Australia: production to fall as re-stocking on horizon

Thursday, 30 April 2020

By Hannah Clarke

The possibility of rebuilding depleted livestock numbers is now on the horizon this year for many Australian beef and sheep farmers, according to Meat and Livestock Australia (MLA).

The extreme weather conditions that plagued Australian farmers in 2019 and early 2020 led many to reduce livestock numbers in order to cope with limited resources. However, good levels of rainfall since February have improved conditions in several regions, with many farmers now in a position to consider rebuilding herds and flocks.

What might this mean for production and trade in 2020?

Beef production

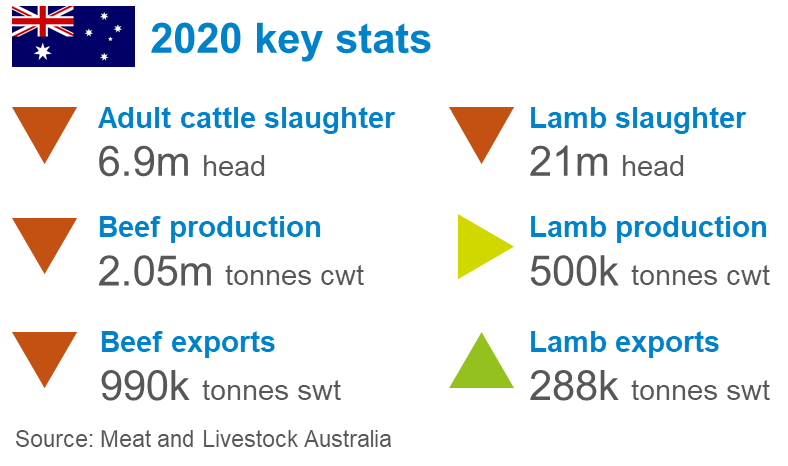

With many producers expected to hold on to animals as part of restocking efforts, MLA has forecast adult cattle slaughter to fall 19% from 2019 to 6.9 million head - lows not seen since the mid-1990s. They expect this to continue for the next two years.

Improved feed availability and fewer cattle on the ground is expected to allow producers to finish cattle to heavier weights than last year, going some way to offsetting slaughter reductions. However, due to lower slaughter, Australian beef production is forecast to fall 16% to 2.05 million tonnes cwt in 2020.

Lamb production

The story is similar for sheep and lamb producers. Due to animal retention, MLA forecasts sheep slaughter will fall 22% to 7.2 million head in 2020. Lamb slaughter is forecast to fall to 21 million head.

As with cattle, sheep and lamb carcase weights are forecast to be higher in 2020, and MLA anticipate this will keep lamb production steady at 500,000 tonnes cwt, despite slaughter reductions. Mutton production however, is not expected to benefit from heavier carcase weights, and so is forecast to fall by 21% on the year.

Trade

During Q1 2020, Australian beef and sheep meat exports have remained steady overall, despite the uncertainty caused by the COVID-19 pandemic, according to MLA. The re-emerging Chinese foodservice market is reportedly offering some support to Australia’s red meat exports. However, foodservice closures in key markets like the US is hampering demand.

Looking ahead, there are concerns that economic downturn following the COVID-19 pandemic will reduce demand in key Australian red meat markets such as the US, China and Japan. This is likely to affect pricier cuts in particular, as they would typically sell through the restaurant trade. On a positive note, a weaker Australian dollar and the Chinese protein deficit caused by African Swine Fever may offer some support to Australian red meat exports.

MLA’s April outlook anticipates that Australian beef exports will be 20% lower in 2020 year-on-year at 990,000 tonnes, based on the domestic supply outlook. Lamb exports are forecast to rise 2% year-on-year to 288,000 tonnes, on the back of higher carcase weights and stronger demand from key markets like China. However, the lamb export forecast is from MLA’s February outlook, and so developing economic effects of COVID-19 may have clouded this forecast since.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.