Beef market update: what's the latest in retail demand?

Wednesday, 30 August 2023

Following on from our previous analysis on beef prices, this week we explore how beef is performing through retail.

Key points:

- Recent uplift in quantity of beef sold via retail, driven by mince, roasting joints and steaks

- Longer-term demand picture looks less positive

- GB deadweight prime cattle prices ticked up again in week ending 26 August as supply falls

Recent uplift in retail demand

Total beef volume sales through retail were up 1.7% for the 4 weeks ending 6 August 2023, as shoppers drop BBQs in exchange for family favourites according to Kantar. The uplift in beef sales came through existing beef shoppers buying more. A small number of shoppers are dropping out of the beef category – probably due to price increases as average price per kilo of beef was up 10% on last year.

Throughout grocery, instead of the usual summer fare, shoppers have been turning to more traditional winter warmers instead. The amount of soup bought has gone up by 16% year on year, while ice cream fell by 30% and halloumi declined by 27%.

We have seen a similar picture for beef with burgers down 23.7% but this loss was made up for by increased demand for mince (+12.4%), roasting joints (+7.5%) and steaks (+3.4%). Beef ready meals and beef pies also saw growth.

Longer-term, beef performance is less positive

Despite this growth year-on-year, the volume sales are still less than we might have expected. Volumes in the last 4 weeks were down 8.1% compared to 2019 and are the lowest levels seen since last August (Kantar). Last year was a particularly poor month for beef volumes as the 4 weeks ending 7 August 2022 saw the lowest volume sales for beef in the last 5 years. This low was driven by the impacts of the cost-of-living crisis combined with a July which was too hot for BBQs. See our full review of Summer 2022.

Looking over a longer time, volumes for beef are down 1.1% over the last 12 weeks and down 2.9% over the 52 weeks to 6 August 2023 (see the data visualised here). Therefore, even with this year-on-year growth there is still a relative lack of demand, which is likely one of the factors that has played into the recent fall in cattle prices. We expect that beef demand will remain subdued for the remainder of 2023 as cost-of-living pressures continue. Read more in our Beef Market Outlook.

Cattle price update: prime prices rise and cow prices stabilise on lower supply

In the week ending 26 August, GB deadweight prime cattle prices ticked up again, while cull cows stabilised further. The overall average steer price gained 2.6p to average 459p/kg, while heifers rose by 2.2p on average to 457p/kg. Both measures stood around 24p ahead of the same week a year ago. The overall GB deadweight cow price steadied in the latest week, down just 0.1p to 313p/kg, but this was nearly 32p lower year-on-year.

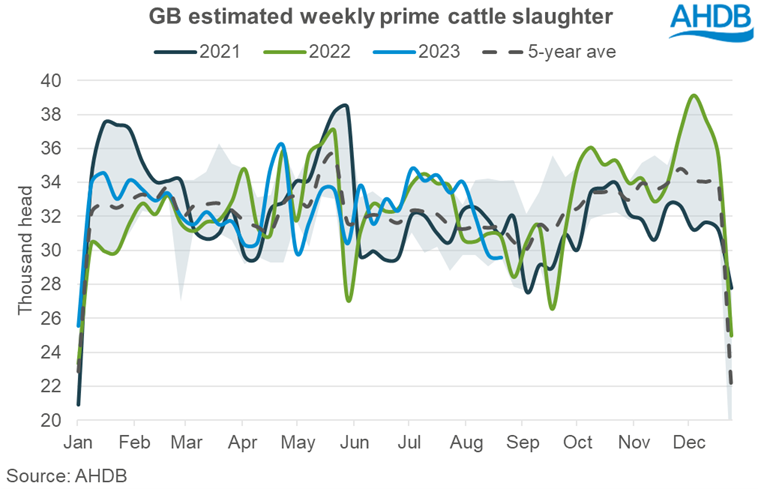

Estimated slaughter figures would suggest that cattle supplies are shorter currently. Weekly GB prime cattle slaughter has fallen through August to an estimated 29,600 head per week in the week ending 26 August (estimated kill was 34,000 in the week ending 5 August). Slaughter has been running below previous years’ levels for several weeks. Cow slaughter figures show that the latest week’s estimated kill was the lowest for the time of year in at least the last five years (-18% vs same week in 2022).

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.