EU pork market: Production and exports increase in H1 2025

Wednesday, 24 September 2025

Key points

- EU pork production saw an increase of 3% in the first six months of the year compared to 2024

- The EU breeding pig population recorded a decline in December, which may limit production later this year

- China has remained the top EU export destination, with an increase of 24,100 tonnes (4%) year-on-year

- Imports of pig meat to the EU decreased by 4,000 tonnes (-6%) year-on-year

Production

EU pork production saw an increase of 3% in the first six months of the year compared to 2024. Production rose to 10.91 million tonnes, an increase of 341,000 t.

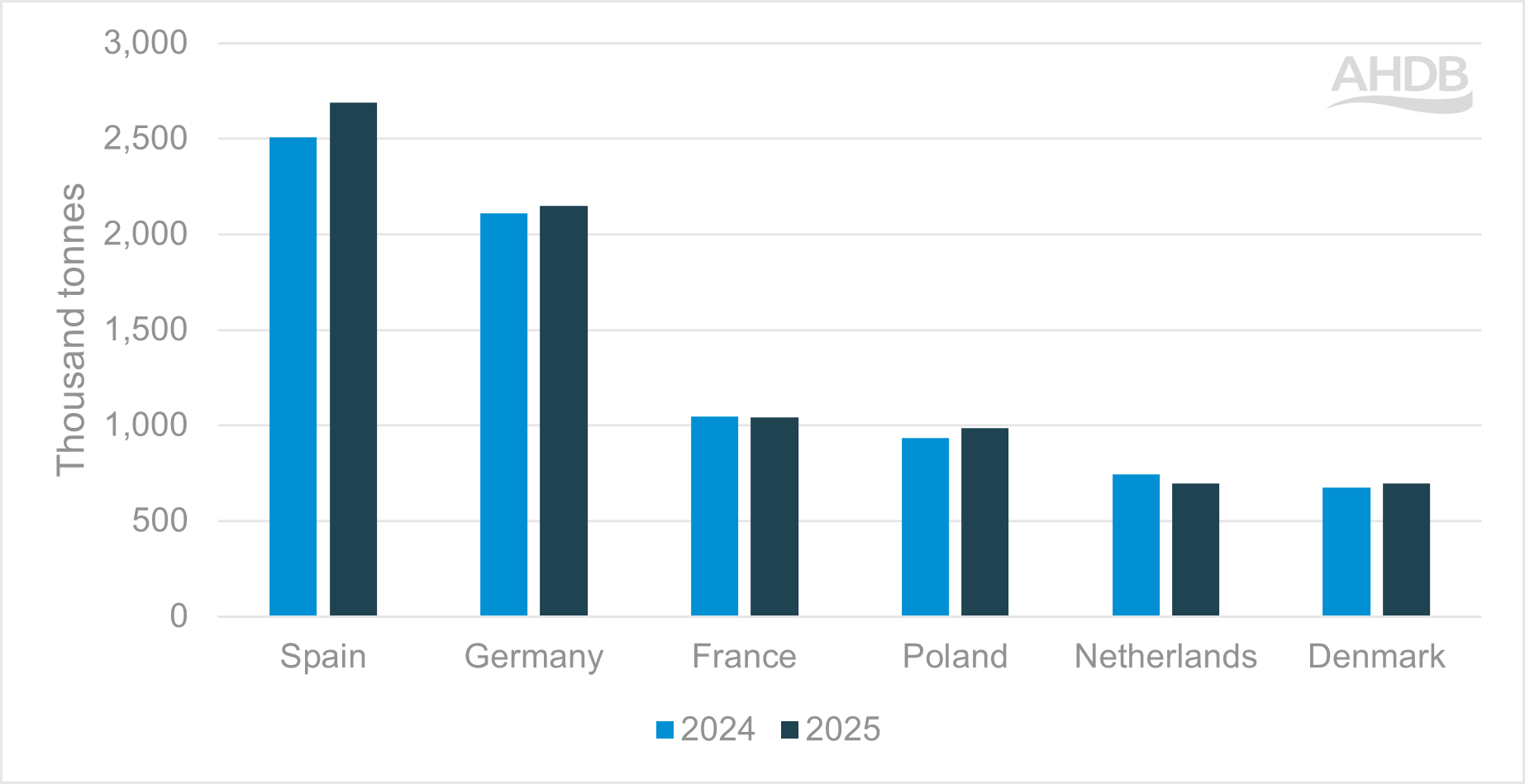

Spain had the largest increase of 184,000 t (7%) to 2.70 Mt, followed by Poland with an increase of 50,000 t (5%) to 984,000 t and Germany gaining 39,000 t to reach 2.15 Mt.

The Netherlands saw the largest decrease of 49 Kt (7%) to 985 Kt. Production in France was relatively stable year-on-year.

Average pig carcase weights for January to June stood at 97.4kg/head. Please note there is no separation between finishers and culls in the European Commission data.

Pig meat production of select EU27 countries (YTD Jan–June)

Source: European Commission

Slaughter numbers increased 1.77 million head (2%) to total 111.90 million head. Spain saw the largest increase of 1.27 million head (5%) to 28.02 million head.

Poland also recorded a significant increase, up 441,000 head (5%), with growth in Germany more muted at 1% (171,000 head).

The remaining key producing countries saw numbers decline year-on-year with France and Denmark both down 1%, meanwhile the Netherlands was back a substantial 7% (499,000 head).

The latest figures from Eurostat for the European breeding pig population (December 2024) shows herd contraction of 3% from 2023.

All key producing countries apart from Germany and Denmark recorded a reduction in breeding pig numbers.

Spain had the biggest reduction of 153,000 head.

Given this decline it is forecast that EU pig meat production could decline in the second half of 2025, on the back of reduced throughputs.

Price

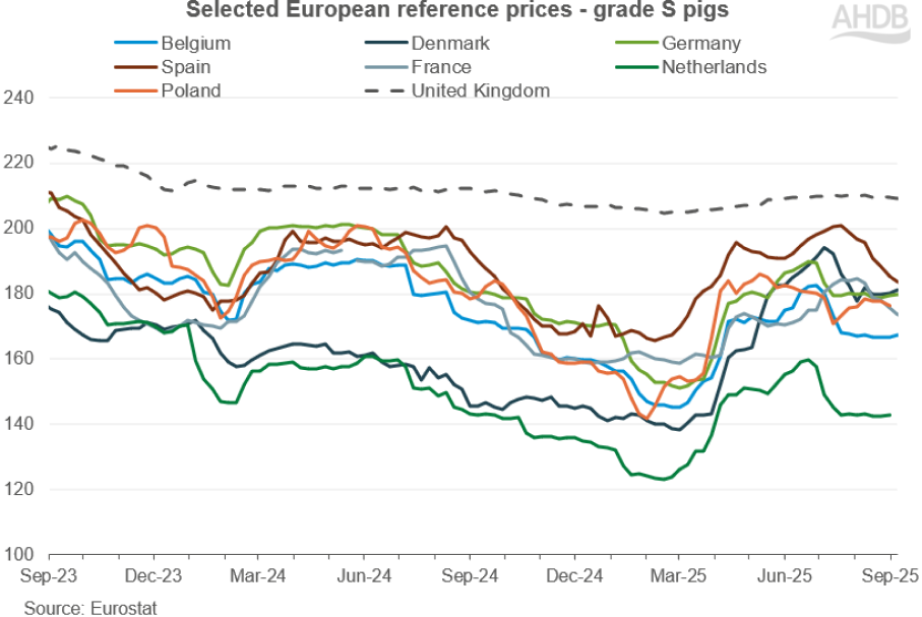

Prices have been recovering since lows in the beginning of 2025. The outbreak of foot-and-mouth disease in Germany weighed heavily on the European market in the first three months of the year, as one of the key producing and trading nation lost access to markets outside of the EU bloc.

Prices picked up in April but then flattened in May. Heading into June prices began to increase, the highest price for the year so far was recorded at 187.98p/kg for the week ending 29 June. The price increases were supported by improved domestic demand following good weather for BBQ season, as well as export demand, especially China.

However, prices have gradually been declining since early July.

For the week ending 7 September, the average EU grade S price was 177.80p/kg, a decrease of 0.55p from the previous week. This marks the fourth consecutive week of decline, due to production being higher than expected but weaker demand.

Select EU27 grade S pig reference prices

Source: EU Commission

Trade

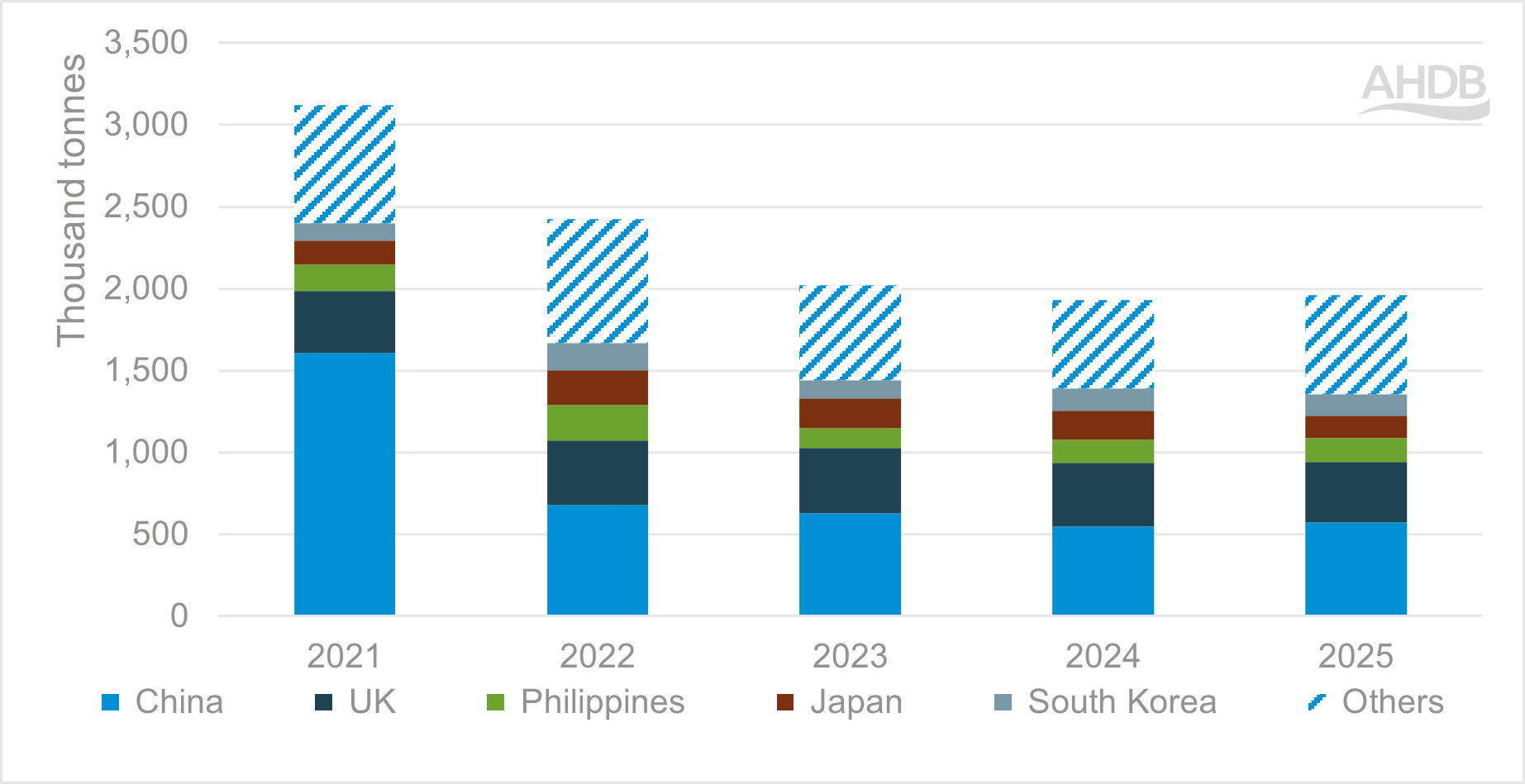

Total EU pig meat (including offal) exports in the first six months of 2025 have increased by 26,800 t (1%) to 2.96 Mt.

China remained the top export destination, as it has been for the past four years. So far in 2025 China has received 574,500 t of pig meat from the EU, an increase of 24,100 t (4%) compared to 2024.

China has been moving away from US imports and utilising other importers. The main EU product exported to China is frozen edible offal. Spain and China signed a new export protocol earlier this year meaning Spain gains better market access for products such as stomachs.

Exports to the UK declined 5% to 367,000 t (-21,300 t) year-on-year and shipments to Japan show three years of decline, after peaking in 2022.

Compared to the same period in 2024, EU exports to Japan have fallen 35,000 t (20%) to 137,500 t.

Exports of pig meat (including offal) from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan–Jul)

Source: Eurostat compiled by Trade Data Monitor LLC

Imports of pig meat to the EU decreased by 4,000 t to 66,200 t (-6%). The UK remains the top supplier for EU imports at 51,900 t.

After a significant increase in imports from Chile in 2024, so far in 2025 volume has decreased 6,700 t to 3,800 t, returning in line with 2023.

Although small, it is notable that imports from the USA have grown to over 500 t in the first half of 2025 amid ongoing trade negotiations.

Looking ahead

Although EU pig meat shipments to China have been doing well in the first half of the year, the new EU-China pork dispute is likely to cause some disruption in the coming months.

The introduction of cash deposits will result in EU imports becoming more expensive and burdensome to prospective buyers, which may see volume displaced from the Chinese market.

This could create some opportunity for the UK to further increase exports to China as a more favourable trading partner.

However, the risks associated with displaced EU product are that it is likely to increase competition in other established trading nations (such as Vietnam and the Philippines) and generate downward price pressure on the global market for product with limited, or no, use in the domestic market.

This pricing movement could filter through to UK pig prices.

Sign up for regular updates

Subscribe to receive pork market news straight to your inbox. Simply complete our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.