Beef market update: Irish beef production lower to July

Thursday, 7 September 2023

Key points

- Irish cattle kill running below 2022 levels

- More 18-30 month-old beef cattle on the ground in Ireland as of 1 July

- Year-to-date Irish exports slightly below 2022 levels, but annual growth in June

- Irish beef prices have steadied in recent weeks, while a tightening domestic supply picture also offering support to GB beef prices

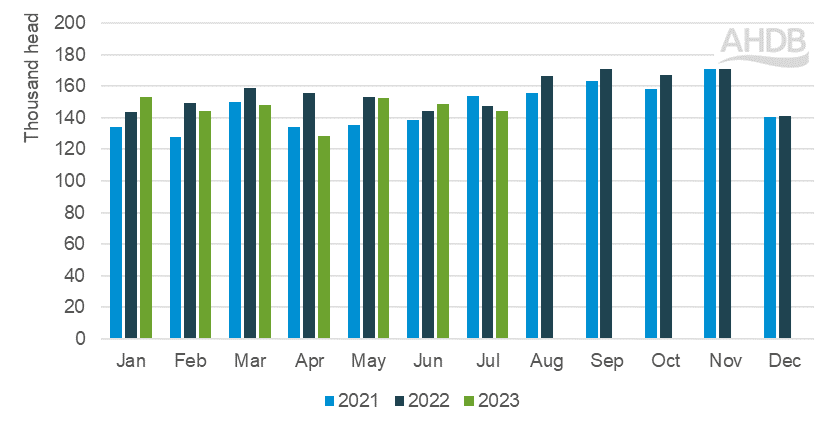

Fewer cattle slaughtered so far in 2023

According to CSO Ireland, cattle slaughter (excluding calves) was 3.1% lower during the first seven months of the year versus the same period in 2022. Slaughter of steers and heifers, and cull cows declined by a similar proportion (2.4-3%) to 690,000 and 230,000 head, respectively.

Similar trends have been reported in Northern Ireland ; clean cattle slaughter was down 4% year-on-year from Jan-Jul (at 206,000 head).

Monthly Irish adult cattle slaughter, 2021-2023

Source: CSO Ireland

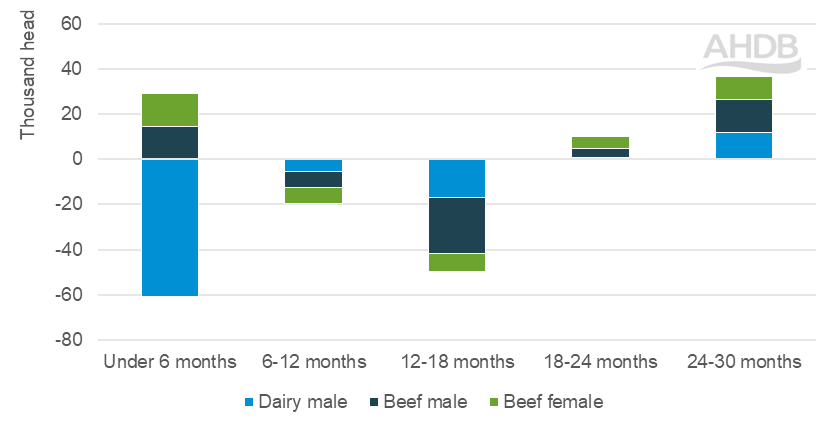

More cattle on the ground in the short-term

Looking at the latest cattle population data from DAFM, as of 1 July the number of cattle on holdings in the Republic of Ireland available for shorter-term beef production looks higher than a year ago, supporting expectations of higher kill in the second half of this year. This is particularly evident in the number of 24-30 month old cattle. Looking further ahead, the number of younger cattle that could come available for beef production looks tighter than a year ago, particularly those aged 12-18 months.

Year-on-year change in Irish cattle numbers at 1 July 2023

Source: Department for Agriculture, Food and the Marine

Irish calf registrations in the year to July have fallen by 1.6% year-on-year, according to data from DAFM. Within this, the number of calves registered to a beef sire have risen by 5% year-on-year to 1.4 million. On the other hand, dairy-sired registrations have fallen by 12% to 717,000 head.

Irish exports slightly lower year-on-year

Irish beef exports for the first half of the year have fallen by nearly 3% compared to the same period a year ago but remain elevated comared to the same period in 2020-21. The amount of beef imported into the UK in June fell slightly when compared to May, although the quantity was 6% above June 2022. Meanwhile, Irish shipments to the Philippines have continued to see notable decline, and exports have also fallen to European countries including the Netherlands, Sweden and Spain.

Since regaining market access for beef at the start of this year, Irish exports to China have shown strong growth but remain at low levels (accounting for just under 1% of total Irish beef exports so far this year). Competition into the Chinese beef market is strong, especially with growing Brazilian and Australian production at globally competitive prices. See recent global cattle price trends here.

Cattle prices stabilise

Irish cattle prices have shown some stabilisation over recent weeks, with industry reports of upwards movement in the latest factory quotes. Recent slaughter figures suggest that weekly cattle supplies are generally still behind year-ago levels. Indeed, the supply picture looks tighter in GB at present, with AHDB estimated GB weekly prime cattle kill figures having fallen quite sharply through August, offering support to domestic prices, with the all-prime deadweight average measure at 462.4p/kg in the week ending 2 September. Estimated GB cow slaughter meanwhile is particularly low.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.