European sheep market update: Imports and exports increase

Wednesday, 15 October 2025

Sheep meat production has fallen year-on-year in key European countries. Meanwhile, we have seen the EU reference price remain broadly stable as both imports and exports of sheep meat to and from the bloc have increased in the first seven months of the year.

Key points:

- EU fresh/frozen sheep meat imports for the year to date (Jan-July) 2025, totalled 99,400 tonnes

- EU fresh/frozen sheep meat exports totalled 16,400 tonnes, an increase of 1,100 tonnes (7%) on the same period last year

- For the week ending 28 September, the EU reference price averaged 748 p/kg, prices have remained relatively stable over the past month

Production

Sheep meat production has fallen year on year in key producer countries, mainly due to structural decline with producers leaving the sector and disease challenges.

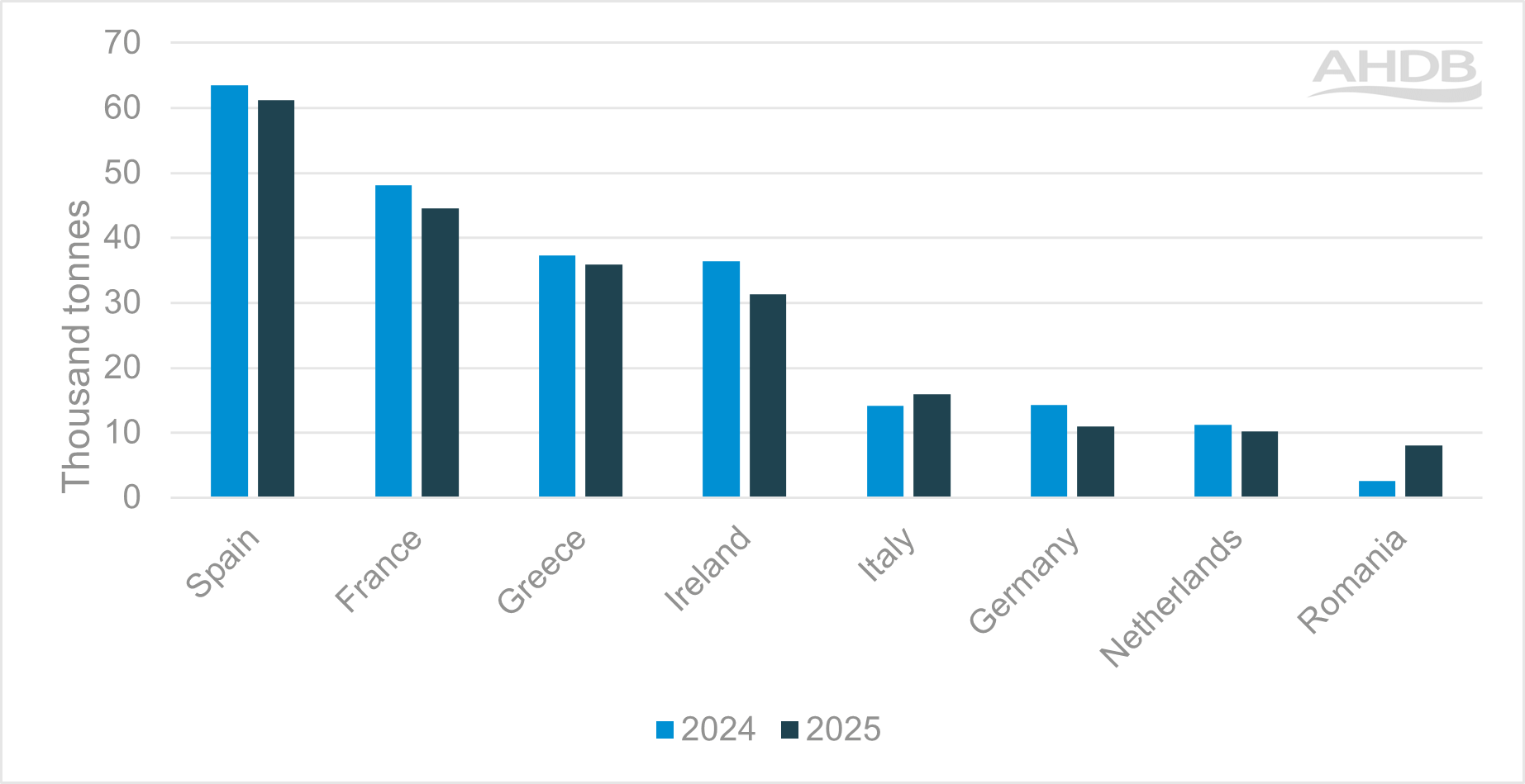

For the year to date (Jan-July) 2025, Ireland saw a 14% decrease in production to 31,300 tonnes, the largest volume decline year on year. France and Greece also saw annual decreases of 7% and 4% respectively. Spain, the EU’s top producer saw decreases of 3% (2,200 tonnes) to 61,300 tonnes.

The only country to see a significant increase in sheep meat production was Romania, with a 206% increase in production to 8,000 tonnes. This is due to a significant disease outbreak which resulted in increasing culling as a control method.

Sheep meat production of select EU27 countries (YTD Jan-July)

Source: European Commission

Prices

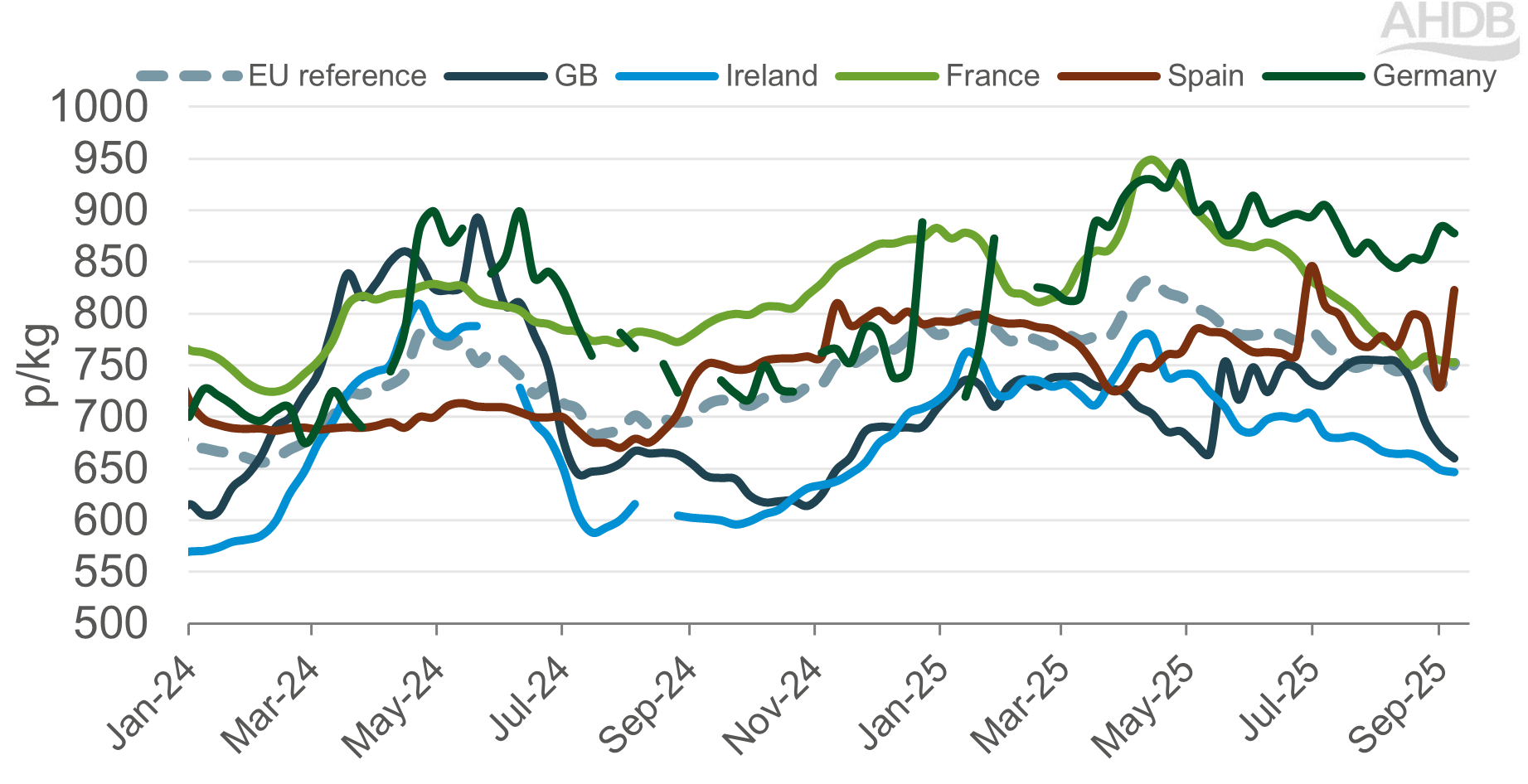

For the week ending 28 September, the EU reference price averaged 748 p/kg, down 12% from the same period in 2024. The EU reference price was stable at the beginning of the year, with seasonal rises beginning in April. However, prices have been gradually declining since the spring.

German prices fell to 805 p/kg, the lowest price this year since week ending 26 January 2025. According to German market analyst AMI, this is due to weaker demand and more seasonal supply.

Weekly EU and GB deadweight lamb prices p/kg

Source: EU Commission

Trade

Imports of fresh and frozen lamb into the EU for the year to date (Jan-July) 2025, totalled 99,400 tonnes an increase of 16,200 tonnes (20%) from the same period in 2024. The main import supplier was the United Kingdom with 46,600 tonnes in the year to date, an annual increase of 19% (8,000 tonnes). This was closely followed by New Zealand at 45,400 tonnes, an increase of 16% (6,300 tonnes) on the same period of last year.

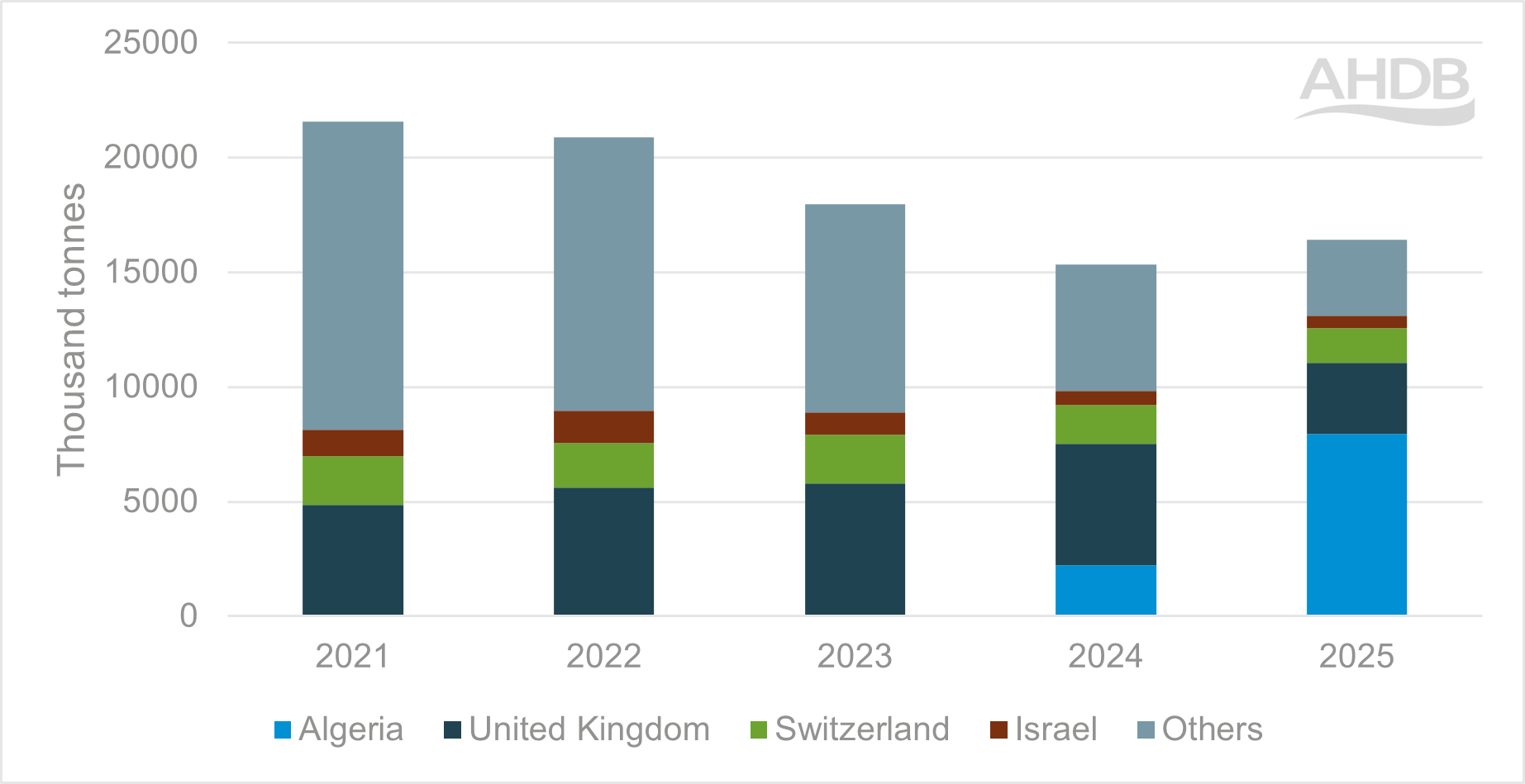

Exports of sheep meat from the EU totalled 16,400 tonnes in the same period (Jan-Jul), an annual increase of 1,100 tonnes (7%). Algeria has been the largest export destination, with shipments increasing significantly since 2024. This is due to extreme heat and below average rainfall within the country’s sheep producing regions limiting domestic production. This has meant that imports have increased to meet demand, especially during religious festivals such as Eid.

Exports to the United Kingdom fell by 2,200 tonnes to total 3,100 tonnes a decrease of 41%, weaker domestic demand for lamb in GB, combined with lower product availability in the EU has likely driven this trend.

Exports of sheep meat from the EU27 to non-EU countries between 2021 and 2025 (YTD Jan-Jul)

Source: Eurostat compiled by Trade Data Monitor LLC

Sign up for regular updates

You can subscribe to receive Beef and Lamb market news straight to your inbox. Simply fill in your contact details on our online form.

While AHDB seeks to ensure that the information contained on this webpage is accurate at the time of publication, no warranty is given in respect of the information and data provided. You are responsible for how you use the information. To the maximum extent permitted by law, AHDB accepts no liability for loss, damage or injury howsoever caused or suffered (including that caused by negligence) directly or indirectly in relation to the information or data provided in this publication.

All intellectual property rights in the information and data on this webpage belong to or are licensed by AHDB. You are authorised to use such information for your internal business purposes only and you must not provide this information to any other third parties, including further publication of the information, or for commercial gain in any way whatsoever without the prior written permission of AHDB for each third party disclosure, publication or commercial arrangement. For more information, please see our Terms of Use and Privacy Notice or contact the Director of Corporate Affairs at info@ahdb.org.uk © Agriculture and Horticulture Development Board. All rights reserved.