Beef market update: increased UK cattle slaughter in October as trade remained strong

Friday, 6 December 2024

Key points

- Prime cattle slaughter rose 17% in October from the previous month, with price and demand high.

- Irish imports remained strong in September, supported by competitively priced supply

- Despite strong pricing, UK beef exports were up 10% year-on-year through Jan-Sep. France and Hong Kong have seen particular growth in shipments.

Production

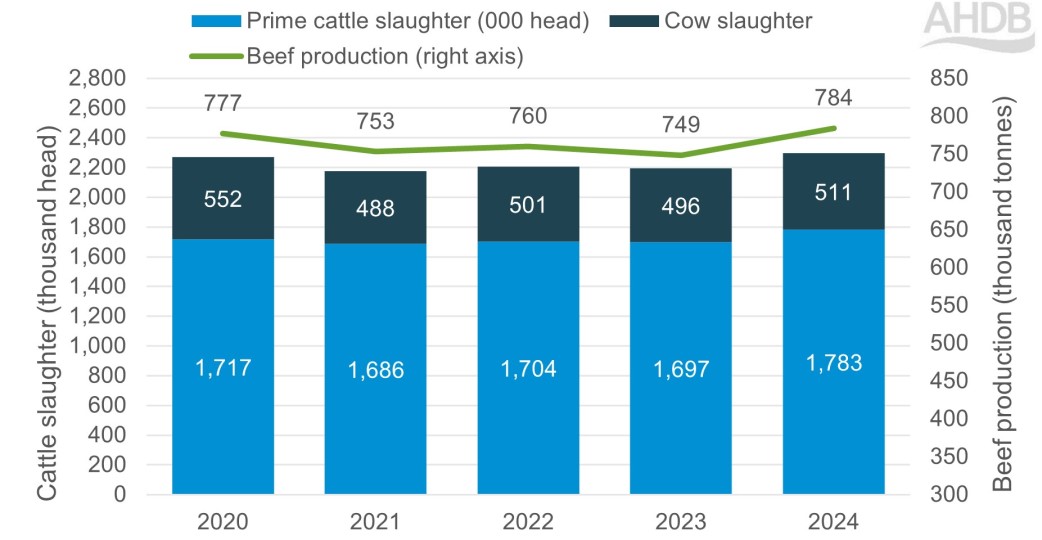

UK beef production totalled 92,000 tonnes in October, a significant increase of 19% from September. This was also up on October 2023’s levels by 12% (+10,000 tonnes) with forecasted production expected to reach 933,000 by the end of the year.

Prime cattle slaughter grew in October by 17% to 204,000 head, representing a 13% year-on-year increase compared to 2023 and driving growth in overall beef production.

Additionally, cull cow slaughter grew by 32% in October compared to the previous month to just under 70,000 head. Although largely a seasonal rise, this figure is still 6,000 head above October 2023 and a 9% year-on-year rise.

A key driver of this has record Northern Irish kills of 47,000 head in October, an increase of 13,000 head from the previous month. Reports suggest as well as strong prices, carbon reduction schemes are likely adding incentive to slaughter. Stable year-on-year beef volume sales and market reports suggesting encouraging festive demand are supporting prices into the winter months.

Read our predictions for red meat and dairy performance this Christmas

Yet, October prime cattle carcase weights have remained relatively consistent with previous months and compared to the same time last year at an average of 340kg.

UK beef production – YTD Jan-Oct

Source: Defra

Trade

Imports

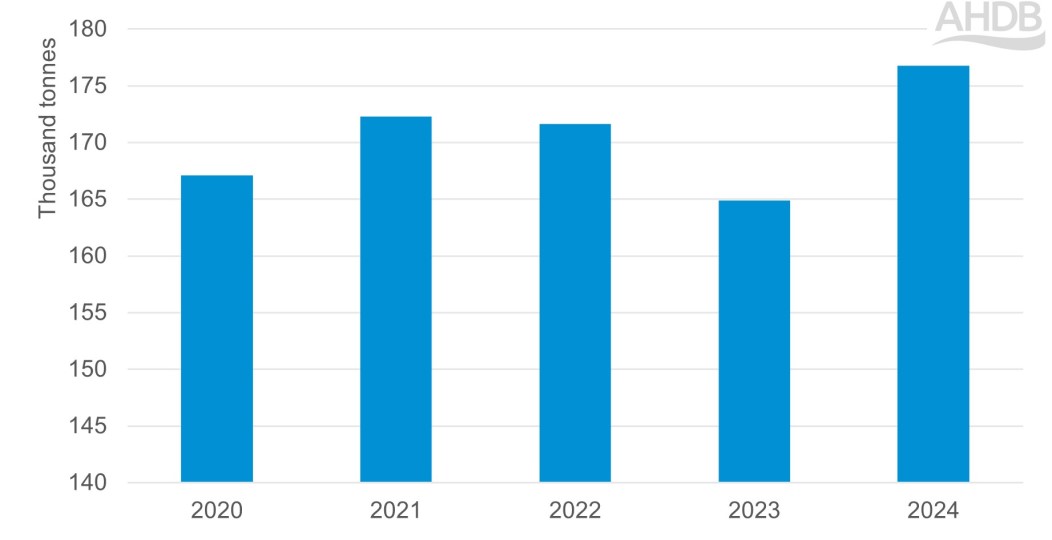

For the year-to-date (January to September), UK fresh & frozen beef imports reached 177,000 tonnes, an increase of 7% compared to the same period in 2023. Although, September volumes fell marginally compared with August, down 200 tonnes.

UK imports of fresh and frozen beef, year-to-date (Jan-Sep)

Source: HMRC via Trade Data Monitor

Imports from Ireland have continued to climb this year with 15,000 tonnes imported in September, an increase of 750 tonnes from August, contributing to a year-on-year (Jan-Sep) increase of 15,000 tonnes (+12.8%).

Ireland’s market share of imports to the UK has grown further YTD, January to September, with a market share now at 76.7% compared to 72.9% over the same period in 2023. Other key importers, Poland, the Netherlands and Germany have seen imports to the UK fall, down 15%, 23% and 77% respectively, likely contributing to Ireland’s increased market share of UK imports.

Ireland’s ability to pick up excess demand for imports is likely the result of relative price differentials providing incentive to export across the Irish Sea together with their own increase in production.

Exports

For the year-to-date (January to September), exports of fresh and frozen beef from the UK were up 10% on the same period in 2023, an increase of 7,500 tonnes. Exports in September grew by over 1,000 tonnes compared to August, reaching 9,300 tonnes.

A large contributor to this recovery in export figures has been an increase in exports to France, up 13% on 2023, year to date, and Hong Kong, where export volumes increased from 2,900 tonnes in 2023 to 4,500 tonnes in 2024 YTD (+54%). This is despite the UK’s higher price differential relative to the EU in 2024. Yet, this may be a consequence of the UK’s increase in supply relative to the EU.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.