Analyst Insight: What does the Early Bird Survey mean for markets and marketing?

Thursday, 28 November 2019

Market Commentary

- UK wheat futures (May-20) closed yesterday at £150.75/t, down £0.25/t. Nov-20 futures closed at £156.55/t yesterday, down £0.20/t. The 20-day rolling average of both contracts continue to gain over the longer-term 50 and 100-day rolling averages.

- Chicago soyabean futures (May-20) continued their fall yesterday, with beneficial rain hitting Brazil. Conversely, Paris rapeseed futures (Nov-20) closed yesterday at €376.00/t, gaining €2.50/t.

- The Russian Agriculture Ministry downgraded its 2019/20 wheat production forecast from 78Mt to 75Mt yesterday.

What does the Early Bird Survey mean for markets and marketing?

As rain continues to fall across the UK, progress in winter plantings remains hampered. According to the Environment Agency, England received 143% of the long term average rainfall in August-October, making 2019 the third wettest year in the last 20. Furthermore, rainfall in November has totalled 101% of the long term average so far.

The rainfall has significantly delayed plantings of winter wheat. The Early Bird Survey results suggest the area intended to be planted to wheat is 1.65Mha, a drop of 9% year-on-year and the lowest planted area since 2013.

Many will be intending to carry wheat planting into the New Year with a number of varieties suitable for planting late into January, albeit with associated yield and development penalties.

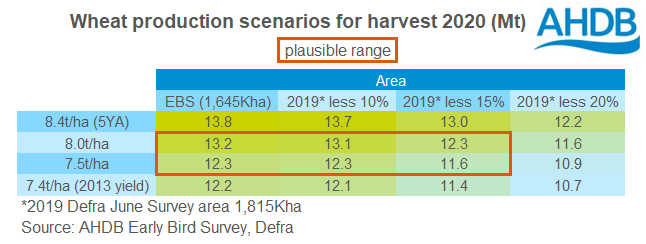

In other wet years we have seen yields impacted. The most recent example is harvest 2013, the wet 2012 autumn led to yields of just 7.4t/ha, 5% below the previous five-year average (excluding 2012). While it is still monumentally early to be estimating yields for harvest 2020, we can look at possible scenarios for plantings and yields.

Anecdotal reports have suggested that wheat plantings could be down by as much as 20% for harvest 2020. Accounting for an uptick in spring wheat plantings and improved conditions in the New Year, I have provisionally worked with an area drop from 10-15%.

Using a yield of 7.5t/ha to 8.0t/ha gives a plausible production range of 11.6Mt to 13.2Mt.

What does this mean for the domestic wheat market?

While the area intended to be planted to wheat is down, and production of wheat is more than likely to be down significantly, the impact on prices is likely to be capped.

Crop conditions elsewhere in the world have been less challenging than they have been domestically. The International Grains Council has provisionally estimated the wheat harvest area up marginally year on year. If the crop develops well, domestic markets may well be capped at import parity.

Moreover, the large crop for harvest in 2019/20 increases the chance of high carry out stocks, which could cover some of the shortfall in supply next season, further limiting price gains.

As we move into the New Year, crop conditions, both domestically and globally, will be an increasingly important watch point for determining where UK wheat prices are at.

Rampant rise in spring barley

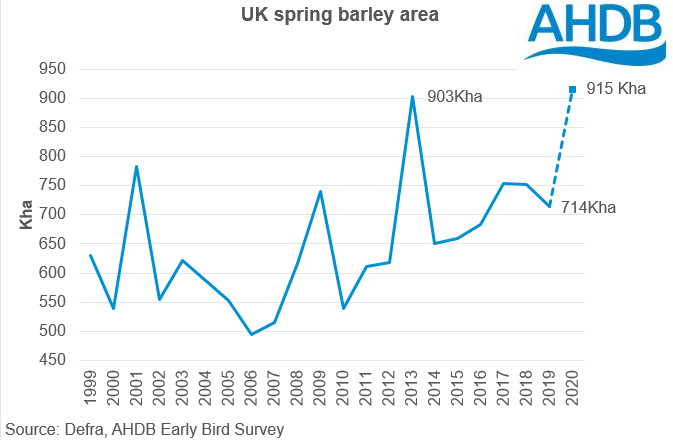

Another key takeaway from the Early Bird Survey is the sharp rise in spring barley planting intentions, up 28% on the year at 915Kha. This poses a large risk for a barley market which is already pricing £18.00/t under wheat.

Large barley yields during 2019 harvest pushed barley production to its highest level since 1988, at 8.2Mt. If yields were around the five-year average for both winter and spring barley, and using the Early Bird intentions, total barley production could easily top 8Mt for the second season in a row.

We could yet see further rises in spring barley area, should the weather remain dismal into the New Year. While we would also see a decline in winter barley area, the price risk associated with the barley market should not be ignored when making planting decisions.

The risk of two large barley crops two seasons in a row, is heightened by the potential for tariffs into the EU, which would likely increase carryout whilst pressuring prices.

Oats also a risk

As with spring barley, oat plantings are also expected to rise sharply on the back of delayed winter crop plantings. The intended oat area is provisionally estimated at the highest level since 1976, 200Kha.

This creates a risk for a market which is already heavily depressed by the 1.1Mt crop harvested in 2019/20. Ex-farm milling oat prices in the spot market have fallen considerably on the year, however, it is worth noting that a high proportion of oats are grown on futures linked contracts and these will not have declined to the same extent.

Contracts for oats are one way to reduce income volatility, particularly with the open market likely to be pressured by consecutive large oat crops.

Understanding the risks of a low price, high cost year

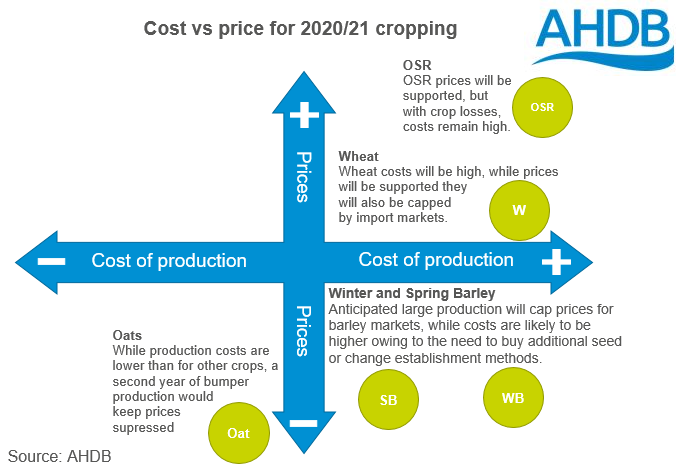

There is no escaping the fact that 2020/21 will be a high cost season for many, be that through changes to establishment techniques or through sunk expenditure on seed, feed and lost crops (OSR).

Understanding the relative cost and price of each crop can help to determine a strategy for marketing. Knowing that a crop is going to be high cost, with relatively low prices (e.g. spring barley) highlights the need to focus on minimising costs to maximise returns. Whereas, if prices are high and costs are low, then the price risk is comparatively lower.

Additionally, taking the “long view” on crop marketing and business planning will be crucial in smoothing volatility in pricing.

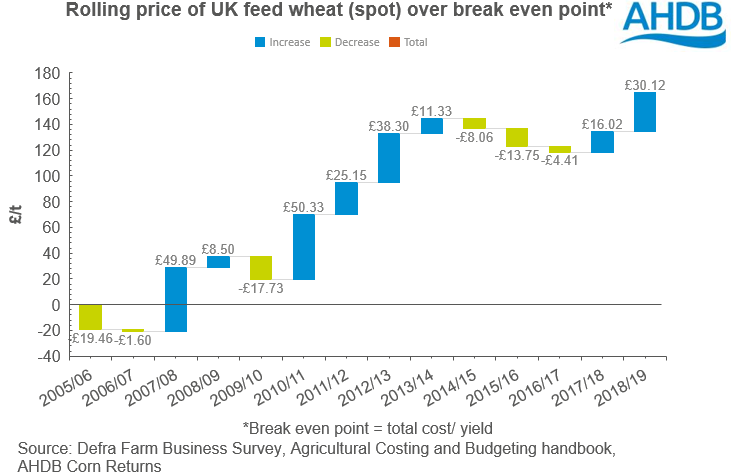

Looking at net-profit for feed wheat crops over a long period of time highlights the importance of using the good years to offset the bad. Understanding your costs of production and the direction of markets in challenging years, can help to increase returns and offset losses.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.