China pork update: Imports rebalance amid expanding supply and trade measures

Wednesday, 22 October 2025

China’s pork market enters the final quarter of 2025 under mixed conditions. Domestic prices have softened as supplies outpace demand, sow numbers remain elevated near policy limits, and the country’s trade landscape is being reshaped by new anti-dumping duties on EU pork.

Key points

- Chinese wholesale pork prices averaged ¥19.32/kg in late September, down around 10% year-on-year

- Breeding sow numbers stood at 40.43 million head in June 2025, roughly 104% of the official baseline, with production forecast to remain stable into 2026

- Pork imports for Jan–Aug 2025 totalled 1.47 million tonnes (Mt) with little overall change on last year, yet key exporting nations USA and Brazil saw huge declines, down 14% and 31% respectively

Price

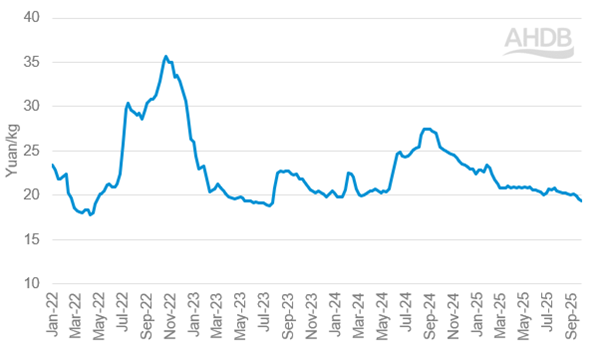

Chinese wholesale pork prices have continued to ease through the third quarter of 2025, reflecting a combination of increased slaughter, seasonal demand weakness, and changing import conditions.

According to MARA data, the national wholesale average stood at ¥19.32/kg for the week ending 29 September, down from spring highs above ¥23/kg and roughly 10% below the same period last year. The downward trend follows more than a year of strong profitability which had encouraged herd expansion and heavier marketings through early 2025.

Farms reliant on purchased piglets have reportedly faced negative margins since June, with rising throughput, and high temperatures weighing on demand. Larger integrated units are said to remain profitable but are prioritising cost-efficiency and technology investment over expansion.

Government reserve purchases have occasionally steadied the market, though not reversed the broader slide. MARA has also urged producers to reduce breeding sow numbers to correct oversupply, acknowledging that production growth has outpaced domestic demand.

Figure 1. The average price of pork in the national agricultural products wholesale market (¥/kg)

Source: Ministry of agriculture and rural affairs of the People’s Republic of China

Production

Production for the first 9 months of 2025 reached 43.7 Mt, an increase of 1.3 Mt (3%) year-on-year. USDA forecasts stable swine production in 2026, with sow numbers levelling off after 2025 growth. China’s breeding herd reached 40.43 million head in June 2025, 104% of the 39 million baseline set under MARA’s capacity control policy. This remains within the designated “green-zone” (92–105%), but near the upper limit.

Profitability earlier in 2025 encouraged restocking at large commercial farms, yet declining prices since late spring are now expected to discourage replenishment through the remainder of the year. Smaller producers continue to exit.

Regional specialisation is intensifying, with northern provinces favouring finishing operations while southern areas maintain a breeding focus.

Trade

China’s pork import landscape has undergone a marked shift in 2025, shaped by changing domestic supply conditions and new external trade barriers. For the year to date (Jan–Aug), total pork imports reached 1.47 Mt, broadly steady year-on-year but reflecting significant adjustments in both supplier mix and product focus.

Spain remained the leading import origin, shipping 369,000 t (Jan–Aug), up 8% year-on-year, followed by the United States with 212,000 t over the same period although this represented a 14% fall year-on-year, likely driven by recent tariff measures. Brazil also saw notable falls, down 31% year-on-year to total 130,000 t (Jan–Aug).

While no specific anti-dumping duties against Brazilian pork appear to have been published, several other dynamics likely contributed to the 31% drop in Brazil’s shipments to China (Jan–Aug) – such as possible shipment rejections or SPS delays, China’s growing domestic supply reducing import dependence and stronger competition from other major suppliers.

Offsetting these falls have been gains in import share from the UK (+20%), a gain of 15,300 t and Russia (+233%), a gain of 28,500 t, totalling 90,400 t and 40,700 t respectively.

Product-wise, imports were split between offal (762,000 t, 52%) and frozen pork (699,000 t, 48%), confirming China’s continued reliance on fifth-quarter products, an area traditionally dominated by EU exporters.

Looking ahead, the introduction of provisional anti-dumping duties on EU pork from 10 September 2025 has added a new layer of disruption. Duties range between 15.6% and 62.4%, typically around 20% for most firms, and are applied on arrival at Chinese ports as margin deposits. These measures, widely viewed as retaliation for EU tariffs on Chinese electric vehicles, have made EU pork less competitive in recent weeks and prompted importers to seek alternative suppliers.

Despite this disruption, China’s overall import requirement remains firm. However, the composition of suppliers is changing rapidly. As US and EU shipments contract, trade flows are diversifying which is likely to persist into 2026.

Figure 2. Imports of pig meat to China by country (YTD Jan–Aug)

.png)

Source: Trade Data Monitor LLC

Implications for the UK

With both EU and US exporters facing reduced access, more fifth-quarter and frozen cuts are likely to be redirected into South East and East Asia (Philippines, Vietnam, Japan and South Korea), adding competitive pressure and potentially easing prices.

For the UK, this brings tougher competition in those markets but also scope to consolidate positions where demand aligns with UK specifications.

Outcomes of ongoing investigations later in 2025 will determine how durable these shifts are into 2026.

For more information about global market access please visit our new blog series – Market access watch – Global meat moves.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.

Topics:

Sectors:

Tags: