Arable Market Report - 14 October 2024

Monday, 14 October 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

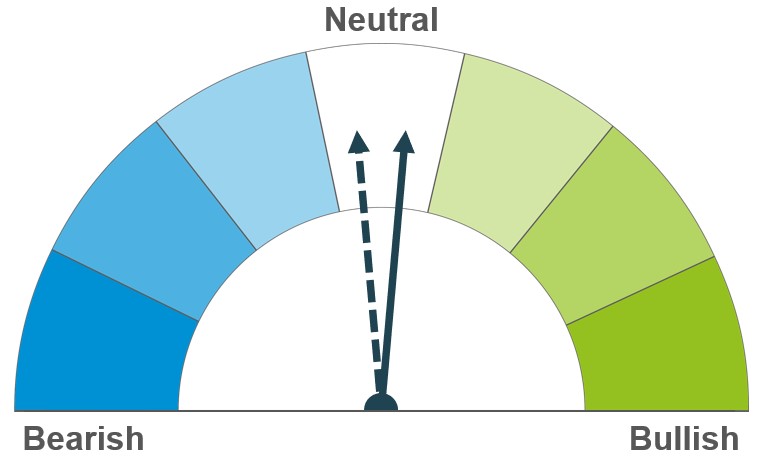

Grains

Wheat

Forecasts of rainfall over key wheat growing regions in Russia alleviate recent dryness concerns. However, attacks on Ukrainian port infrastructure and unfavourable weather in France leading to delayed plantings, offers support.

Maize

Unfavourable weather in France offers support as the harvest is delayed, however, in contrast, US maize harvest continues at a quick pace with an upwards revision to yield.

Barley

Recent strength in the wheat market is likely to support the wider cereals market including barley, however the relatively more favourable European barley production and sizable US maize crop limits support.

Global grain markets

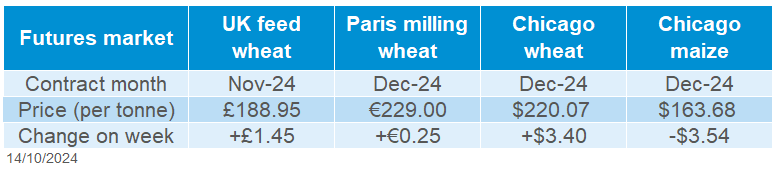

Global grain futures

Global wheat markets were supported on the week (Friday to Friday) as Chicago wheat futures (Dec-24) gained 1.6%, to close at $220.07/t. Weather concerns in France, escalating geopolitical tensions, and speculation that Russia’s export policy could change, offered support across the week. However, the Chicago maize futures (Dec-24) fell 2.1% on the week, to close at $163.68/t, as harvest of the sizable US crop continues at good pace and yield is revised up.

In southwestern Russia, conditions are still reported to be dry with some areas experiencing the least volume of rainfall this season to date in 30 years. Russia’s agricultural ministry has reported that the current weather is not impeding the winter grain planting campaign, though there is varied opinion in the trade. Looking ahead, rain is forecast over key growing areas which could alleviate some dryness concerns.

Russian attacks on Ukrainian port infrastructure escalated last week, with three attacks over four days. While Ukrainian grain exports have been up 58% this marketing year (up to 09 October) in comparison to last year, the increased attacks have made exports more costly for Ukraine (Ukrainian Agri Council).

Speculation arose that Russia was going to amend its current export policy, leading to supposition of export limits. On Friday, the Ministry recommended to exporters that wheat should not be sold for less than $250/t (FOB) and increased the export duty for wheat, though market reaction has been minimal. As at 07 October, Russian wheat (12.5% protein) was calculated at $225/t (Saskatchewan Wheat Development Commission).

Also on Friday, the USDA released its monthly World Agricultural Supply and Demand Estimates (WASDE). Despite modest changes to wheat and maize estimates, most amendments were generally in line with analyst expectations. A slight upward revision to the 2024 US maize yield adds to the heavy supply outlook, with harvest now 30% complete (as at 06 October), 3 percentage points ahead of the five-year average.

In contrast, wet weather in France has challenged the maize harvest, which was reported 6% complete by 07 Oct, below the five-year average of 40% as at the same time. Not only could this impact the quality of the maize crop, it is also delaying the opportunity to plant winter cereals.

UK focus

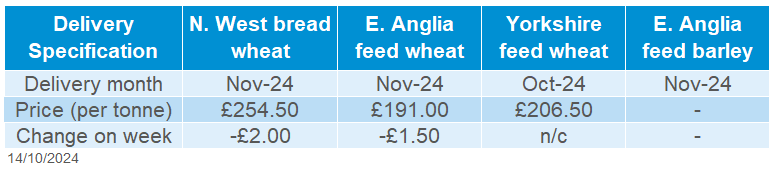

Delivered cereals

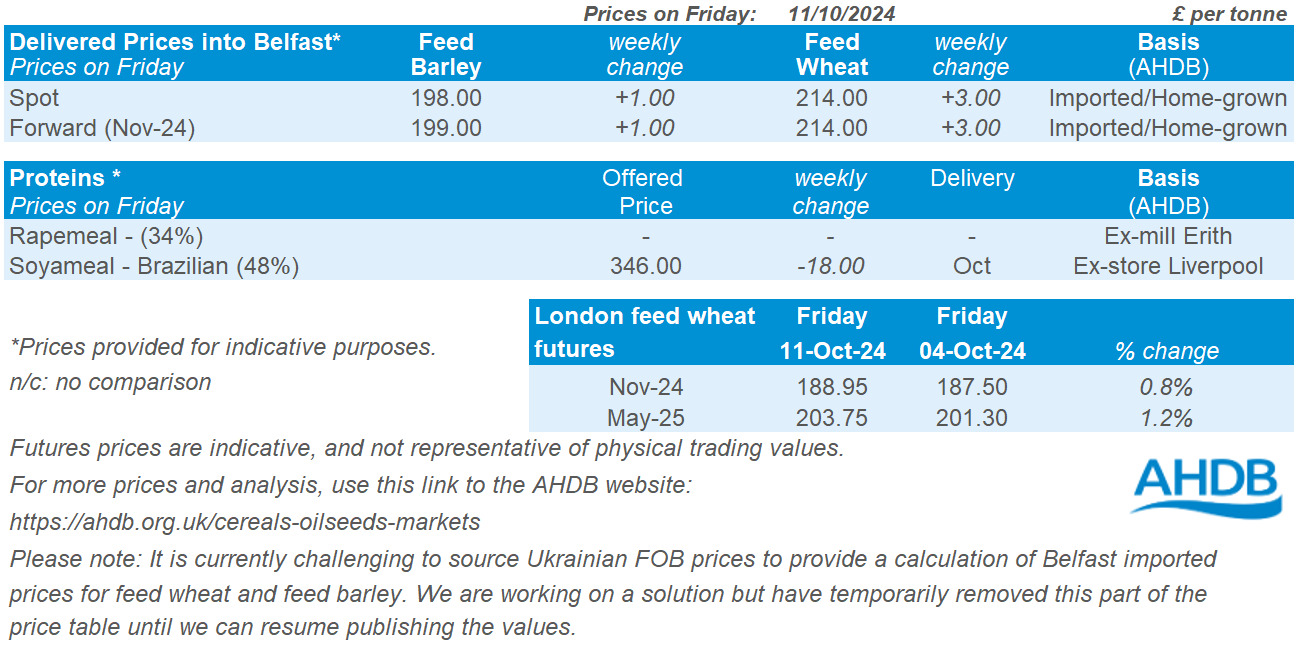

UK feed wheat futures (Nov-24) gained £1.45/t Friday to Friday, closing at £188.95/t. While the May-25 contract closed at £203.75/t, rising £2.45/t over the same period. UK feed wheat futures tracked the gains made in global wheat markets.

UK delivered prices generally followed futures prices Thursday to Thursday. Feed wheat delivered into East Anglia for October delivery was quoted at £189.00/t, falling £1.50/t on the week. For the same period, bread wheat delivered into the North West for October lost £2.50/t on the week, quoted at £252.00/t.

Last week, Defra released its provisional estimates for English crop production. Wheat production is estimated to be the second lowest since 2000 (after the 2020 crop of 8.7 Mt) at 10.0 Mt, while OSR falls to a record low over the same period at 687 Kt, significantly less than the previous low in 2021 of 835 Kt.

Last Friday, the final AHDB harvest report for 2024 was produced as harvest was complete for all farmers in the survey. Overall, despite being later planted than usual, spring crops fared much better than winter crops, which had a very tough start as total rainfall from August 2023 to February 2024 was the second greatest since 1837. The 2024 UK wheat harvest commenced in week four of a ‘typical’ harvest period and ended in week 11. Rapid progress was made earlier in the harvest, before slowing with more variable conditions as the harvest moved north and west.

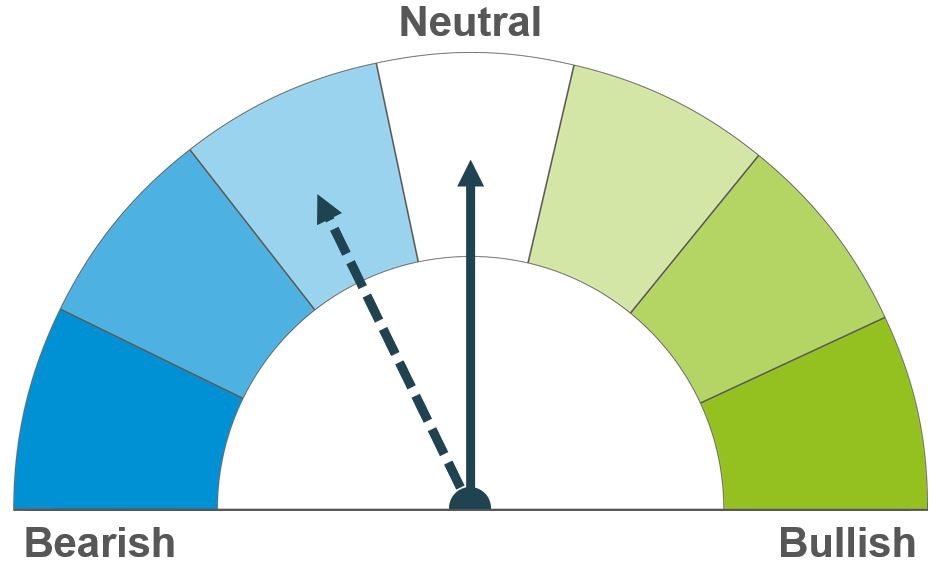

Oilseeds

Rapeseed

Increasing oil price volatility, weather concerns in key producing countries, and rising palm oil prices, could provide support both short and longer term. However, the expectation of ample soyabean supplies longer term keeps prices stable.

Soyabeans

Harvest pressure in the US and improved weather in Brazil weighs, though Malaysian palm oil futures could offer some support for vegetable oil markets. Longer-term, amply global soyabean supplies are still expected.

Global oilseed markets

Global oilseed futures

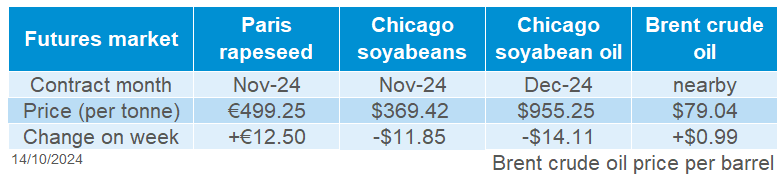

Chicago soyabean futures (Nov-24) dropped $11.85/t last week (Friday to Friday), to close at $369.42/t. Harvest progress in the US, combined with lower levels of exports, and an improved weather outlook in Brazil pressured the market.

Last Friday’s monthly WASDE report was without any surprises for the soybean market. The latest estimates for world soybean ending stocks for 2024/2025 season are at a record level of 134.645 Mt.

As of 06 October, the US soyabean harvest was 47% complete (+21% for week to week), ahead of the previous five-year average of 34%. According to last Thursday’s USDA Weekly Export Sales report, soybean sales totalled 1.264 MT from 27 September – 03 October, the lowest weekly sales since the start of the current marketing year (01 Sep). This was also down 12.4% on the previous week. China was the top buyer with 583 Kt (last week 963 Kt), with the Netherlands at 207 Kt and Mexico 135 Kt.

Speculators trimmed their net short position in Chicago Board of Trade soyabean futures for the week to 08 October. Technically, Chicago soyabean futures (Nov-24) closed last Friday slightly above the very strong support level of $10/bshl. Further speculator actions this week will be something to keep an eye on.

As of 10 October, Brazilian farmers had planted 9.3% of the expected 2024/2025 soybean area, versus 17.4% at this time last year. However, an improved weather outlook in Brazil for the near term mitigated the impact of the poorer planting pace.

Malaysian palm oil futures (Dec-24) rose more than 3% on Friday. Robust Palm oil export figures from cargo surveyors for the Oct. 1-10 period and stronger Dalian Commodity Exchange vegetable oils supported the market. It’s possible that this could have an impact on Chicago soybean futures prices in the near term.

Rapeseed focus

UK delivered oilseed prices

Paris rapeseed futures gained on the week (Friday to Friday). The Nov-24 contract rose by €12.50/t to close at €499.25/t on Friday. Last week, we saw a divergence in the direction of price movements, with Chicago soybean futures falling and Paris rapeseed futures rising. A rally in Paris rapeseed futures prices last week came from supported crude oil markets following escalating tensions in the Middle East, and a firm physical rapeseed oil market in the EU. Again, a weaker euro against the US dollar supported European markets specifically.

The EU rapeseed import campaign continues to outpace last year, offering support to the market. The EU Commission reported last Tuesday that EU rapeseed imports since July had reached 1.41 Mt by 06 October, against 1.20 Mt in the same period last year.

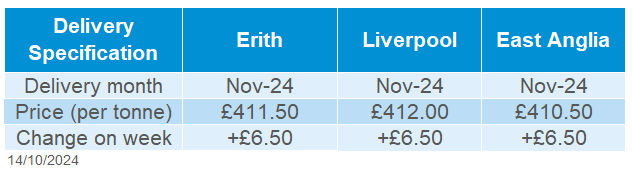

Rapeseed to be delivered into Erith in November was quoted at £411.50/t, up £6.50/t on the week. For May delivery to the same location, rapeseed was quoted at £426.00/t, up £4.50/t on the week.

In last Friday’s WASDE report, the estimate for 2024/25 rapeseed production in the EU was lowered 200 Kt to 17.45 Mt. Production in Ukraine was revised down 100 Kt to 3.60 Mt. World rapeseed ending stocks for 2024/25 decreased 288 Kt to 8.054 Mt (-2.1 MT compared to the last 2023/24 marketing year).

Recent rain in Ukraine may help to improve soil moisture for winter rapeseed especially in the western region, but crop conditions in some central and north-east regions remained unfavourable due to dryness.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.