English winter crop area drops confirmed by Defra: Grain Market Daily

Friday, 21 August 2020

Market commentary

- UK feed wheat futures (Nov-20) slipped yesterday from £165.00/t at Wednesday’s close to £164.15/t.

- Paris rapeseed futures (Nov-20) closed at €50/t yesterday, down €0.25/t from Wednesday. A fall in soyabean futures was partly offset by small gains in palm oil prices.

- There has been pressure on US maize and soyabean prices after an annual crop tour in the US pointed to good maize and soyabean yield prospects in many of the top producing states. However, unsurprisingly there were poorer yield prospects in Iowa. Iowa is the top maize growing state in the US and was battered by an exceptional storm last week.

English winter crop area drops confirmed by Defra

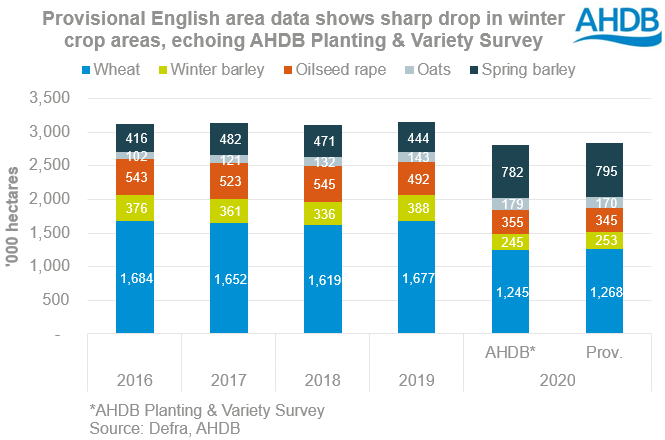

The provisional results of Defra’s June 2020 survey show sharp drops in the areas of winter crops in England compared to June 2019. This echoes the sharp drops reported by AHDB’s Planting and Variety survey early last month.

The English wheat area as at June 2020 is provisionally 24% smaller than in June 2019, while the winter barley area is down 35% and winter oilseed rape was back 32%. The drops in winter crop areas from last year are no surprise given the wet weather at planting last autumn, which was compounded by the challenging spring.

Spring crops are confirmed as the main beneficiary by the June Survey, though Defra estimates a slightly larger increase in the spring barley and so total barley area than AHDB.

The impacts?

Last year England accounted for 86% of total UK wheat, barley, oat and oilseed rape production.

While only relating to England, this provisional data from Defra increases the evidence that UK is in the process of harvesting its smallest wheat and oilseed crops in many years. High maize imports will be a feature of the UK market this year, because of the small wheat crop and competitive maize prices. There are also technical and nutritional factors which limit the amount of barley (and oats) that can be included in compound animal feeds.

Meanwhile, the substantial increase in the English oat and barley areas mean we are again looking at large UK oat and barley crops, depending on yields. These grains will need to compete against maize for animal feed demand in the UK market and overseas (barley) in order to avoid to further build up in stock levels.

This need to compete can be seen in ex-farm prices, with feed barley and feed oats in the Eastern region averaging £122.60/t and £116.70/t respectively in the week ending 13 August. In comparison, feed wheat in the Eastern region averaged £157.00/t.

The provisional area results for the whole of the UK, along with yield and production estimates are to be released by Defra on Thursday 8 October.

Sign up for regular updates

You can subscribe to receive Grain Market Daily straight to your inbox. Simply fill in your contact details on our online form and select the information you wish to receive.