While not enough to outweigh Australian losses, shipments increased from Canada, Mexico and Brazil, the latter following the lifting of a US ban in 2020.

The UK recently gained access to the US for beef exports, and according to HMRC, 1,500 tonnes was shipped in 2021, a five-fold increase from the year before.

Exports

US beef exports reached a record high in 2021, with over 1.1 million tonnes (fresh and frozen) shipped during the year, up 18% compared to 2020. Almost the entire increase was driven by a near four-fold rise in shipments to China, with other suppliers such as Brazil, Argentina and Australia losing market share.

Tensions between Australia and China have negatively affected beef trade over recent years, with several Australian factories suspended from the Chinese market. Industry reports suggest that falling demand from lower-tier channels in China has affected South American trade, as that is predominantly where their cheaper grass-fed beef finds a home. Grain-fed beef however has grown in popularity among the middle to upper-class restaurant trade, on which the US has capitalised.

What’s the outlook?

The USDA forecast that US beef production will fall slightly in 2022, exports will fall and imports will remain largely stable year-on-year. These forecasts are based on an expectation of greater exportable supplies in Oceania and South America and tighter US cattle supplies.

External impacts on the UK beef market are perhaps more local in nature, as most beef trade is done with neighbouring Ireland and mainland EU. However, there could be opportunities for UK beef in the US in 2022, if imports remain at historically high levels, and prices there continue to strengthen to make UK beef more price-competitive.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.