Black Sea crop conditions critical watchpoint: Grain market daily

Thursday, 4 April 2024

Market commentary

- UK feed wheat futures (May-24) closed at £170.55/t yesterday, down £0.85/t from Tuesday’s close. New crop futures (Nov-24) closed at £193.10/t, up £1.85/t over the same period

- Old crop prices were marginally pressured with the Paris market, which ended down due to a stronger euro against the US dollar. New crop futures gained with the Chicago market which was supported from technical buying and short covering

- Paris rapeseed futures (May-24) closed yesterday at €448.25/t, up €2.50/t from Tuesday’s close. The Nov-24 contract ended the session at €458.50/t, up €1.00/t over the same period. Rapeseed prices were up from support in Chicago soyabeans, which gained on technical buying and short covering after lacklustre demand and rising South American supplies pushed prices to one-month lows early in the session

Black Sea crop conditions critical watchpoint: Grain market daily

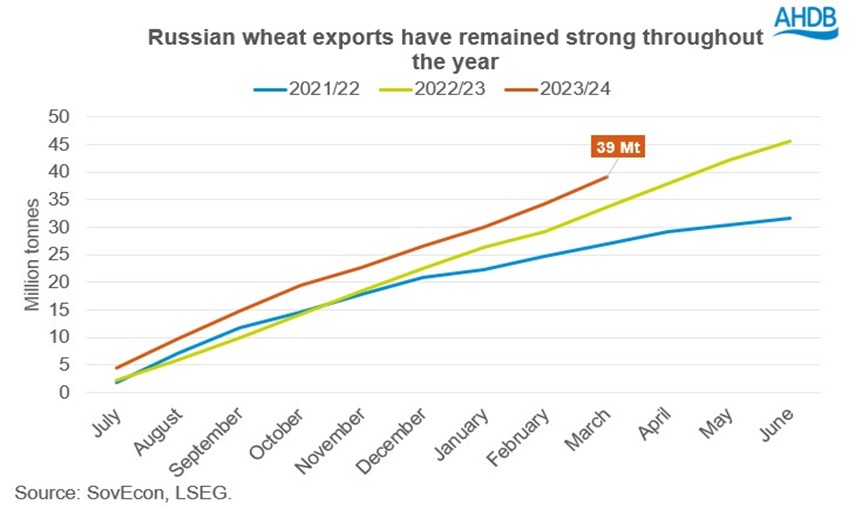

Notably, since the start of 2024, global grain prices have been pressured significantly. Largely pressuring this market has been Russian grain exports, which have remained strong throughout this marketing year.

The export pace of Russian grain remains strong with wheat, barley and maize exports for March estimated at 6.0 Mt, up from February’s figure of 4.9 Mt. Wheat accounts for the greatest proportion of exports at an estimate of 4.9 Mt, the largest amount since September 2023. To date, this season, 39.1 Mt of wheat have been exported from Russia.

Furthermore, in large part, Ukrainian grain has been exported via the humanitarian corridor unfazed, with 70.5% of exports in the first half of March going via the humanitarian corridor. Ukraine exported 339 Kt of barley in March – this is the largest volume this season, with prices remaining competitive (LSEG).

Black Sea new crop outlook

Although Black Sea grain has pressured grain prices throughout this marketing year, the region's production for 2024 harvest is going to set the market sentiment for the 2024/25 marketing year.

Initial estimates show that Ukraine's combined grain and oilseeds harvest is likely to decline to 76.1 Mt, compared to 82.6 Mt seen last year (UGA). The Ukrainian Agricultural Ministry reported that spring sowing has begun within their key regions, seeding almost 500kha reported last Friday (29 March). Ukraine’s maize area is expected to reduce at the expense of soyabeans, due to the profitability they offered in 2023.

For Russia, a large wheat crop is expected and is slightly increasing year-on-year. Initial estimates from Sov econ estimate the wheat crop at 94 Mt for 2024. IKAR, an agricultural consultancy, estimates the wheat crop slightly lower at 93 Mt.

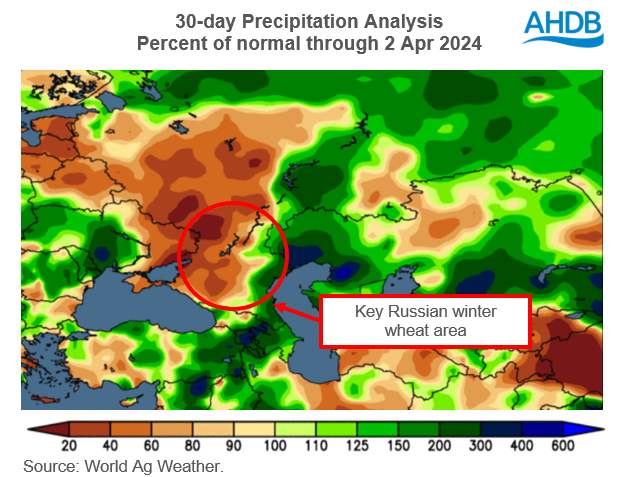

There has been a low amount of rain over key Russian winter wheat growing regions over the last 30 days. Over the next seven days, temperatures across the Central, Volga, Southern and North Caucasus regions are going to remain abnormally warm too.

This Russian crop size is a critical price driver of global grain prices, which will inherently feed into domestic wheat prices. There are current expectations of a large Russian crop; however, if that is cut significantly, there could be an element of price support.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.