Arable Market Report - 28 October 2024

Monday, 28 October 2024

This week's view of grain and oilseed markets, including a summary of both UK and global activity.

Grains

Wheat

Maize

Barley

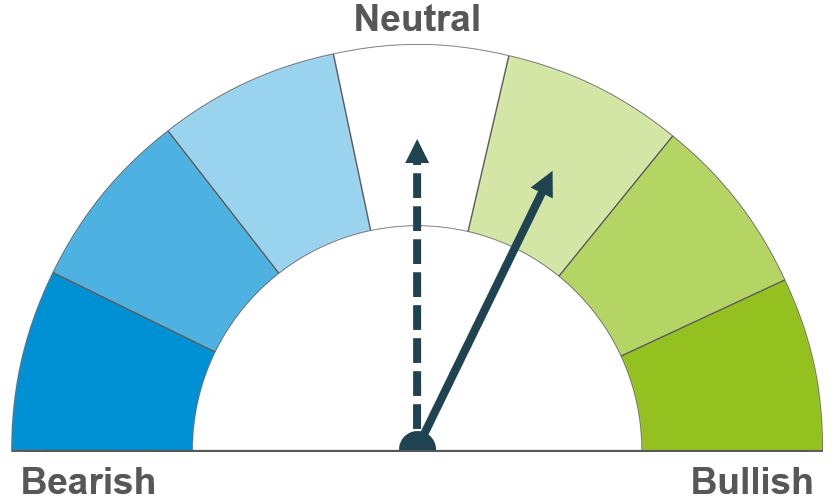

The modest rise in Russian grain value offers support, however export prices remain competitive and therefore strong export pace continues. The forecast of more favourable weather also weighs on the market, but expectations of a smaller Russian 2025 wheat crop limits pressure.

Strong US export sales and slow French harvest buoys the market despite the rapid US harvest pace and ample global supply.

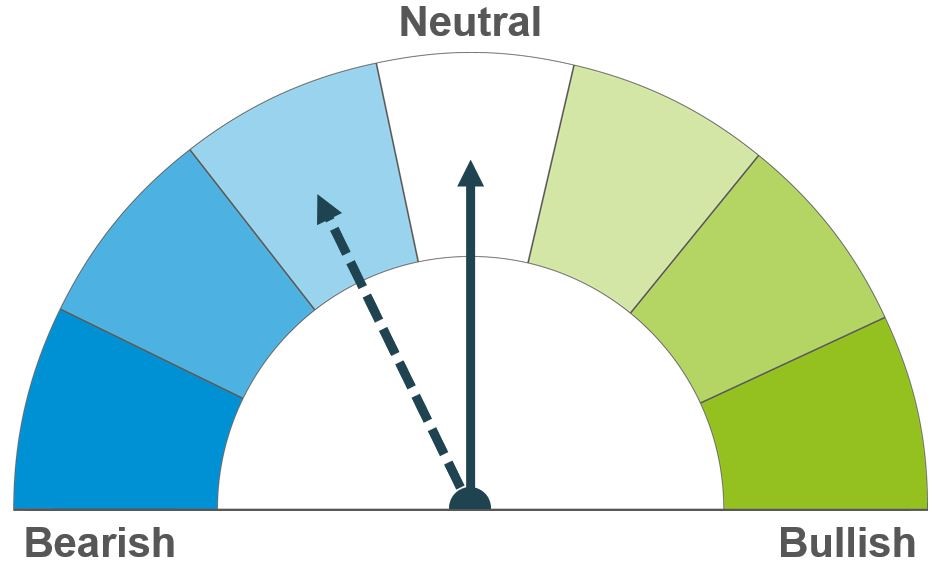

The balance of drivers seen in both the wheat and maize markets is likely to guide the direction of barley both short and longer term.

Global grain markets

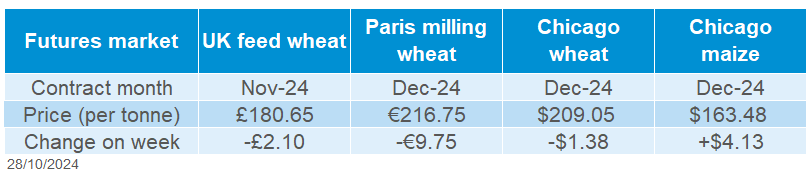

Global grain futures

While there had been mixed movements throughout the period, global wheat markets were pressured on the week while maize was supported (Friday – Friday). Considerable value was lost across the cereals complex on Friday (25 Oct) following a forecast of more favourable weather in key growing regions as well as the ongoing competitiveness of Russian wheat.

In the US, 58% of the winter wheat crop was reported to be in drought condition (as at 22 Oct), the third consecutive weekly rise. However, the forecast of rains over key wheat-producing states (e.g. Kansas) has alleviated concerns regarding establishment, with 46% of the US winter crop now emerged (as at 20 Oct).

France’s soft winter-wheat planting campaign is 21% complete (as at 21 Oct), behind the five-year average of 47% for the same time period. Planting has been delayed due to incessant rainfall which has also delayed the maize harvest, reported 25% complete (as at 21 Oct), behind the five-year average of 69% at this point in the season. However, drier weather is forecast over France in the next two weeks, which is expected to improve harvest and planting progression.

In the US, the maize harvest is reported 65% complete (as at 20 Oct), still exceeding the five-year average which was 52%. Export sales of US maize last week were reported at 4.2 Mt (3.6 Mt for 2024/25 and 0.6 Mt for 2025/26), exceeding the trade estimates for 2024/25 and the largest weekly sale since May 2021.

Russian wheat values are still trading lower than EU origins (e.g. France, Germany), although export values are reported to have risen on the week by a few dollars towards the unofficial floor price set by the Russian government. The pace of Russian exports remains strong as Rusagrotrans forecast that wheat exports for October could reach 5.4 Mt, above the record 5.1 Mt for October last year.

Recent rains over key-wheat producing areas in Russia has improved soil moisture conditions, bringing the planting progression back to a more usual pace. SovEcon forecasted the 2025 Russian wheat crop at 80.1 Mt, which would fall below the country’s five-year average (88.1 Mt) due to the drought experienced earlier in the month impacting planted area and establishment. IKAR expects the crop to be in a range from 80.0 Mt – 85.0 Mt.

UK focus

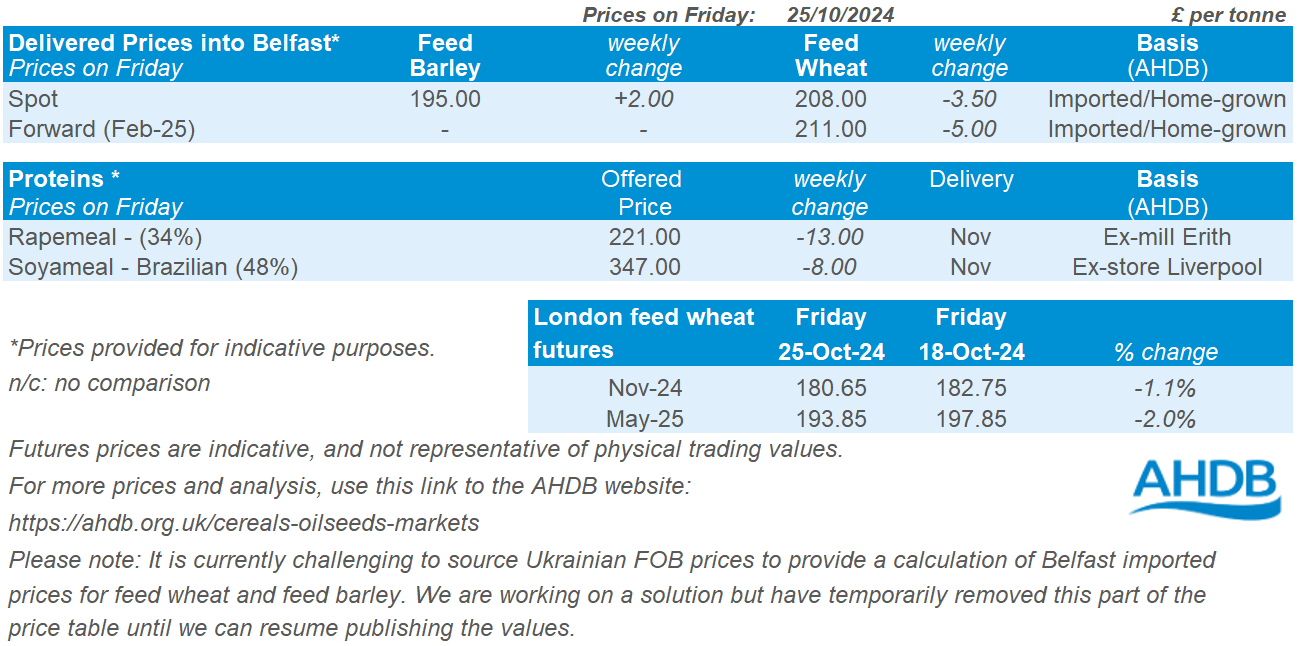

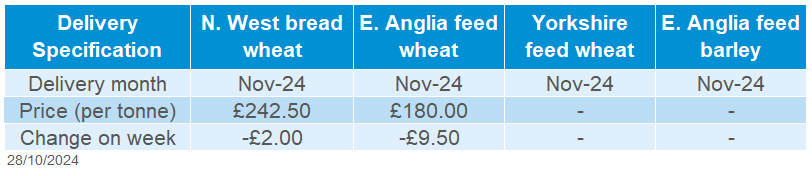

Delivered cereals

UK feed wheat futures tracked the downward movement of global wheat markets over the week (Friday – Friday). The Nov-24 contract lost £2.10/t over the period to close at £180.65/t, and the May-25 contract fell £4.00/t to close at £193.85/t.

UK delivered wheat prices also lost value across the week (Thursday – Thursday). Feed wheat delivered into East Anglia for November delivery was quoted at £180.00/t, £9.50/t less than the previous week. Bread wheat delivered to the North West for November delivery lost £2.00/t over the same period, quoted at £242.50/t.

Last Thursday, AHDB released the 2024/25 Early Balance Sheets for wheat and barley. For wheat, reduced supply outweighs an estimated decline in demand. Whereas for barley, a significant climb in consumption outweighs increased availability.

Defra published the monthly agricultural prices indices for August last week. For all agricultural inputs, the index (2020 = 100) has fallen for the third consecutive month to the lowest level since December 2021. The indices for two key input types, energy and lubricants and fertilisers and soils improvers, were both reported to have fallen on the month to August.

Oilseeds

Rapeseed

Soyabeans

Ongoing weather concerns in key producing regions and strong support from the wider vegetable oil complex could keep prices elevated in the short term. However, the rapid pace of the US soybean harvest and its impact on global oilseed supply is likely to stabilize rapeseed prices longer term.

Strong demand from China, the largest buyer, is keeping prices steady in the short term. However, harvest pressure from the US, along with the expectations of ample global supply, could weigh on prices in the long term.

Global oilseed markets

Global oilseed futures

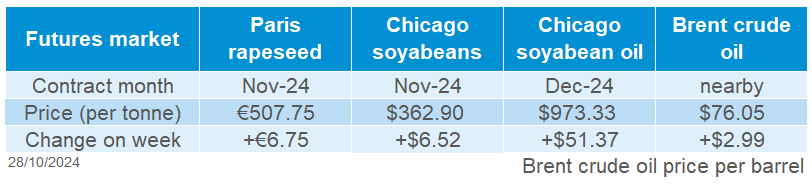

Global oilseed markets saw an overall increase last week (Friday-Friday). Nov-24 Chicago soyabeans futures gained $6.52/t to close at $362.90/t. This was mainly driven by the increase in US soyabeans exported to China (largest global buyer), which helped counter the harvest pressure from the US and favourable weather forecast over South America.

China stepped up its purchases of the US soyabeans last week, buying 1.29 Mt, the largest weekly purchase since the start of the marketing year (September). The USDA’s latest export data shows US soyabean exports reached 2.45 Mt for the week ending 17 October, with 1.81 Mt (74%) shipped to China. This surge in US exports is driven by renewed concerns over potential trade tensions between the US and China, particularly with the uncertainty surrounding the upcoming US presidential elections.

Meanwhile, the US soyabean harvest is progressing rapidly, aided by dry weather in the US Midwest. According to the USDA’s crop progress report from last Monday (21 October), the US soyabean harvest was 81% complete as at 20 October. This was up 14 percentage points from the previous week and 9 percentage points above this time last year.

In Brazil, the USDA’s Foreign Agricultural Service (FAS) increased its estimate for the 2024/25 Brazilian soyabean production to 161.0 Mt, up by 1.0 Mt from the previous estimate of 160.0 Mt. The Agricultural attaché also forecasted a record export figure of 102.0 Mt in 2024/25, up 3.0 Mt from its previous estimates of 99.0 Mt. The domestic crush in 2024/25 is predicted at 55.5 Mt, up by 2.5% compared to 2023/2024.

Benchmark Malaysian palm oil futures (Jan-25) rose by 6.6% last week, continuing the upward trend from the previous week. This increase was driven by expectations of lower output due to dry weather in Malaysia and Indonesia, and reduced stock levels. The Malaysian Palm Oil Board also reported a 3.8% drop in crude palm oil production in September compared to August.

Rapeseed focus

UK delivered oilseed prices

Rapeseed futures followed soyabeans up last week (Friday-Friday). Nov-24 Paris rapeseed futures rose by €6.75/t to close at €507.75/t. The May-25 contract also gained €7.00/t to end the session at €511.75/t. Rapeseed prices remain supported by expectations of lower global production this year and increased demand.

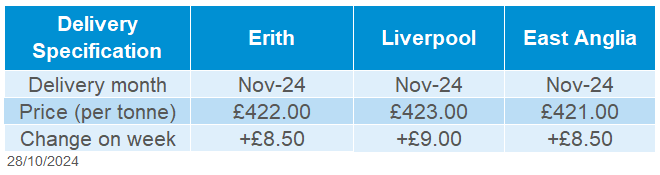

Delivered rapeseed prices into Erith for November was quoted at £422.00/t on Friday, up £8.50/t from last week. For December delivery to the same location, prices were quoted at £426.50/t, rising £10.00/t over the same period.

According to consultancy firm ASAP Agri, Ukraine’s 2025 rapeseed harvest could drop by 20% due to a smaller sowing area and poor weather. As at 21 October, Ukrainian farmers had sown 1.05 Mha of rapeseed compared to 1.27 Mha last year. The agency noted that the reduction in sowing area is already accounted for since the optimal sowing period has ended. Most of Ukraine's rapeseed exports go to Europe, with the Agricultural Ministry reporting exports had reached 1.9 Mt for the 2024/25 season.

Rapeseed prices were also supported by the wider vegetable complex, particularly, Winnipeg canola which strengthens over Canada’s temporary removal of tariffs on certain Chinese imports. The nearby Winnipeg canola futures rose by 4.11% on the week (Friday-Friday). Meanwhile, canola harvest in Saskatchewan, Canada’s main rapeseed region, is 98% complete as at 14 October.

Northern Ireland

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.