Arable Market Report – 04 November 2024

Monday, 4 November 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Forecasts of increased rainfall in the US Plains and Midwest could pressure prices in the short term. However, expectations of reduced Russian exports due to export restrictions and lower production this year could support prices in the long term.

Maize

Strong US export demand is balanced by harvest pressure from the US and France, along with comfortable global supply forecasts.

Barley

Slow winter barley planting progress in the EU is a longer-term concern. However, results from the Australian harvest, which is now underway, are being closely awaited with a range in forecasts.

Global grain markets

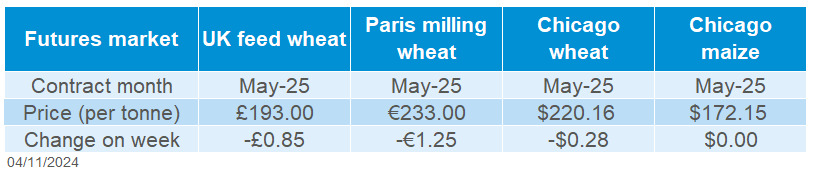

Global grain futures

Global grain prices were mixed last week (Friday-Friday). Both Dec-24 Chicago wheat and maize futures fell 0.2% each, while Dec-24 Paris milling wheat futures rose by 0.1%. Prices were initially supported by a poor US winter wheat condition rating. However, rain showers in dry cropping areas of the US and Russia limited price increases.

Last Monday (28 Oct), the USDA provided its initial assessment of US winter wheat crop conditions for the 2025/26 season. Only 38% of US winter wheat was rated good or excellent as of October 27. This is lower than last year’s 47%, the five-year average of 43%, and average analyst expectation of 47% (LSEG). It is also one of the worst winter wheat ratings for this time of year, only better than 2022.

SovEcon cut its 2024/25 Russian wheat export forecast to 45.9 Mt from 47.6 Mt due to a smaller 2024 harvest (estimated at 81.5 Mt) and new export regulation. This is the lowest export level since the 2021/22 season, when 33.4 Mt was exported.

In France, FranceAgriMer reported that the maize harvest pace increased last week due to drier weather. As at October 28, the harvest was 38% complete, up from 25% the previous week but still down from 89% a year ago. Meanwhile, 41% of the expected soft wheat area and 62% of the winter barley area for next year’s harvest had been sown by Monday, compared to 21% and 38%, respectively, a week earlier but also still behind average.

The European Commission cut its EU soft wheat export projection by 1.0 Mt to 25.0 Mt, which is 10.3 Mt less than last season. This follows further cuts to wheat production estimates and signs of a tough export season, including French wheat being excluded from Algeria’s latest tender. The Commission also lowered its estimate for barley production to 49.8 Mt, down from 50.4 Mt last month.

According to the Rosario Stock Exchange, Argentina is expected to produce 19.5 Mt of wheat this season. Argentina's wheat exports for the 2024/25 season could reach 13.3 Mt, marking the second-highest year on record, with the export estimate only behind the 15.4 Mt exported in the 2021/22 season.

UK focus

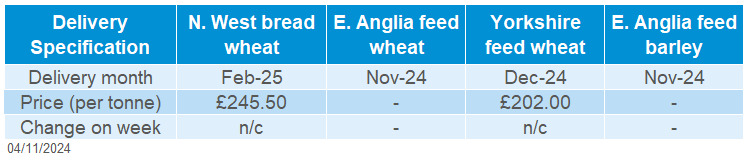

Delivered cereals

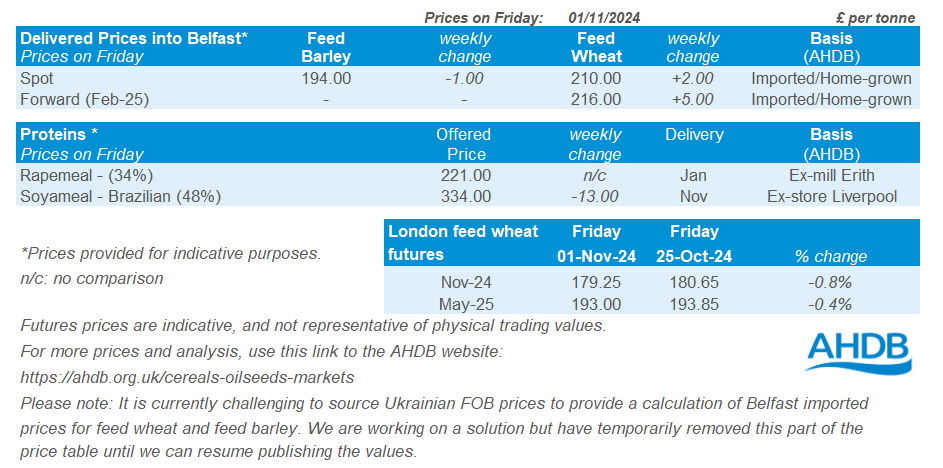

UK feed wheat futures (Nov-24) dropped 0.8% on the week (Friday – Friday) to close at £179.25/t, tracking the neutral direction of global wheat markets.

For the latest UK delivered wheat prices, feed wheat delivered into Avonrange for November delivery was quoted at £189.00/t and £200.50/t for May delivery. Bread wheat delivered into Northamptonshire for November delivery was quoted at £230.00/t.

On Wednesday (30 Oct), Chancellor Rachel Reeves announced the Autumn Budget 2024. The key points from AHDB’s response are as follows:

- Average farm holding value of £2.2 million would incur £240,000 inheritance tax from April 2026

- Static agricultural budget of £2.4 billion will see purchasing power eroded through higher inflationary forecasts

- Farming confidence at lowest level since 2010, added uncertainty may stifle investment appetite and so reduce productivity, resilience and food security

To read AHDB’s full response regarding the Autumn Budget 2024, please click here. Sterling strength continued to slide in response to the high-tax, high-spend, and high-borrowing proposals from Autumn Budget 2024. The Bank of England is due to review the current interest rate (5.0%) on Thursday this week (07 Nov).

The malting barley premium remains under pressure from ample supply and lower domestic demand, returning to its historical average. Corn Returns for 24 October reported the ex-farm premium malting barley for spot delivery at £175.40/t, while ex-farm feed barley was reported at £153.10/t, offering a premium of £22.30/t.

Oilseeds

Rapeseed

Strong demand for rapeseed in the EU remains, and cuts to European sunflower production is supporting prices. Paris rapeseed futures are volatile, but additional fundamental drivers are needed for further price rises.

Soyabeans

Recent strengthening in the vegetable oils complex offers some support, especially as palm oil reaches its highest level in two and a half years. Soyabean plantings in Brazil are a watchpoint, though heavy supplies are still expected.

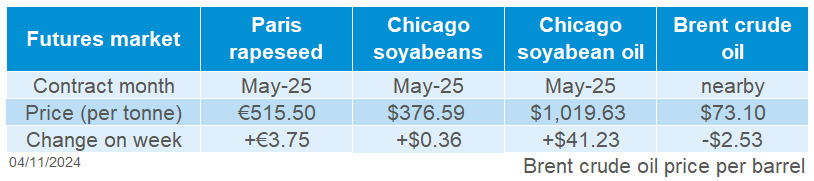

Global oilseed markets

Global oilseed futures

The vegetable oils complex was supported last week, while soybeans were pressured slightly (Friday – Friday). Chicago soyabean futures (Nov-24) fell by $1.93/t to close at $360.97/t. Meanwhile, Chicago soyabean oil futures (Dec-24) gained 4.9%, with strong demand for soyabean oil in Argentina and the US. Support also came from strengthening palm oil and other vegetable oils (rapeseed and sunflower). On the other hand, Chicago soyabean meal futures (Dec-24) fell 3.4%, limiting the upside potential for soyabeans.

According to last Monday’s USDA crop progress report, the US soyabean harvest was 89% complete as of 27 October. This was 11% ahead of the five-year average. The weekly export sales report on Thursday (31 Oct.), showed that 2.27 Mt of soyabeans were sold in the week ending 24 October, up 6% from the previous week. This was within trade estimates of 1.6 Mt to 2.8 Mt (LSEG). Speculators increased their net short position in Chicago soyabean futures in the week to 29 October.

After a delayed start due to dry weather, soybean plantings in Brazil crossed the halfway mark last week, and are now slightly ahead of the same point last year, according to consultancy firm Patricia Agronegocios. The latest StoneX estimate for soyabean production in Brazil is 166.2 Mt up 1.17 Mt on the previous figure, but 2.8 Mt lower than the USDA’s October estimate. We are awaiting the USDA’s November WASDE report this Friday.

Argentina soyabean crush is estimated to be high in October. This supports soybean prices in the short term but could pressure the soybean oil and meal market in the medium term with more supplies on the global market.

Malaysian palm oil futures soared more than 3% last Friday, reaching their highest level in almost two and a half years. The recent strong export pace continues to support prices.

The EU sunflower crop, which had suffered damage from drought in eastern Europe, was revised down by the EU Commission last week from 9.5 Mt to 8.1Mt, 17% below the previous year’s crop.

Rapeseed focus

UK delivered oilseed prices

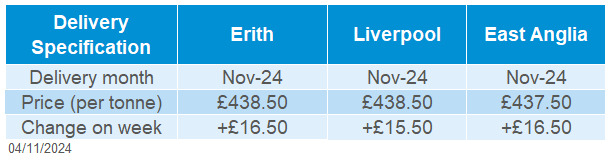

Paris rapeseed futures (Feb-24) gained €3.00/t over the week (Friday-Friday), to close at €517.00/t. On Thursday (31 Oct), the Feb-24 contract closed at €522.25/t, a two-year high. Despite losses in Chicago soyabean futures and relative weakness in oil markets, continued strength in the vegetable oilseeds complex, particularly soyabean oil and palm oil, has supported the rapeseed market significantly. However, for harvest 2025, Paris rapeseed futures (Aug-25) are trading lower than nearby contracts.

The delivered rapeseed price into Erith for November was quoted at £438.50/t on Friday, up £16.50/t from last week. For February delivery to the same location, the price was quoted at £447.50/t, rising £15.00/t over the same period. The spot price for oilseed rape delivered to Erith has now risen to a high not seen since March 2023.

Last Monday (28 Oct), the European Commission released its monthly crop monitoring report for Europe. In France, Germany, and Poland, the top three EU rapeseed producers, sowing is complete, but establishment has been mixed due to unfavourable weather leading to concerns about vulnerability during winter.

The European Commission also revised its 2024 rapeseed production forecast down 0.1 Mt to 17.1 Mt, 3% below the five-year average. Since 01 July to 25 October, EU exports of rapeseed are 26% less than last year (0.2 Mt) while imports are 5% greater (1.8 Mt).

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.