Red meat hit by reduction in volume-driving deals

Wednesday, 9 May 2018

The major multiples are moving away from multibuy and Y for £X promotions as they look to simplify their offering and focus more on an everyday low pricing strategy in order to compete with the Hard Discounters. This is one of the biggest changes occurring in grocery as a whole and it’s definitely affected meat, which has historically relied on these promotions in order to boost volume.

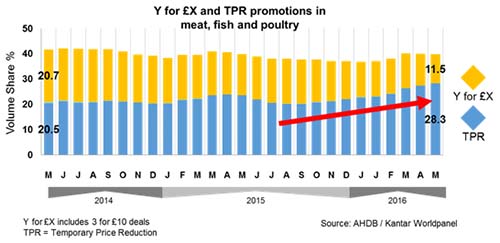

Around 40% of grocery sales are through promotions, this is also the case for meat, fish and poultry (MFP). This proportion has been consistent for a number of years, but what’s changing are the promotional mechanics. Retailers are moving away from Y for £X deals (eg 3 for £10) and multibuys (eg buy one, get one free), to simpler temporary price reductions (TPRs). There has been some growth in non-promoted product sales as retailers move towards an everyday low pricing (EDLP) strategy. The focus for the major multiples is on pricing in order to better compete with the Hard Discounters, while Aldi and Lidl themselves look to areas such as more store openings for further growth.

The cutting of Y for £X deals has been led by Sainsbury’s, which has cited direct competition from the discounters as a driving force behind this. Sainsbury’s decision was based on its customers need for simpler, clearer prices and it has reported increased customer satisfaction during the time it phased out multibuys. Although the offer is still present at a number of retailers, Tesco recently joined Sainsbury’s in phasing out the deal. Together, these two retailers have almost 45% market share of grocery.

Why it affects meat so much

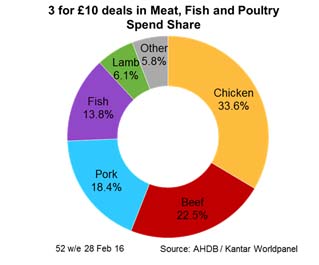

Meat, fish and poultry categories are more reliant on promotions than other categories and the leading 3 for £10 offer is well recognised by shoppers. This type of deal is also featured in sausages and bacon, with 2 for £4/£5 offers.

The most popular way for shoppers to fulfil the 3 for £10 deal was bulk buying ? three packs of chicken breasts being the most common, followed by three steaks or packs of mince. Pork is often a later consideration, making up the final product to fulfil the deal. Without this offer, shoppers need more persuasion to add pork to their baskets.

The reduction in Y for £X deals resulted in a loss to MFP of £272 million, in volume this equates to 28,000 tonnes annually. Around 40% of the loss in spend is solely from 3 for £10. The categories most affected by the decline of Y for £X are red meat and sausages, as poultry has managed to negate much of the decline through TPR deals.

Conclusion

Retailers are looking to simplify their offering for an overarching increase in customer satisfaction and long-term trust. But many individual categories such as meat are suffering the impact of this, at least in the short term. If other major multiples move this way and shoppers react in a similar way, it would result in a further loss to MFP of over £100m. The deal ensured that shoppers were putting a fair amount of meat in their baskets, but now the purchase will be more considered. Shoppers may now move away from their default bulk-buy and become more susceptible to other messaging and more varied purchases. But volumes are likely to take a hit as they have already. The long-term impact of this change remains to be seen and will continue to be monitored.

Topics:

Sectors:

Tags: