What do the falls in dairy commodity prices mean for retail and shoppers?

Thursday, 11 December 2025

Falling dairy wholesale and farmgate prices means that the cost of dairy products should start to reduce for consumers. Lower dairy prices in retail and foodservice should encourage consumers to buy more, which will help balance supply and demand and hopefully stop dropping dairy commodity prices.

This article explores the relationship between dairy wholesale and retail prices, assessing what the recent falls might mean for shoppers.

What’s happening to dairy in wholesale and retail markets?

With UK and international milk supplies elevated, commodity prices have seen significant drops in value since September.

Wholesale butter prices are currently 35% lower in November 2025 than the previous year and mild Cheddar prices dropped 29% year-on-year (AHDB).

At retail level, shoppers have been challenged by the cost-of-living crisis and have been cutting back on dairy, with total volumes down 1.2% year on year.

This is driven primarily by cows’ milk volumes, which declined 2.6%, while butter volumes fell 2.2% (NIQ Homescan POD, 52 w/e 1 November 2025).

However, we are seeing areas of cows’ dairy in growth including cheese up 1.7%, yogurt (including yogurt drinks and fromage frais) up 6.4% and cream up 2.2% despite increasing prices in these categories.

For more detail on dairy retail performance, you can see our dairy dashboard for all the data and our accompanying market commentary.

Butter

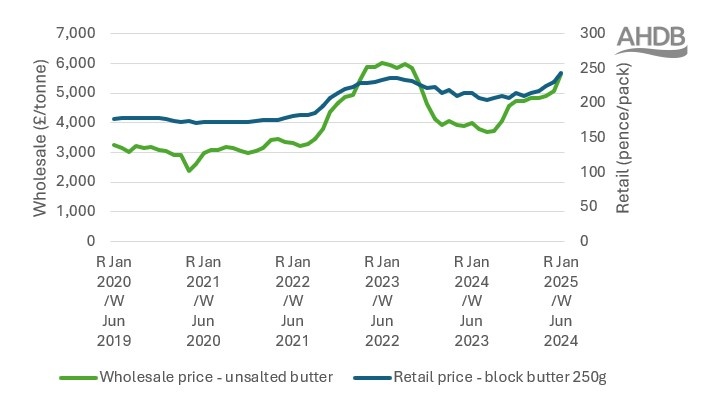

Looking at retail butter prices, there is a significant correlation between movements in wholesale price and the retail price, using the ONS butter price reported monthly for 250 g block butter and AHDB’s wholesale butter price.

However, there is a notable time-lag both for price rises and price falls. Over the last decade, this lag has averaged at around seven months.

Average butter prices (wholesale with seven-month delay)

Source: Wholesale price – AHDB, Retail price – ONS

Based on this, we would anticipate that retail prices for butter would start to fall, but not until April, with the biggest price drops from June.

In the wholesale market, there has been a 35% drop in prices, but it is important to recognise that the wholesale value of a product is not the only cost which impacts the supermarket butter price, so we wouldn’t expect to see such a large price fall in store.

A considerable volume of butter will have been bought on contract pricing rather than spot, which probably accounts for some of the slowness in transmission.

Other factors, such as labour and energy costs in manufacturing and retail, together with transport and distribution, will help determine retail pricing.

Taking into account wholesale prices, previous trends and slowing but continued inflation, we expect prices to fall but remain in single digit decline unless further price drops are seen in wholesale.

It is hard to determine the effect of price declines on retail volumes of butter as other influences impact consumer demand, making the overall effect more difficult to predict.

For example, there is already volume growth for block butter despite rising prices due to consumer trends toward natural and less processed products (NIQ panel on demand, 52 w/e 1 November 2025).

However, high price rises in spreadable butter have led to reductions in retail volumes. Keeping a close eye on the butter to margarine price ratio could be an indicator for potential volume movements.

Cheddar

There is also a correlation between mild Cheddar wholesale and retail prices, but the time lag for any price changes is longer than for butter, averaging around 11 months in recent years.

Average Cheddar prices (wholesale with 11-month delay)

Source: Wholesale price – AHDB, Retail price – ONS

We predict that retail prices for Cheddar would start to fall in July or August 2026, with larger declines in prices coming into the autumn.

While the correlation between wholesale and retail is less strong in cheese, and we see the wholesale price falling slower, our modelling predicts there could be greater price drops for Cheddar – potentially hitting double digits.

Cheddar is slightly more likely to be promoted than block butter with 15.7% of Cheddar volumes sold on deal (NIQ panel on demand, 52 w/e 1 November 2025). Compared to total grocery, this is comparatively low, so brands and retailers could use promotions to deliver price declines to shoppers.

This would be welcome news for consumers as cheddar accounts for nearly half of all cheese volume sales in Britain and shoppers spent over £56 on Cheddar on average in the last year (NIQ panel on demand, 52 w/e 1 November 2025).

As we see consumers increasingly turning to premium options, we could see further increases in premium Cheddar if it becomes more accessible, rather than shoppers banking any savings.

Conclusion

Any shoppers hoping for immediate drops in retail, to a similar scale to those seen at the wholesale level, are going to be disappointed. The steep drops in wholesale prices are unlikely to lead to equally steep drops in retail, due to time lags and additional costs within the supply chain.

However, our analysis shows that the recent price drops are likely to feed through to modest falls in retail prices – albeit at a time-lag.

Many shoppers will not be aware of changing prices in the wholesale market, and any price falls will help to stimulate domestic demand for dairy products from the spring of next year.

These will be a welcome surprise for consumers battling with the ongoing cost-of-living situation.

Sign up to receive the latest information from AHDB.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.