Australian cattle and sheep outlooks forecast greater production in 2023

Friday, 10 March 2023

The latest Australian cattle and sheep industry forecasts have been released by Meat and Livestock Australia. The reports point to a year of growth for 2023, as the cattle herd and sheep flock are set to rise to their highest levels in 9 and 15 years respectively. This is forecast to result in a greater surplus available for export. But, what could the impact of this outlook be on UK markets?

The outlooks

Beef

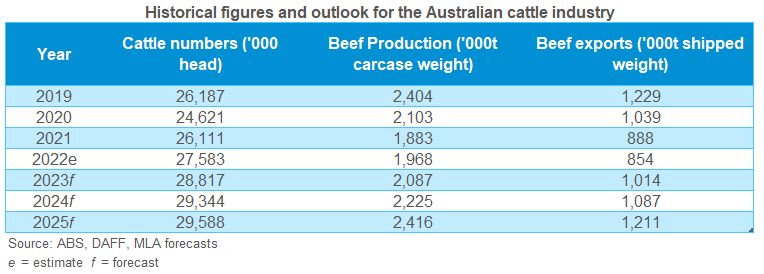

The Australian cattle herd is forecast to grow by 4.5% to 28.8 million head in 2023. The herd is now maturing following rebuilds, since prolonged droughts in 2020 reduced cattle herds to their lowest levels in 20 years. Year-to-date slaughter levels are up 22% at 758,000 head, reflecting greater cattle availability and pressuring prices. With carcase weights set to remain above the 5-year average at 315kg, production is forecast to remain high, at 2.1 million tonnes.

Globally, beef markets are expected to remain tight during the year ahead, due particularly to reduced production in the US. The magnitude and consistency of US domestic beef consumption means that swings in production are particularly born out in trade volumes. The US could therefore return to a net importer position in 2023, which could benefit Australian exports into the US itself, plus Japan and South Korea where the US and Australia compete for market share. The recent suspension of Brazilian beef into China could also be favourable for Australian exporters. However, it's still uncertain as to how long the situation will last, and any further weight on Brazilian beef prices from curtailed exports could hamper Australia’s competitiveness in other export markets.

A key influence on Australian production highlighted by the MLA is labour availability. The potential for insufficient labour could bring slaughter expectations back in-line with 2022 levels of 6 million. This could tighten supplies available for export.

Sheep meat

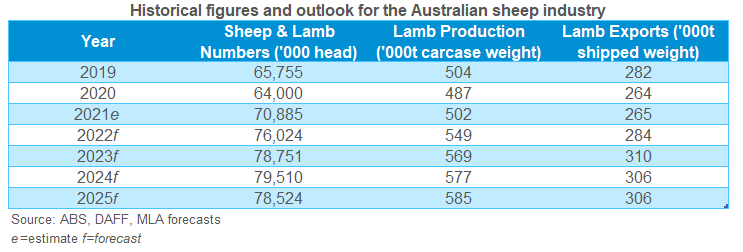

Australia is expecting record lamb production (569Kt) and exports this year due to a 2.7% rise in lamb slaughter on the year, at 22.6 million head, and carcase weights at 25.1kg, 11% above the 10-year average. This has all been enabled by supported prices, improved genetics and greater lambing leading to growth in the national flock, which is forecasted to reach 78.8 million head.

This increased production provides the opportunity for Australia to increase its market share of international sheep exports, especially as the New Zealand flock has declined due to squeezed land availability, and reduced profitability compared to dairy production.

While Australia has access to a range of markets globally for sheep meat, the UK is on the more premium end of the spectrum. Free Trade Agreements with the EU and UK are currently being worked on, with the UK agreement expected to be ratified later this year. AHDB has modelled the potential impact of the UK-AU FTA, and whilst it is likely we will see a modest growth in Australian beef and sheep meat imports, this will be from relatively small bases.

Elsewhere, well established supplier New Zealand has been shifting its sheep meat exports away from Europe towards China as demand and returns improve, driven by a growing middle class. While the UK and EU may be attractive markets for Australia currently, long-term consumption trends suggest demand for sheep meat will ease. Of course, the competitive nature of Australian sheep meat will be advantageous.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.