Beef market update: Effects of the contracting herd in the US are felt globally

Friday, 2 August 2024

The global picture

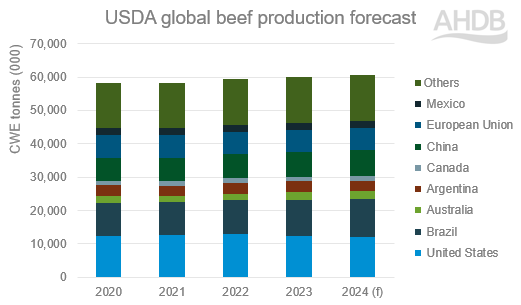

The US Department of Agriculture (USDA) has released its latest quarterly outlook for global red meat production and trade. Global beef production for 2024 is forecast to reach 60.7 million tonnes, 1.3% above 2023 levels.

Key points:

- The effects of the contracting herd in the US are felt globally as trade shifts are evident. US imports at record highs while Asian demand is relatively flat.

- Greater global beef production in the first half of the year, spurred by improved pasture conditions in southern hemisphere and greater carcase weights.

- However, global production forecasts for Q3 and Q4 are projected to fall as declines in EU and US production outweigh growth in Australia and Brazil.

Source: USDA, July 2024 forecast

US

Beef production in the United States continues its downward trend. For 2024 as a whole, current forecasted production is -1.2% below 2023’s lowered levels, with the USDA outlook indicating further declines into 2025. However, the outlook has improved slightly compared to previous estimates, supported by good carcase weights. Retail beef prices have reached record highs due to robust demand. In turn, farmgate prices have been especially strong.

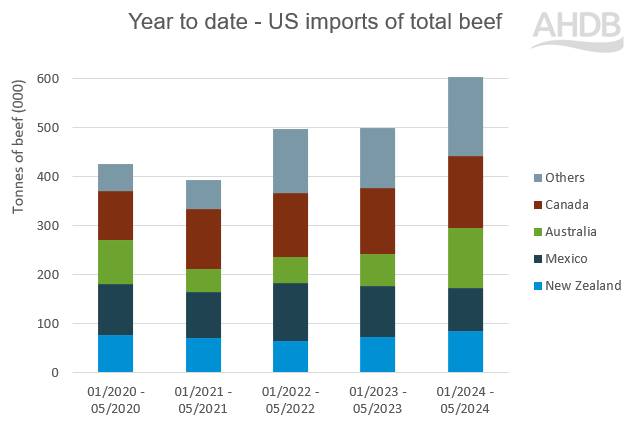

Import levels in 2024 are predicted to reach a record high, to increase by 11.2% year-on-year (YoY). Benefitting from this market so far this year has included Australia, Uruguay, Argentina, Canada, Brazil and New Zealand. The depletion in US domestic production is expected to lead to a 4.3% YoY reduction in exports over the whole of 2024.

Source: US Customs compiled by Trade Data Monitor LCC

Brazil

Record production is forecasted for 2024 (+3.7% YoY) and good rainfall has helped to shorten cattle finishing times, allowing for a larger exportable surplus. Subdued prices have reflected the good supply.

April’s beef exports were the largest on record, with China being the largest destination for Brazilian beef (Brazil Customs compiled by Trade Data Monitor LCC). However, the CEPEA reported that supplies reduced in the first few weeks of July. Forecasts of a dry La Niña winter in Brazil is likely to dampen pasture raised beef supplies and feedlots are reportedly holding fewer animals, which may hinder exports somewhat in the second half of 2024. Although, record slaughter rates are expected to raise 2024 exports as a whole by 13.9% YoY.

Australia and New Zealand

Australia's production is forecasted to increase by 11.1% YoY in 2024, which reflects the ongoing rebuilding of the national herd over the past few years. The growth in the cattle herd is set to stabilise in 2024, according to the Meat & Livestock Australia’s (MLA) latest Cattle Industry Projections, as the herd enters a “maintenance phase”. Robust youngstock numbers are expected to contribute to further production growth in 2025.

Although exports to China have reduced so far this year, overall exports have increased substantially thanks to demand from the US market. The decline in US production is expected to create further demand and develop the upward price direction. New Zealand cattle prices have been subdued but good feed levels have supported margins.

Asia

Chinese production is forecasted to see growth of 3.6% YoY. Large inventories, driven by strong growth in imports in 2023 and weaker-than-anticipated economic growth this year, have led to lower prices. These market drivers could dampen demand for imported product.

European Union

So far in 2024, beef production in both the EU and UK has been higher year-on-year, with most major EU producers reporting growth. Meanwhile, farmgate cattle prices have generally persisted at historically high levels, pointing to robust consumer demand and competition for cattle. EU beef exports have grown significantly against last year, driven particularly by Turkey, helping to keep product moving through the EU marketplace.

European Commission forecasts from earlier in the year suggested a 2.3% reduction in total 2024 production due to smaller herd inventories. However, the higher kill rates through the first part of the year could increase this outlook. Heifer and cow slaughter have been particularly elevated, which against a backdrop of declining breeding herd numbers could point to future tightening in the supply base. Indeed, Irish prime slaughter is projected to reduce by around 2% for 2024 as a whole based on cattle inventory.

What does this mean for the UK?

Market drivers in the northern hemisphere have generally supported cattle prices so far in 2024, with the UK being no exception. Our latest beef market outlook forecasts UK beef production to be relatively stable this year at 903,000 tonnes, with slight growth in prime kill and lower cow kill. Similar to trends in the EU and Ireland, prime cattle slaughter was up YoY during the first half of the year, with robust prices pointing to sustained demand. However, data on youngstock populations points to supplies tightening up in the final quarter and into 2025.

This, coupled with supply dynamics in Ireland and the EU could suggest underlying support for cattle prices generally, as long as consumption remains stable. Read our market outlook for more.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.