Primary pork’s performance knocked off top red meat spot but prices remain favourable

Thursday, 24 August 2023

In value terms, the primary pork market has grown 10.2% year-on-year (yoy) to £800m for the 52 w/e 09 July 2023 according to Kantar. This is 1.8 percentage points (pp) ahead of the yoy increase for total grocery over the same period.

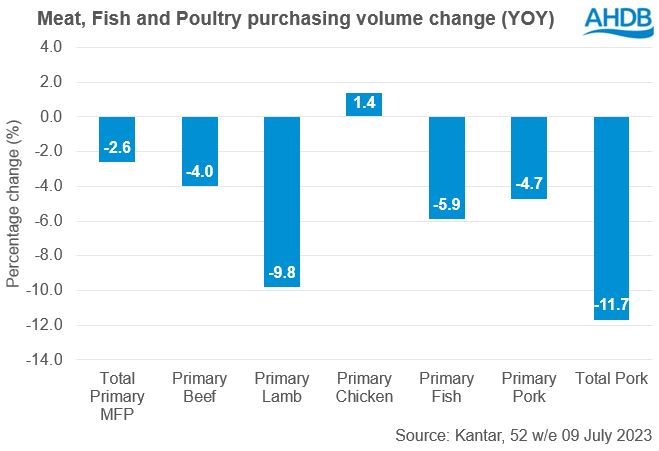

This value growth is driven by inflation, as average primary pork prices rose by 15.7% yoy to £5.71/kg. However, according to Kantar, in the 52 w/e 9 July volumes sit 4.7% lower, 2.1pp more than the yoy decline for total meat, fish and poultry (mfp). This continues the 52 w/e declines seen since November. Whilst new shoppers are typically younger, majority of sales come from older shoppers, so it remains key to mobilise repeat consumers.

Pork is a small but key part of primary mfp, making up 10.6% of volumes (Kantar, 52 w/e 9 July 2023).

Due to the large number of processed pork options, primary pork makes up a small portion of total pork volumes, at 14.9%. However, it is one of the cheapest proteins, coming in at £1.50/kg cheaper than the average for total primary mfp (Kantar, 52 w/e 9 July 2023). So, what is the outlook for primary pork and are there opportunities for retailers to maximise sales?

Primary pork is no longer the best performing red meat

Much like for primary red meat, as primary pork prices have risen, purchasing volumes have declined. However, until July, primary pork was the best performing red meat as its yoy volume decline has typically been much lower than that of both primary beef and lamb. This is due to primary pork’s relative affordability.

However, we are now beginning to see primary pork’s retail performance slip and its yoy volume decline outpace beef. This comes as the cost-of-living crisis causes consumers to trade down to cheaper products like mince and sausages, and cheaper proteins like chicken, as well as limiting their meat consumption in an attempt to save money. Consumers switching to primary chicken accounted for 26.2% of all primary pork volume losses yoy, as chicken is the cheapest protein on the market at £4.81/kg.

Previous AHDB research has shown taste becomes more important to shoppers in times of economic struggle. Out of all the red meats, pork has the smallest proportion of customers agreeing it is tasty, at just 46% compared to 63% for beef (AHDB/YouGov Tracker, May 23), which may be a reason why beef is now performing slightly better than pork.

Messaging on how pork can be used in tasty and affordable meals could help to boost sales. These are key points within AHDB’s Mix up Midweek campaign.

Specific cuts

With steaks and roasting joints making up majority of primary pork volumes at 61.5% (according to Kantar, 52 w/e 9 July), their yoy volume decline of 5.7% and 8.8% respectively has contributed heavily to the general trend of declining retail volumes. However, this poor retail performance is not characteristic of all primary pork cuts as retail volume growth has been seen in mince and pork loin medallions, rising by 17.5% and 14.9% yoy respectively.

Mince

Mince’s popularity can be easily explained by its price at just £4.98/kg, making it the cheapest primary pork cut (Kantar, 52 w/e 9 July) and the cheapest mince cut of all red meats. It is also versatile, used in a wide variety of dishes and goes a long way, contributing to its high frequency of usage. As a result, just over a fifth of pork mince’s yoy volume gains have been from consumers switching from beef and lamb mince.

With mince performing well, and even over indexing in discounter stores, retailers could tap into multibuy promotions or special offers, boosting sales and appealing to new shoppers to trade down from other red meats.

Pork Loin Medallions

In contrast, pork loin medallions are the most expensive primary pork cut, averaging £7.60/kg (Kantar, 52 w/e 9 July). Its strong performance is down to promotions with 38% of volumes sold on deal, especially through temporary price reductions (Kantar, 52 w/e 11 June 2023).

For details on all cuts of pork see our retail dashboards.

New customers and valuable shoppers

Customers are trading down to cheaper meat to save money. This is evident as 139,000kgs of primary lamb switched to primary pork (Kantar, 52 w/e 09 July 2023). However, this is also occurring at the other end of the scale as people enter the pork market for the first time from more expensive proteins.

New primary pork shoppers* tend to be more affluent than lost shoppers and on average pay £0.82/kg more for primary pork than lost shoppers (Kantar, 52 w/e 11 June 2023). However, new shoppers only make up 3.3% of total primary pork volumes; they are receiving smaller volumes per trip and are spending less on primary pork overall than lost shoppers.

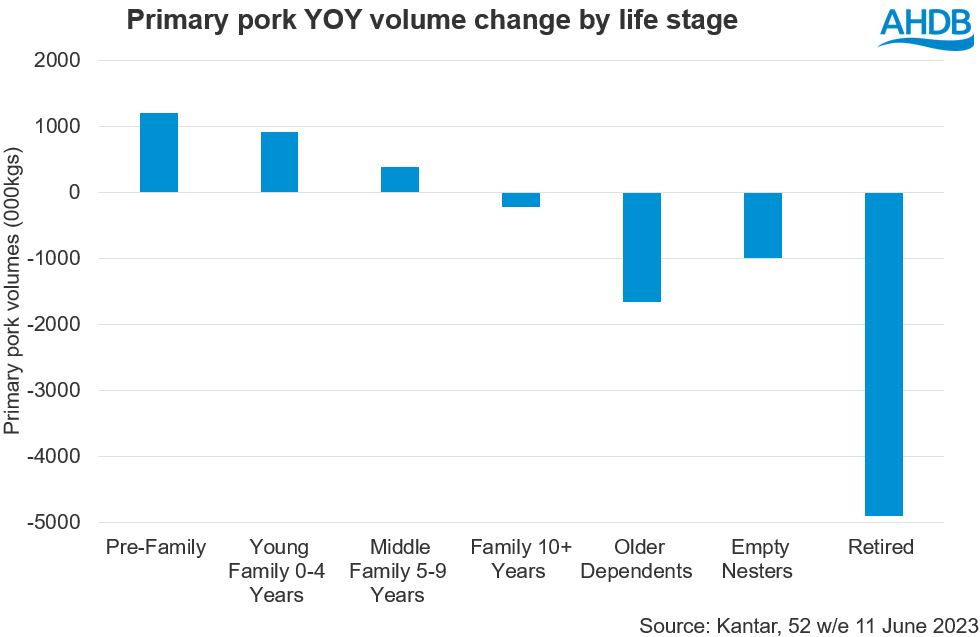

The average new shopper tends to be slightly younger as pre-family and young family groups continue to gain shares in primary pork volumes at a faster rate than all other age categories. Unfortunately, these primary pork shopper gains are outweighed by losses, as older shoppers (older dependents, empty nesters and retired) make up 60.8% of the primary pork market and are the predominant age group of lost shoppers (Kantar, 52 w/e 11 June 2023).

Repeat shopper purchasing volumes have also fallen, by 2.8% yoy, and these shoppers are continuing to trade down in retailers (Kantar, 52 w/e 11 June 2023). With repeat purchases accounting for 96.7% of all primary pork retail volumes it is imperative for retailers to focus on retaining this shopper base.

Opportunities for primary pork

Pork’s lower price point compared to other red meats stands it in a good position within the market. This means that over the coming months we could continue to see primary pork’s retail volume declines limited when compared to beef and lamb. As the cost-of-living crisis will continue into the festive period, we could see increased demand for pork at Christmas as pork roasting joints are approximately 50% cheaper than that of beef and lamb.

Previous research by AHDB on popular dishes cooked at home has shown that opportunities exist for steaks and diced and cubed pork within East Asian meals such as sweet and sour and Thai meals.

As explored in a recent AHDB study, making the in-store shopping experience more attractive to shoppers is also an opportunity. Bold packaging design and in-store posters can inspire existing shoppers to switch up their meals and help attract new shoppers to primary pork.

Retailers can also promote the health credentials of pork through highlighting how pork is high in protein, a source of zinc and B vitamins including B12. This could encourage consumers to purchase pork, especially when combined with messaging around primary pork’s affordability.

* New and lost shoppers are defined over a two year period, as new shoppers are people who shopped this year but not last year, and the opposite is the case for lost shoppers. Repeat shoppers are those who have bought the product at least once and continue to buy it.

Sign up

Subscribe to receive the consumer insight newsletter straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.