Brazil-China beef trade suspension: what could it mean for markets?

Friday, 10 March 2023

Update: Brazilian shipments resumed to China at the end of March, after a 4 week suspension.

On the 23 February, shipments of beef from Brazil to China were suspended over a confirmed case of atypical BSE. This comes under a health protocol maintained between the two countries, requiring the voluntary suspension of sales upon notification of the disease.

Brazil and China are goliaths of the global beef market, heavily reliant on one another for trade. So, what could this all mean for markets, and could there be any impact on the UK? The key question is how long the suspension will last.

How much beef does Brazil export to China?

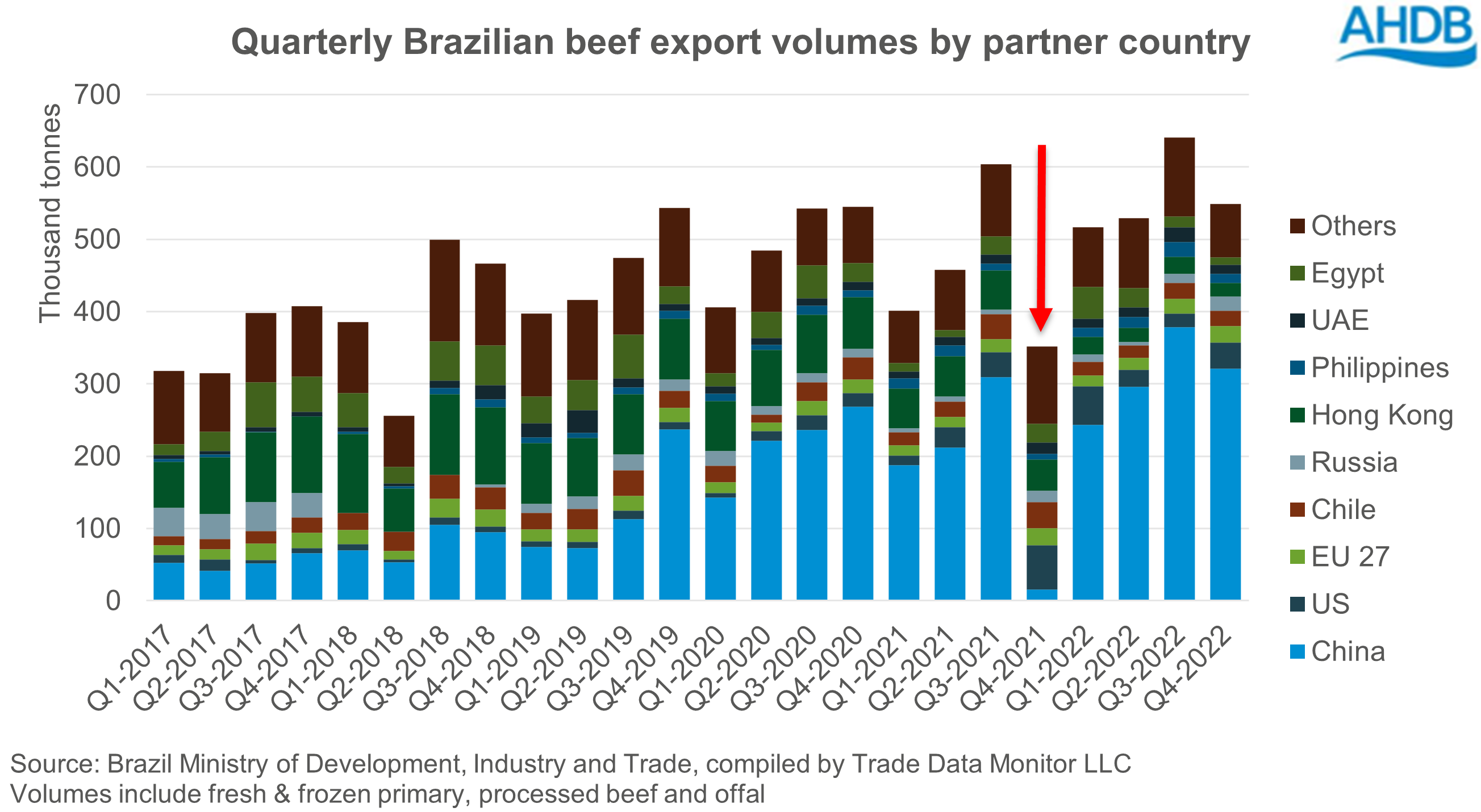

Brazil’s beef exports have generally been growing at a rate of knots over the past two decades, spurred by rising global demand for beef. Growth in the past ten years has largely been driven by China, with trends in Chinese demand now of significant influence on Brazilian trade.

To put the size of these markets in context, on average Brazil exports more beef around the world in one month, than the UK exports in one year (Brazilian average monthly exports of 150-190kt from 2020-2022). In 2022, 55% of Brazil’s annual volume went to China, up from 2% ten years ago.

Previous suspensions

Brazilian beef has been suspended from the Chinese market before due to BSE. The most recent ban was in September 2021, and lasted for around three months. Although, previous suspensions (such as in 2019) have not lasted as long. Looking at trade volumes, during the fourth quarter of 2021, total Brazilian beef export volumes plummeted. More beef was shipped elsewhere, particularly into the US, but this nowhere near offset the loss from China. However, volumes recovered quite quickly once the suspension was lifted.

Looking at price movements around that time, Brazilian (and indeed neighbouring countries) prices came under pressure, dipping throughout October-November. However, it is unclear how much influence the export ban itself had on prices. While Brazil is hugely reliant on China for its beef trade, exports only account for around a fifth of Brazil’s total beef production. Weaker domestic consumption was also reportedly weighing on prices at the time. Indeed, Brazilian cattle prices have since returned to levels seen during that time, pressured by increased cattle supply and slow domestic consumption.

What could the impact be on global markets?

Overall demand for protein in China is expected to grow in 2023, as COVID restrictions are eased, although there remains some uncertainty over just how quickly this will happen. Industry forecasts point to increased import demand for pork and beef in 2023, as consumption outstrips anticipated growth in production.

The key question is: how long will Brazil be out of the Chinese market? The longer the suspension remains in place, the more stock will be built-up domestically and/or looking for a home elsewhere. Traders around the world will be watching the situation closely and assessing the size of the opportunity.

It’s likely that China will look to backfill at least some of the potential protein gap left by the absence of Brazilian beef, either by importing more beef from elsewhere, or by turning to other proteins like pork. For beef, Argentina, Uruguay, Australia and the US could be the most likely candidates to capitalise. However, production and exportable supplies are forecast lower in Argentina and the US this year according to the USDA, and the Australian opportunity could be limited by continued Chinese bans on several abattoirs. Although self-imposed export bans remain on certain beef cuts from Argentina until the end of 2023, China is the only country where shipments are not restricted, so volumes may be concentrated there in the short-term.

What about the UK?

The impact on the UK will likely be minimal, with an influx of Brazilian beef unlikely. Brazil accounts for around 8% of the UK’s beef imports, with the majority of it being corned beef. However, the EU is more reliant, with around 25% of its beef imports coming from Brazil. The majority is frozen boneless product. It is possible that Brazil could look to the EU as a potential outlet, or the US, given expected supply shortages. However, total volumes to both partners are minimal in comparison to Chinese orders. Brazil’s own domestic market for beef is huge, and so it’s likely at least some of the product will be absorbed at home, at the right price.

Closer to home, Ireland has recently regained access into China after a longstanding BSE-related ban and will be eager to take advantage of the situation. However, volumes are expected to be small initially.

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.