Beef prices rise from farmgate to checkout: Beef market update

Friday, 8 August 2025

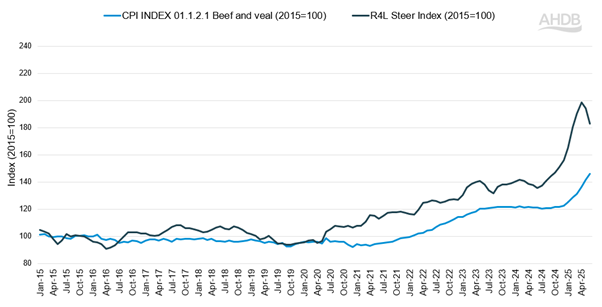

Long-term data reveals that both farmgate and retail beef prices have climbed markedly since 2020, though producers have seen the bigger lift. After May’s record high, farm prices have edged lower while shelf prices keep rising, trimming, but not erasing, the wide gap between them.

Key points

- R4L steers averaged 709p/kg in April, up 107% since January 2020 and 43% above last April.

- Retail beef prices for June 2025 stand 52% above January 2020 after a 17% rise this year.

- Relative to 2015 prices, the gap between the farmgate and retail beef price narrowed from 62 to 37 index points between April and June.

- Prime slaughter fell by 3% between January and June. For 2025 as a whole, UK output is forecast to drop by 4% to 885kt, putting further pressure on future prices.

Farmgate momentum and the tightening cattle pool

R4L steer values averaged 590p/kg in January 2025, accelerating to a record 713p/kg in the first week of May and closing June at 646/kg. That sequence amounts to an 11% rise in the first half of the year, a 35% jump on June 2024 and a cumulative 91% lift since January 2020.

A significant driver is supply. Prime cattle slaughter from January to June totalled 1.02m head, 3% fewer than a year earlier. Meanwhile, cow throughput fell 5% to 277,000 head as dairy farmers retained cows on firmer milk prices and scarce replacements. With calf registrations still subdued, we now forecast 2025 beef output to total 885,000 tonnes, 4% lower than 2024 and slightly below the last outlook released in May. Tight domestic availability, echoed by shrinking herds in key exporting nations, should keep a firm floor under finished cattle prices. However, extra imports and fragile consumer confidence remain as potential limiting elements.

Long-term UK beef price (2015=100)

Source: AHDB/Office for National Statistics

Retail adjustment and shifting consumer behaviour

On the high street the CPI for beef & veal, recorded by the Office for National Statistics (ONS) has climbed 52% from January 2020 to June 2025, while farmgate prices have surged 91% over the same period. In practical terms the gap between the two series, as shown in the graph above, has ballooned from just 0.3 index points at the start of 2020 to 62 index points in April 2025, showing how much faster producer prices have pulled away from shelf prices. Yet in June, this gap has begun to tighten with the difference now sitting at 37 index points as the farmgate price eased and the retail price continued to rise.

The quicker price pass-through is reshaping demand. Worldpanel data shows retail sales for beef 1% lower over the last year to mid-June (Worldpanel by Numerator UK, 52 w/e 15 June 2025). While in the latest twelve-week period, volumes were 4% down as shoppers switch away, primarily in to cheaper proteins (Worldpanel by Numerator UK, 12 w/e 15 June 2025).

Foodservice volumes see a similar tilt away from beef, while chicken sees growth (Worldpanel by Numerator UK OOH, 12 w/e 15 June 2025). With cattle numbers expected to tighten further into the fourth quarter and global supplies still constrained, retail prices are unlikely to retreat soon. AHDB therefore anticipates total UK beef volumes in 2025 finishing about 2% below last year, despite stable real wages and modest population growth

Explore the full analysis and insights into the impact of rising beef prices within retail in our recent article.

Changing Trade Dynamics

Between January and May 2025, the UK imported 127,500 tonnes of beef, only 1% above the same period in 2024, yet monthly data show imports running about 10% higher from March to May as processors searched overseas for product to offset tight domestic supply and surging farmgate values. Ireland’s share of those volumes slipped from 76% to 70%, allowing competitively priced beef from Brazil, Australia and New Zealand to gain ground.

At the same time, exports have lost momentum. In June, UK beef is 10% more expensive in euro terms than it was in January, undermining sales into core EU markets. Exports for January-May 2025 fell to 51,300 tonnes, down 9% year-on-year, and AHDB expects the full-year total to be 7% lower.

The result is a net trade balance decrease for beef as increased imports outweighed falls in exports which, while still insufficient to reverse the overall supply squeeze, is helping to moderate further spikes in the long-term beef price trajectory and helping to hold the recent peak below the May record.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: