- Home

- News

- Beef and lamb trade: Beef export destinations shift, and Southern Hemisphere capitalise on seasonal lamb demand

Beef and lamb trade: Beef export destinations shift, and Southern Hemisphere capitalise on seasonal lamb demand

Friday, 3 May 2024

Key points:

- Sheep meat imports grew from Australia and New Zealand capitalising on seasonal demand.

- Sheep meat exports remained strong despite increasing domestic prices, as the EU continues to be an important market.

- Beef imports fell 18% from January’s levels, as volumes from fell on the month.

- Beef exports saw a shift in destinations, with growing importance from Hong Kong.

Sheep meat

Total sheep meat imports in February grew to 5,250 tonnes from January’s levels. This is a boost of 1,340 tonnes (34%) on the month and growth of 1,630 tonnes (45%) on the year. Volume imported in February 2024 is the largest seen since 2017, as imports from New Zealand saw particular strength. Demand in retail over the Easter period was strong, with promotional activity helping to boost demand for leg roasting joints up nearly 24% compared to 2023. This demand looks to be a driver of the growth in imports alongside price points.

Imports from the Southern Hemisphere grew for February, with a near 840 tonne increase for New Zealand, and 600 tonne increase for Australia compared to January. Compared to February 2023, volumes from New Zealand have increased by 1,150 tonnes and 640 tonnes for Australia. Global price differentials remain favourable for the Southern Hemisphere, which continues to produce sheep meat at a price advantage compared to the UK and EU.

Frozen sheep legs remain the largest imported product, with growth of nearly 1,000 tonnes from January to February, at 2,250 tonnes. This would indicate that orders were being filled in anticipation of Easter demand for lamb legs in March. The largest supplier of frozen sheep legs into the UK in February was New Zealand, at 1,720 tonnes, growth of 700 tonnes from January.

UK total sheep meat imports from select countries

Source; HMRC via Trade Data Monitor LLC

UK exports of sheep meat (fresh and frozen) totalled 6,420 tonnes in February, a fall of 380 tonnes from January, but growth of 110 tonnes from February 2023. Lamb carcases remain the largest product exported from the UK, at 78% of the total in February. This is a fall of 590 tonnes from January but growth of 145 tonnes from 2023.

The EU-27 remains the most important market for exports, totalling 6,000 tonnes in February. France takes 52% of total UK sheep meat exports, making it an important market to consider. Recent GB deadweight lamb price increases to historic highs have shifted differentials away from a discount to its French equivalents. Prices on the Rungis wholesale market have remained fairly steady despite the loss of discount, indicating continued demand. Recent AHDB partnerships in France are aiming to drive demand for lamb amongst younger consumers and promote English lamb.

Beef

Total beef imports (fresh and frozen) fell from January to 19,700 tonnes in February. This marked a large decline, with an 18% (4,200 tonne) reduction in volumes. This is, however, growth of almost 3,500 tonnes from February 2023. Boneless fresh beef made up 57% of total beef imports in February, sitting at 11,100 tonnes. This was a fall of 2,500 tonnes from January, but growth of 2,200 tonnes from 2023. Boneless frozen beef made up 31% of total beef imports in February, sitting at just under 6,100 tonnes. This was a fall of 1,100 tonnes on the month, but growth of a similar amount compared to 2023.

Irish beef imports totalled 16,000 tonnes in February, a fall of 2,200 tonnes from January, but growth of 4,600 tonnes from the same period in 2023. Looking forward to the rest of 2024, Irish beef production is expected to fall by a further 4%, following a 4.5% decline in 2023. In recent weeks (April 2024), the price differential has softened from the difference seen earlier in the year, as Irish prices sit just under 50p/kg cheaper than GB. This could provide some support to GB cattle prices given the close relationship between both markets.

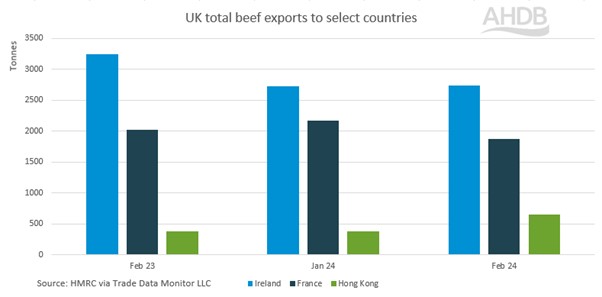

UK exports of total beef sat at just over 9,000 tonnes in February, a minor upwards movement of 130 tonnes from January, and 270 tonnes from February 2023. Exports to Ireland remained fairly flat from January, sitting at 2,700 tonnes in February. Compared to last year, exports to Ireland have fallen by 500 tonnes. Exports to Hong Kong have seen positive movements, totalling 650 tonnes in February. This is growth of 275 tonnes from January, and 280 tonnes from the same time last year. UK producers are well placed to capitalise on increases in food service demand in Hong Kong, supported by an AHDB campaign to showcase British red meat products.

UK total beef exports to select countries

Source: HMRC via Trade Data Monitor LLC

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.