Delivered rapeseed prices at record levels, can they go higher? Grain market daily

Wednesday, 12 May 2021

Market commentary

- UK feed wheat futures for Nov-21 gained £1.10/t yesterday, to close at £186.60/t, after falls on Monday.

- Chicago maize for Jul-21 also climbed yesterday, up $4.13/t to close at $284.35/t. Gains have been made on South American supply continuing to look tight ahead of both Conab’s Brazilian supply estimates and the USDA’s world supply and demand estimates (WASDE), due today.

- Average trade estimates for Brazil’s maize crop for 2020/21 in a pre-WASDE poll by Refinitiv, stand at 103.5Mt, down from April’s forecast of 109Mt. The low end of estimates see production falling to 100Mt or below, reducing the exportable surplus.

- Chinese 2021/22 maize plantings are up 3.4% to 42.67Mha according to the Ministry of Agriculture and Rural Affairs. This would peg production up 4.3% to 271.81Mt, higher than the IGC supply forecast and initial estimates, though still lower than demand projections.

Delivered rapeseed prices at record levels, can they go higher?

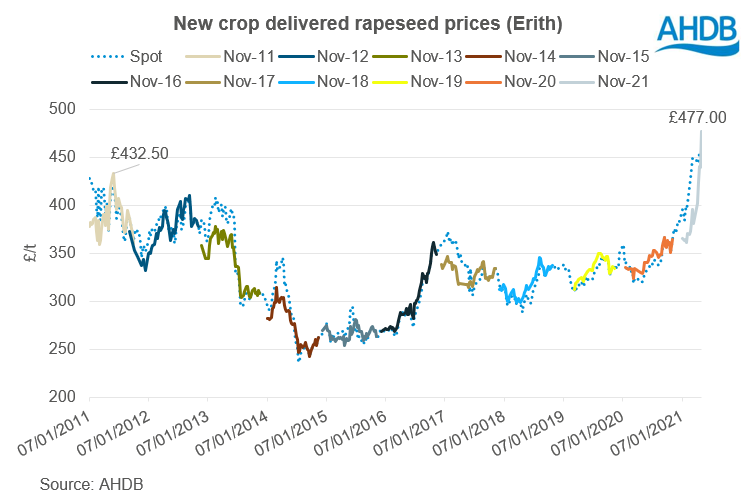

Delivered rapeseed prices recorded by AHDB have been reaching record levels over the past month. The previous record high new crop (Erith, November delivery) price was reached in June 2011, at £432.50/t. On Friday, we recorded Erith (Nov-21) at £477.00/t, surpassing the 2011 November high by £44.50/t.

So, can we expect prices to rise further?

Factors driving price rises

This season delivered rapeseed prices have seen substantial support from rising vegetable oil values and high soyabean prices.

Last Friday, new crop Chicago soyabean futures (Nov-21) closed above 8-year highs, at $526.67/t. Gains were made on dry South American weather and tight US stocks, causing supply concerns. This has been met with continued Chinese demand for feeding their expanding pig herd, as explained in this week’s market report. Furthermore, In Canada, end of March canola stocks were down 37.7% on the year, from increased demand through the pandemic.

In the EU and UK, the balance of supply and demand is expected to be tight again in 2021/22. Recent cold weather across the UK and Europe has heightened concerns for crop development. The latest MARS report made some cuts to rapeseed yields, in France especially, playing into delivered gains.

Are prices going to continue rising?

The flow of bullish news will be a big determinant of when prices reach a turning point.

Monday’s US planting figures leaned slightly bearish, with 42% of US soyabeans planted, as at 9 May. This was above the five-year average by 20 percentage points. Yet yesterday, Chicago soyabeans (Nov-21) climbed $6.39/t to $525.99/t, in anticipation today’s USDA new crop world supply and demand estimates (WASDE).

Soyabean ending stocks will be a key watch point on account of Chinese demand versus global supply.

Vegetable oil prices and crush margins will also be key to watch going forward, to establish crushers demand.

In the EU and UK, weather remains a key watch point to influence the Paris rapeseed futures and so UK delivered prices. Even if global fundamentals pressure global vegetable oil and soyabean prices, it is likely EU and UK prices may stay reasonably elevated until more news emerges on crop progress (next European crop report due on 25 May).

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.